BoE´s Bailey: Alert to any signs of persistent inflationary pressures

Bank of England's Andrew Bailey has crossed the wires and said that the central bank has to be very alert to any signs of persistent inflationary pressures.

Read More...

GBP/USD Price Analysis: Refreshes daily high amid positive risk tone, subdued USD demand

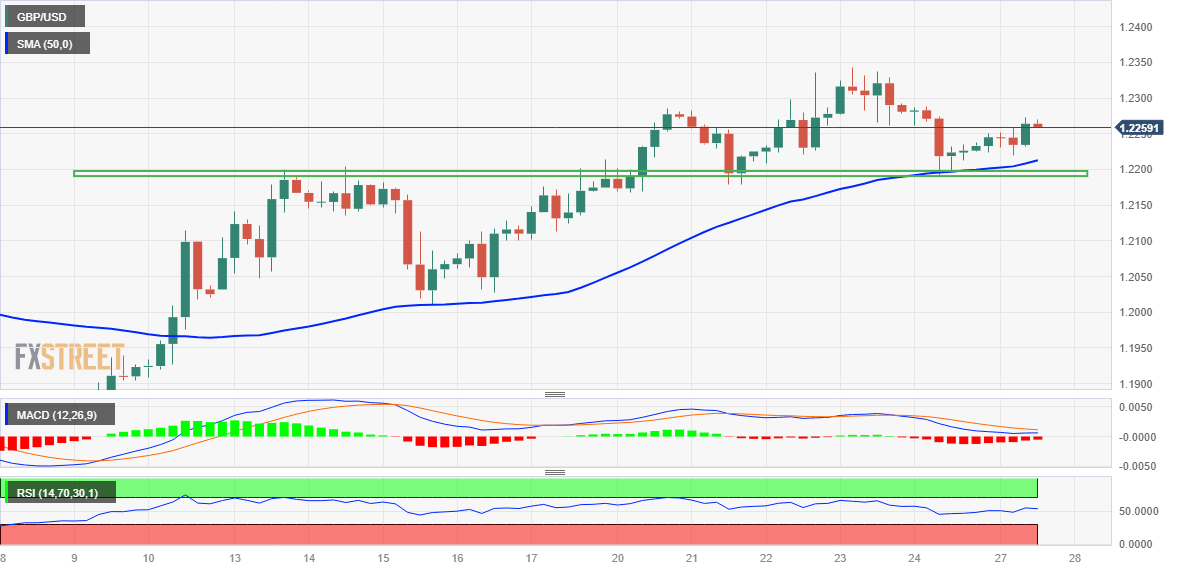

The GBP/USD pair regains positive traction on the first day of a new week and builds on its steady intraday ascent through the mid-European session. Spot prices climb to a fresh daily high, around the 1.2270-1.2275 area in the last hour, and reverse a major part of Friday's losses amid the risk-on impulse.

Read More..

GBP/USD sticks to modest intraday gains around mid-1.2200s, lacks follow-through

The GBP/USD pair builds on Friday's late intraday rebound from sub-1.2200 levels and gains some positive traction on the first day of a new week. The pair maintains its bid tone through the early part of the European session and is currently trading around mid-1.2200s, up nearly 0.15% for the day.

Read More...