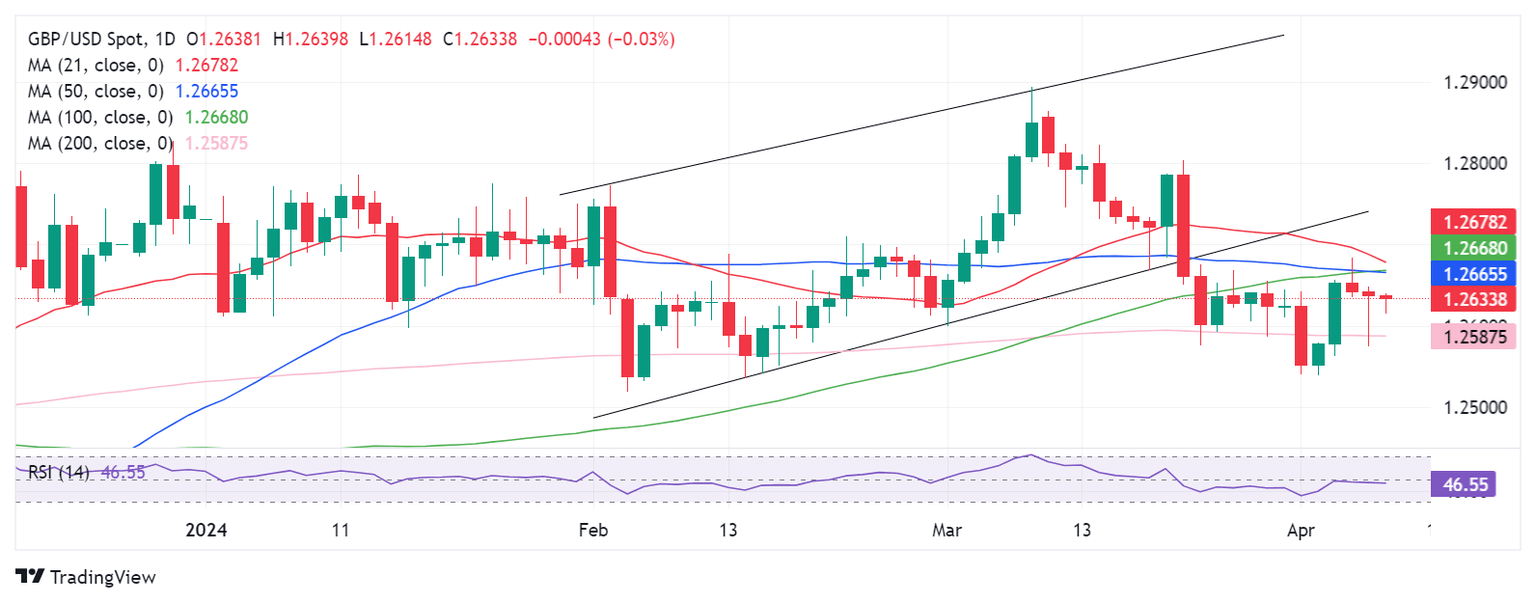

GBP/USD keeps a mild bid tone, aiming for 1.2685

The Sterling has opened the week on a slightly bullish tone. A somewhat softer US Dollar amid the moderate

risk appetite has allowed the pair to extend its recovery from post-NFP lows, returning to the mid-range of the 1.2600s.

Read More...

Pound Sterling consolidates as focus shifts to US Inflation

The Pound Sterling (GBP) broadly consolidates in a tight range above 1.2600 in Monday’s early New York session. The GBP/USD pair trades sideways as investors await the United States Consumer

Price Index (CPI) data for March, which will be published on Wednesday. The inflation data will provide more clarity over whether the Federal Reserve (Fed) will begin to reduce interest rates from June.

Read More...

GBP/USD Price Analysis: Pound Sterling looks vulnerable whilst below 1.2665

The Pound Sterling (GBP) is trading on the back foot against the US Dollar (USD), as

the GBP/USD pair manages to hold above the 1.2600 level at the start of the week on Monday.

Read More...