Pound Sterling Price News and Forecast: GBP outperforms as BoEs slight dovish bets keep downside limited

Pound Sterling outperforms as BoEs slight dovish bets keep downside limited

The Pound Sterling (GBP) outperforms its major peers on Tuesday, with investors focusing on Middle East tensions driving market sentiment. In Tuesday’s Asian session, Iran's Foreign Minister Abbas Araqchi issued a warning to Israel that the nation will face a strong retaliation if it attempts to attack their infrastructure. Though the British currency also carries a negative correlation with the risk-aversion theme, market expectations for the Bank of England's (BoE) shallow policy-easing cycle keep the downside limited.

Market participants expect the BoE to cut interest rates again in one of the two meetings remaining this year. On the contrary, the European Central Bank (ECB) and the Fed are expected to cut their borrowing rates by 25 bps in each of their remaining meetings this year. BoE’s rate cut prospects for November have improved after last week’s comments from Governor Andrew Bailey, which indicated that the central bank could cut interest rates aggressively if price pressures decline further. Read more...

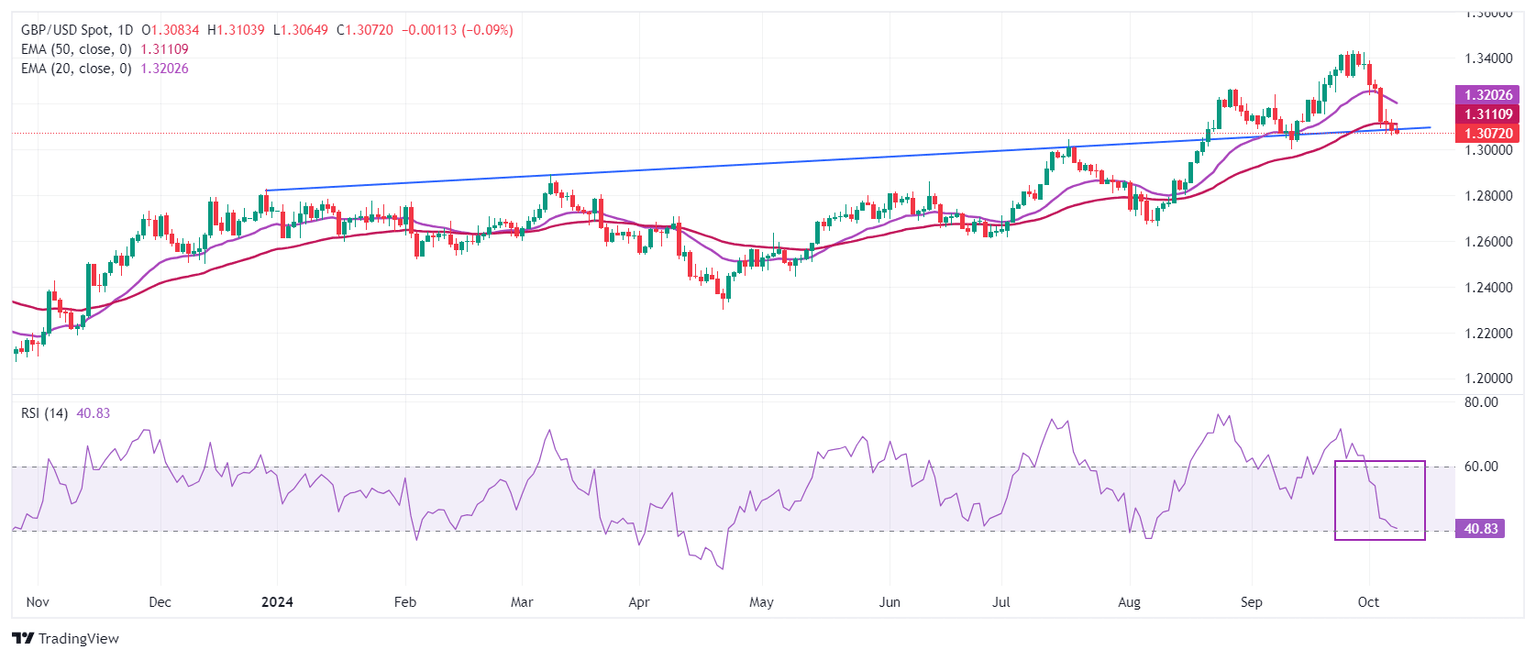

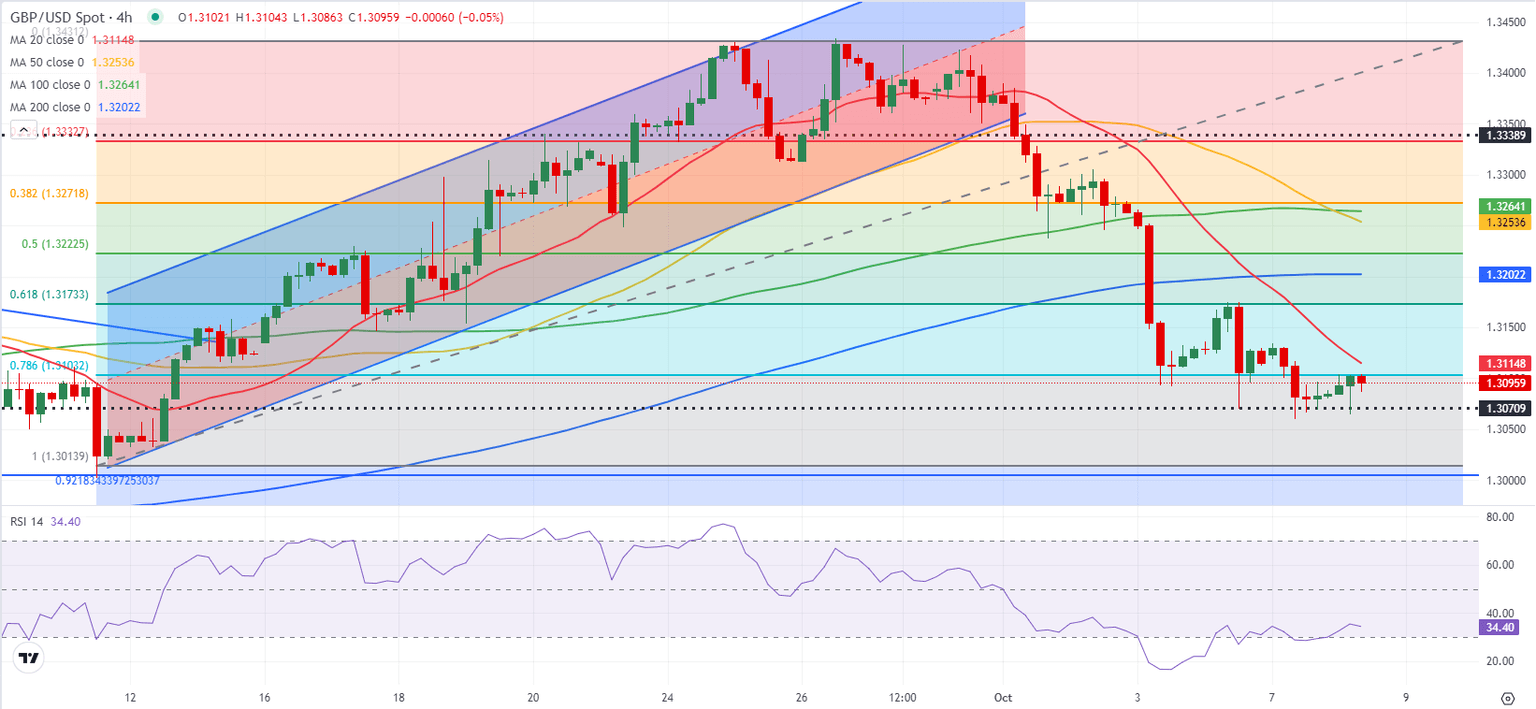

GBP/USD Forecast: Pound Sterling remains fragile as markets turn cautious

After closing in negative territory on Monday, GBP/USD staged a modest recovery early Tuesday but lost its traction after meeting resistance near 1.3100. The pair's technical outlook suggests that sellers look to retain control in the near term.

The negative shift seen in risk mood at the start of the week caused GBP/USD to edge lower. Early Tuesday, investors adopt a cautious stance amid growing concerns over an economic downturn in China. Read more...

Author

FXStreet Team

FXStreet