Pound sterling price news and forecast: GBP/USD upside potential remains limited

GBP/USD Forecast: Pound's upside potential remains limited

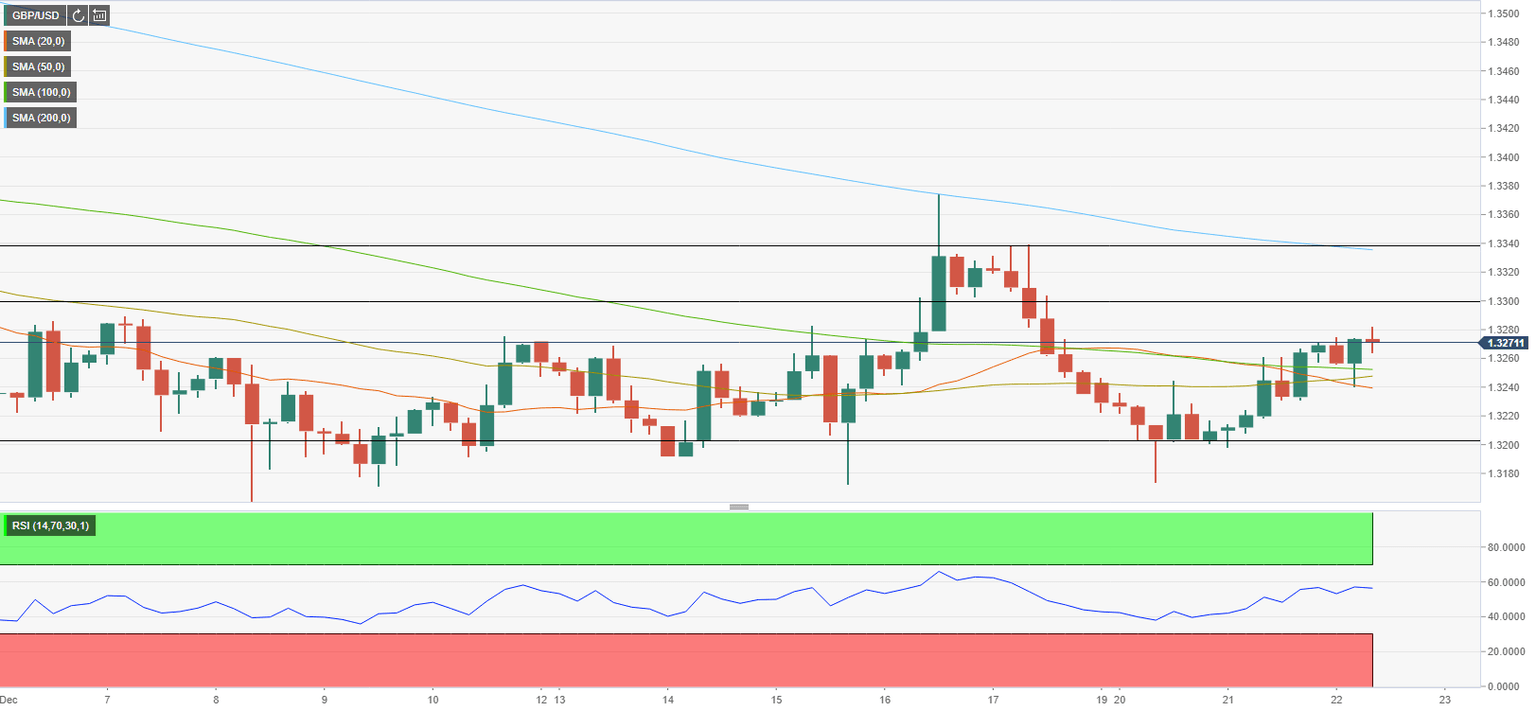

GBP/USD has closed in positive territory on Tuesday following a two-day slide but seems to have lost its recovery momentum before testing 1.3300. The British pound could have a hard time attracting buyers as investors remain on the sidelines ahead of the Christmas holiday. Talks regarding the Northern Ireland Protocol are a factor influencing the pair, and on Tuesday, the Irish Prime Minister noted that talks between the EU and the UK were on track for progress. His comments helped GBP/USD stay afloat in positive territory. Read More...

GBP/USD analysis: Extends its surge

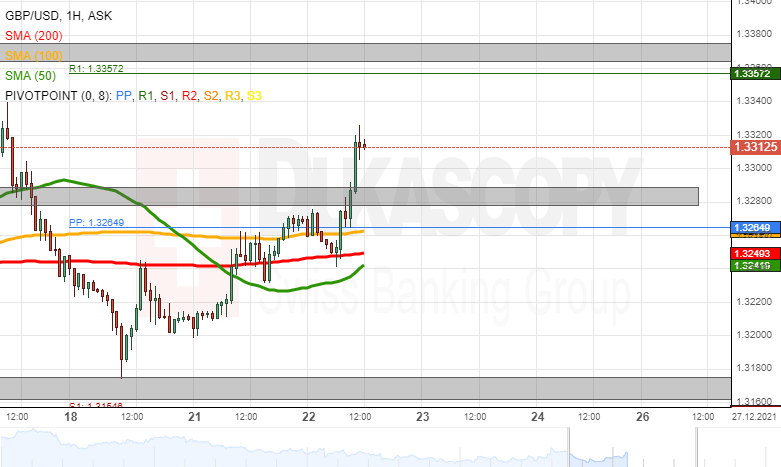

The GBP/USD currency exchange rate has continued to move higher. At mid-day on Wednesday, the rate left below it the hourly simple moving averages, the weekly simple pivot point and the high level resistance zone near 1.3280. By 12:00 GMT, the GBP had reached the 1.3320 mark against the USD. A continuation of the surge of the Pound against the US Dollar could result in the rate reaching the weekly R1 simple pivot point at 1.3357 and the December high level at 1.3375. Read More...

GBP/USD outlook: Cable rises for the second day despite downbeat UK GDP data

Cable keeps bullish tone for the second straight day and hit weekly high above 1.33 mark, following minor negative impact from weaker than expected. UK GDP and improved sentiment on expectations that Omicron may cause limited damage to the economy that revived risk appetite. Fresh bulls eye pivotal barrier at 1.3337 (50% retracement of 1.3513/1.3161 bear-leg/Daily Kijun-sen), close above which would sideline larger bears and open way for a stronger correction. Read More...

Author

FXStreet Team

FXStreet