GBP/USD Forecast: Pound's upside potential remains limited

- GBP/USD has lost its momentum before testing 1.3300.

- UK's Truss reiterated that the remain prepared to trigger Article 16.

- Dollar keeps its footing as investors await key data releases.

GBP/USD has closed in positive territory on Tuesday following a two-day slide but seems to have lost its recovery momentum before testing 1.3300. The British pound could have a hard time attracting buyers as investors remain on the sidelines ahead of the Christmas holiday.

Talks regarding the Northern Ireland Protocol are a factor influencing the pair, and on Tuesday, the Irish Prime Minister noted that talks between the EU and the UK were on track for progress. His comments helped GBP/USD stay afloat in positive territory.

Later in the day, however, British Foreign Minister Liz Truss, who is now in charge of Brexit negotiations after the resignation of former Brexit Minister Lord David Frost over the weekend, noted that the UK's position in negotiations was unchanged. Truss reiterated that the UK was prepared to trigger Article 16 if they were unable to end the European Court of Justice's role as a final arbiter in the Northern Ireland Protocol.

Earlier in the session, data from the UK showed that the annualized Gross Domestic Product (GDP) for the third quarter got revised higher to 6.8% from 6.6%, but the pound was unable to capitalize on the result after the UK's Office for National Statistics reported that Total Business Investment in the third quarter contracted by 2.5% on a quarterly basis.

Later in the day, the US Bureau of Economic Analysis will release the final revision to the third-quarter GDP growth figure. More importantly, the Conference Board's Consumer Confidence for December report will be looked upon for fresh impetus. If these releases point to weakening consumer sentiment amid heightened inflation fears, the dollar could strengthen against its rivals and weigh modestly on GBP/USD.

GBP/USD Technical Analysis

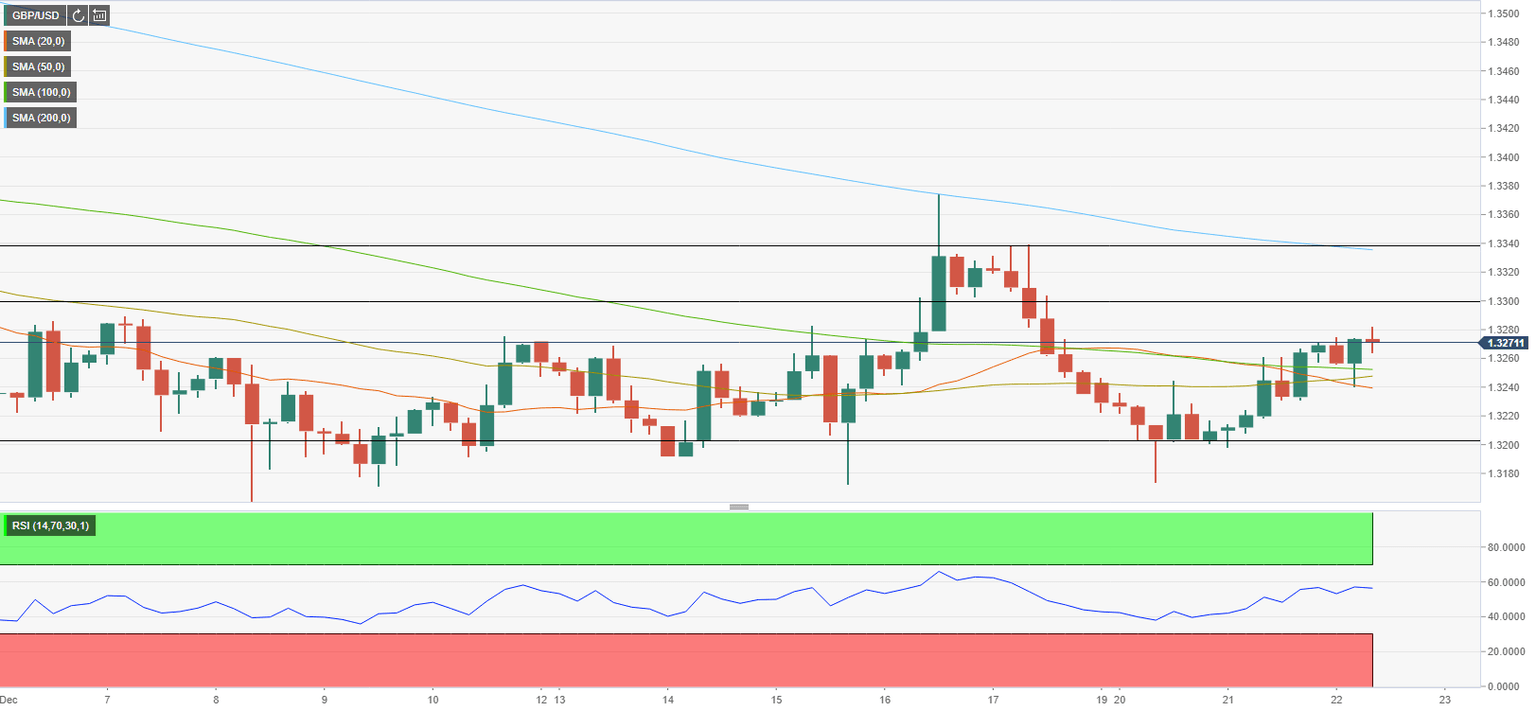

On the four-hour chart, GBP/USD stays afloat above the 100-period SMA but the Relative Strength Index (RSI) has already retreated to the 50 area, suggesting that bullish momentum is fading away.

On the downside, 1.3250 (100-period SMA, 50-period SMA) aligns as the first support before 1.3200 (psychological level) and 1.3160 (December 8 low). Resistances align at 1.3300 (psychological level), 1.3340 (200-period SMA) and 1.3375 (December 16 high).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.