Pound Sterling Price News and Forecast: GBP tracks broader tone in the USD

GBP tracks broader tone in the USD – Scotiabank

The Pound Sterling (GBP) is trading up a modest 0.2% vs. the USD and is a midperformer vs. the G10, Scotiabank's Chief FX Strategist Shaun Osborne notes.

"Relief on trade is offering support via sentiment in the absence of UK data, as market participants consider the positive shift in the US administration’s tone on tariffs and assess the implications for the broader European economic outlook." Read more...

Pound Sterling gains against US Dollar despite Trump tariff fears ease

The Pound Sterling (GBP) rises to near 1.2950 against the US Dollar (USD) in European trading hours on Tuesday. The GBP/USD pair gains as the US Dollar struggles to hold onto Monday’s gains that were driven by strong preliminary United States (US) S&P Global Purchasing Managers Index (PMI) data for March and optimism that tariffs to be unveiled by President Donald Trump on April 2 would be narrower in scope than initially feared.

The S&P Global reported on Monday that the Service PMI, which accounts for activities in the services sector, came in at 54.3, significantly higher than estimates of 51.2 and the 51.0 reading seen in February. Given that the services sector roughly accounts for two-thirds of the US economy, upbeat data indicates a strong business outlook. The report also showed that the increase in prices paid by employers for business inputs was the highest in nearly two years, prompting expectations of higher inflation in the near term. Read more...

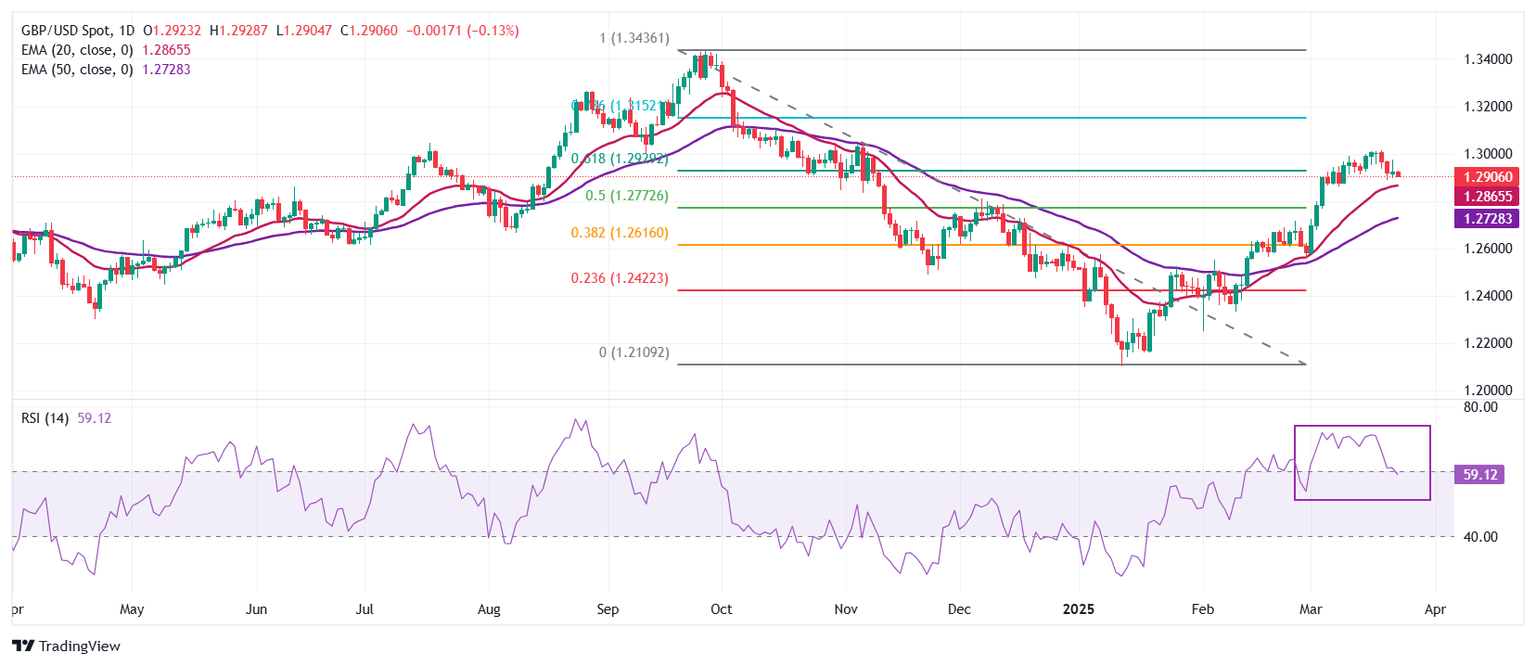

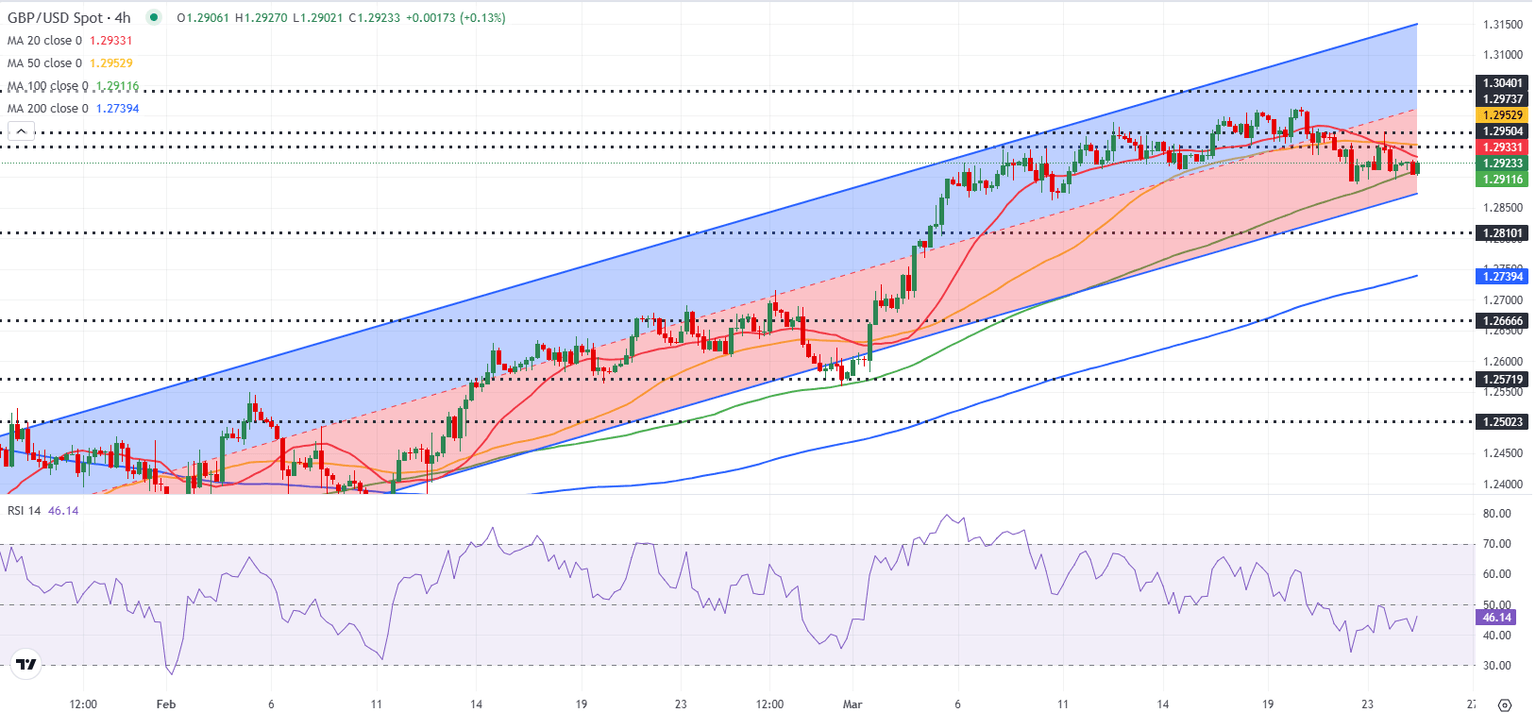

GBP/USD Forecast: Sellers could take action if 1.2870 support fails

GBP/USD holds steady slightly above 1.2900 in the European session on Tuesday. The pair's technical outlook highlights that the bearish bias remains intact, albeit lacking momentum.

GBP/USD started the week on a bullish note and climbed above 1.2970 before losing its traction in the American session, as the US Dollar (USD) benefited from the upbeat data. S&P Global Composite Purchasing Managers Index (PMI) rose to 53.5 in March's flash estimate from 51.6 in February, highlighting an ongoing expansion in the private sector's business activity at an accelerating pace. Read more...

Author

FXStreet Team

FXStreet