Pound Sterling Price News and Forecast: GBP gains ahead of key UK GDP data

Pound Sterling gains ahead of key UK GDP data

The Pound Sterling (GBP) gains against its major peers, except antipodeans, on Wednesday. The British currency trades higher ahead of the United Kingdom (UK) monthly Gross Domestic Product (GDP) and factory data, which will be released on Thursday.

The UK Office for National Statistics (ONS) is expected to show that the economy expanded 0.1% in November. Meanwhile, month-on-month (MoM) Manufacturing Production is estimated to have grown steadily by 0.5%, with Industrial Production remaining broadly flat. Read more...

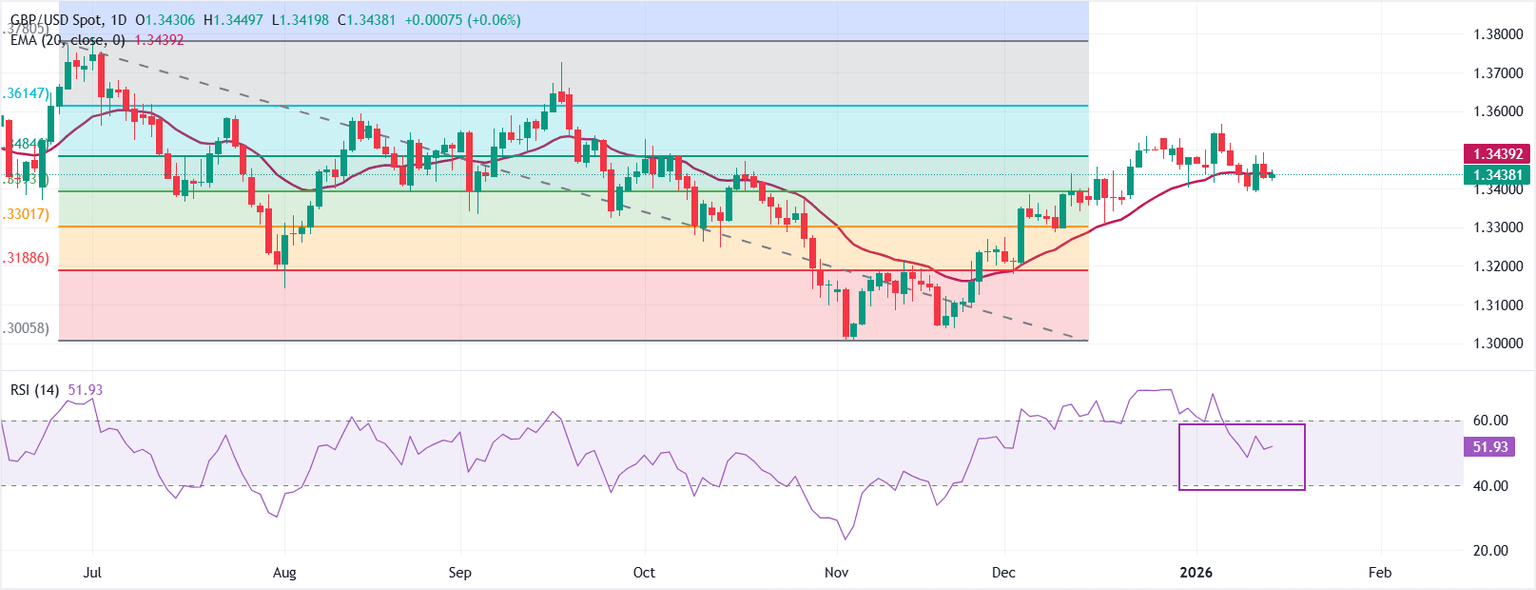

GBP/USD: Major support at 1.3390 is unlikely to come under threat – UOB Group

Pullback has scope to extend; the major support at 1.3390 is unlikely to come under threat. In the longer run, GBP is likely in a range-trading phase between 1.3390 and 1.3520, UOB Group's FX analysts Quek Ser Leang and Peter Chia note.

24-HOUR VIEW: "Following the sharp rebound in GBP that reached a high of 1.3486 two days ago, we indicated yesterday that 'the sharp rebound has scope to test 1.3495 before a pullback can be expected'. We pointed out that 'the major resistance at 1.3520 is not expected to come under threat'. Read more...

Author

FXStreet Team

FXStreet