Pound Sterling Price News and Forecast: GBP strengthens at the start of UK data-packed week

Pound Sterling strengthens at the start of UK data-packed week

The Pound Sterling (GBP) strengthens against its major peers at the start of the week. The British currency gains on upbeat United Kingdom (UK) monthly Gross Domestic Product (GDP) and the factory data for February. The Office for National Statistics (ONS) reported on Friday that the economy grew at a robust pace of 0.5% after remaining flat in January. Economists expected a moderate growth of 0.1%. Meanwhile, month-on-month Industrial and Manufacturing Production rose at a stronger pace.

This week, investors will focus on the release of the UK employment data for three months ending February and the Consumer Price Index (CPI) data for March, which will be published on Tuesday and Wednesday, respectively.

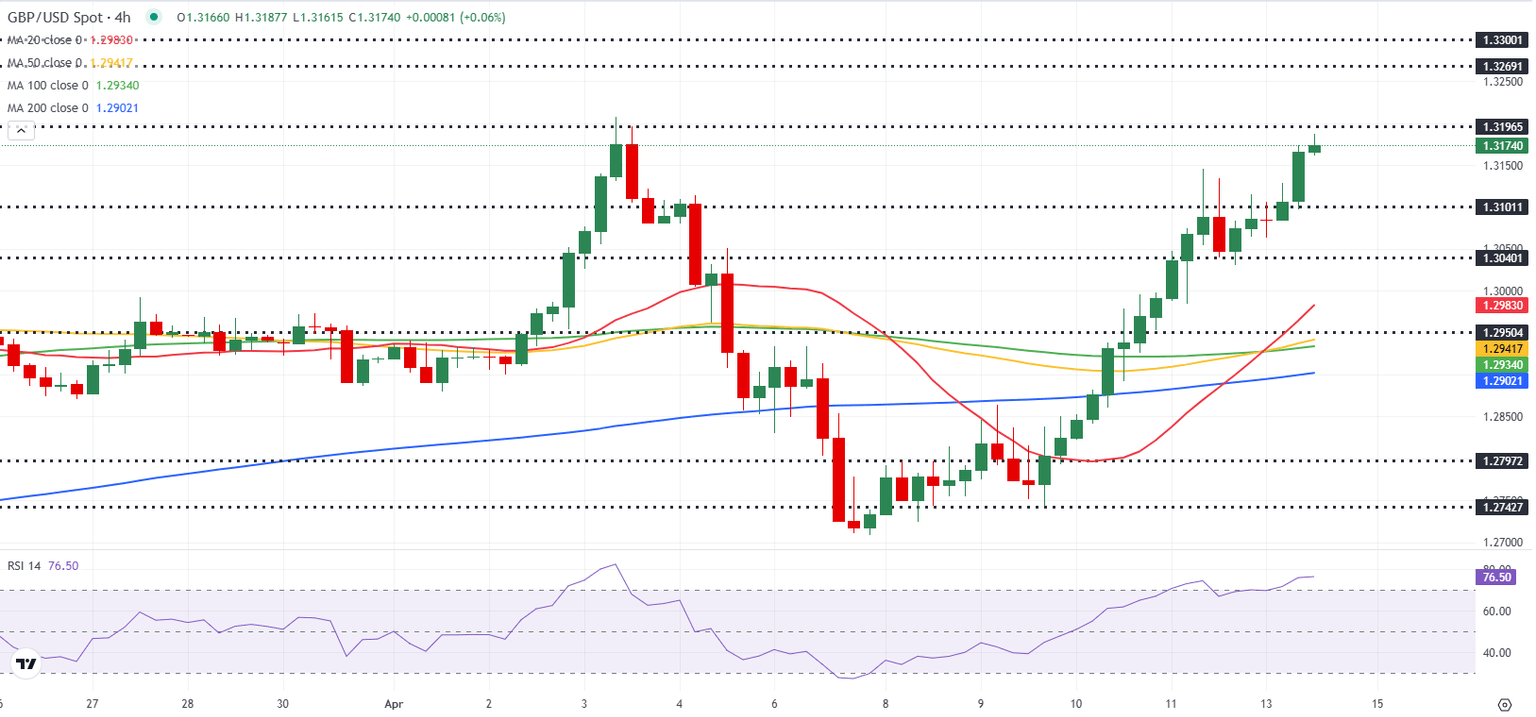

GBP/USD Forecast: Pound Sterling extends rally on broad USD weakness

After rising nearly 1% on Friday and ending the previous week with a 1.5% gain, GBP/USD preserves its bullish momentum on Monday and trades above 1.3150. The pair's near-term technical outlook points to overbought conditions but investors could refrain from betting on a deep correction, given the broad-based selling pressure surrounding the US Dollar (USD).

The USD Index, which tracks the USD's valuation against a basket of six major currencies, lost 3% last week as the deepening US-China trade conflict fed into fears over an economic downturn in the US.

Author

FXStreet Team

FXStreet