Pound Sterling Price News and Forecast: GBP edges slightly lower

Pound Sterling slumps as Trump tariffs send shockwaves to global economy

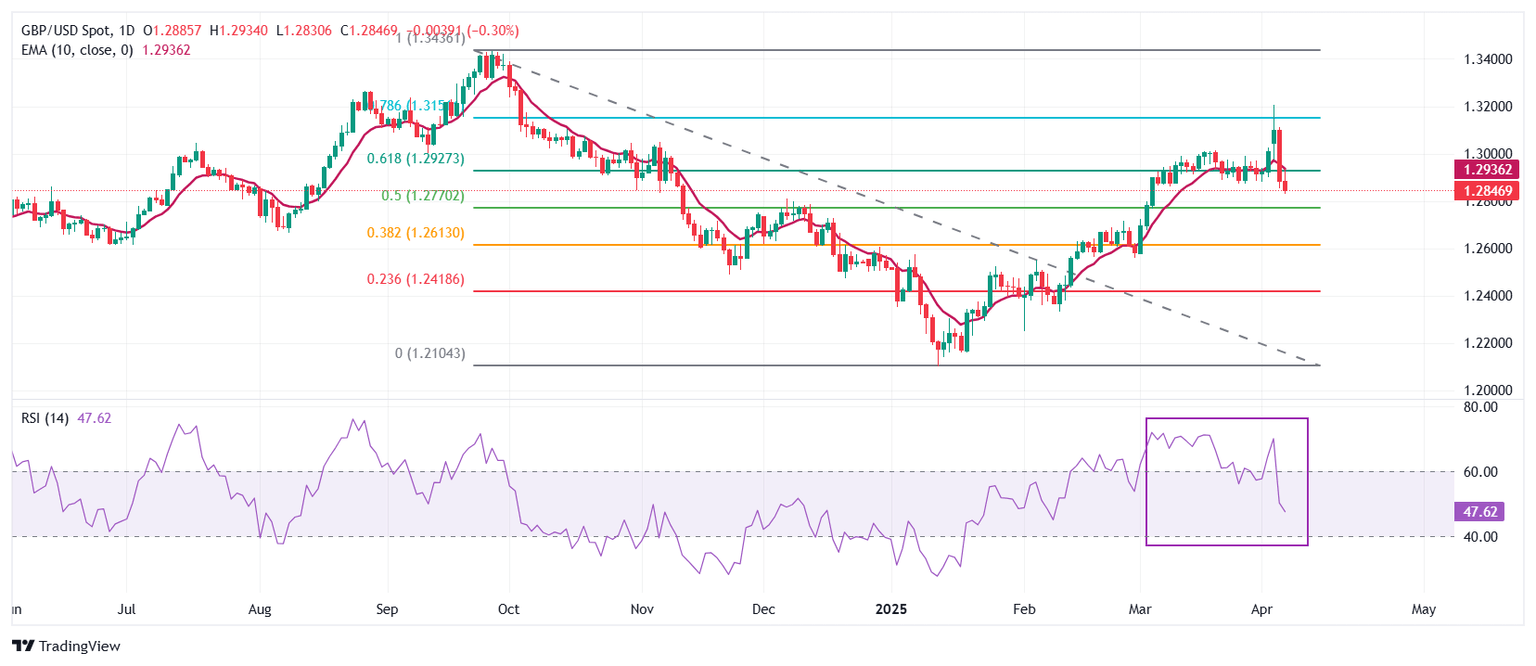

The Pound Sterling (GBP) gives up its intraday recovery move and tumbles to near 1.2800 against the US Dollar (USD) during Monday’s North American session, the lowest level seen in a month. The GBP/USD pair faces an intense sell-off as the US Dollar strives to gain ground, with the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, aiming to hold above 103.00. Read more...

GBP edges slightly lower – Scotiabank

Pound Sterling (GBP) is soft, down a modest 0.2% vs. the USD and a mid-performer among the G10 currencies.

"UK PM Starmer’s response to trade tensions appears to be centered around domestic measures targeting regulation reforms and tax breaks for sectors impacted by the US tariffs. Rate expectations have also shifted, with markets moving to price a full 25bpt for the BoE’s May 8 meeting, adding about 5bpts over the past week or so. The loss of rate support adds to near-term downside risk for GBP." Read more...

GBP/USD bounces off one-month low, defends 200-day SMA and retakes 1.2900

The GBP/USD pair attracts some dip-buyers near the 1.2830 region, or over a one-month low touched during the Asian session on Monday and for now, seems to have stalled its retracement slide from a six-month peak touched last week. Spot prices currently trade around the 1.2900 round figure, though the uptick lacks bullish conviction amid the gloomier global economic outlook. Read more...

Author

FXStreet Team

FXStreet