Pound Sterling trades cautiously against USD, Fed-BoE policy decision looms large

- The Pound Sterling drops to near 1.3330 against the US Dollar ahead of the Fed’s monetary policy announcement.

- The Fed is expected to hold interest rates steady, while the BoE is set to reduce them on Thursday.

- US-China trade talks will be the key trigger for the global market.

The Pound Sterling (GBP) trades cautiously to near 1.3370 against the US Dollar (USD) during North American trading hours on Wednesday. The GBP/USD pair faces slight pressure, while the USD consolidates ahead of the Federal Reserve (Fed) monetary policy announcement at 18:00 GMT, in which the central bank is almost certain to keep interest rates steady in the current range of 4.25-4.50%.

This would be the third straight policy meeting in which the Fed will leave borrowing rates steady amid uncertainty over how new economic policies by United States (US) President Donald Trump will shape the economy. A string of Fed officials, including Chair Jerome Powell, have guided that “wait and see” is an optimal approach until they get clarity on how much new policies will influence inflation and the economic outlook.

US consumer inflation expectations have elevated as local business owners have clarified that they will pass on the impact of high import duties to consumers, a compelling factor for the Fed to demand more time before making any monetary policy adjustments. Additionally, steady job growth in the wake of Trump’s tariff policies is another limiting factor for the Fed to act prematurely by lowering interest rates.

Daily digest market movers: Pound Sterling holds breath as BoE policy takes centre stage

- The Pound Sterling takes a breather on Wednesday after a sharp upside move the previous day. The British currency remains broadly firm against its peers as the United Kingdom (UK) and the US are close to signing a bilateral trade deal.

- A report from the Financial Times (FT) showed on Tuesday that both countries are close to a trade agreement in which the US will lower tariffs on UK steel and cars. In return, the UK would reduce tariffs on autos and agricultural products from the US and make changes to the digital services tax.

- Going forward, the major trigger for the British currency will be the Bank of England’s (BoE) monetary policy decision, which will be announced on Thursday. The BoE is expected to reduce interest rates by 25 basis points (bps) to 4.25%. This would be the fourth interest rate cut by the BoE in the current monetary easing cycle, which started in August last year.

- Investors will pay close attention to the BoE’s guidance on the monetary policy and the economic outlook. Market experts believe that the BoE could guide an aggressive policy-easing outlook in the wake of the US-China trade war. Investors worry that China would move to other economies to sell its products. Given the low-cost competitive advantage of China, the competitiveness of products from other nations would diminish if Beijing pushes more products into the global market.

- Meanwhile, the US and China have agreed to trade discussions this week. US Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer confirmed on late Tuesday that they will meet their Chinese counterparts for trade discussions this week in Geneva. This will be the first confirmed meeting between the world’s two largest powerhouses since the imposition of reciprocal tariffs and retaliatory duties announced by the US and China, respectively.

- Earlier this week, US Secretary Bessent signaled that Washington will have trade talks with Beijing sooner as these tariff rates are not sustainable. A positive outcome from the US-China trade talks will be favorable for risky assets across the globe.

Technical Analysis: Pound Sterling holds 1.3300

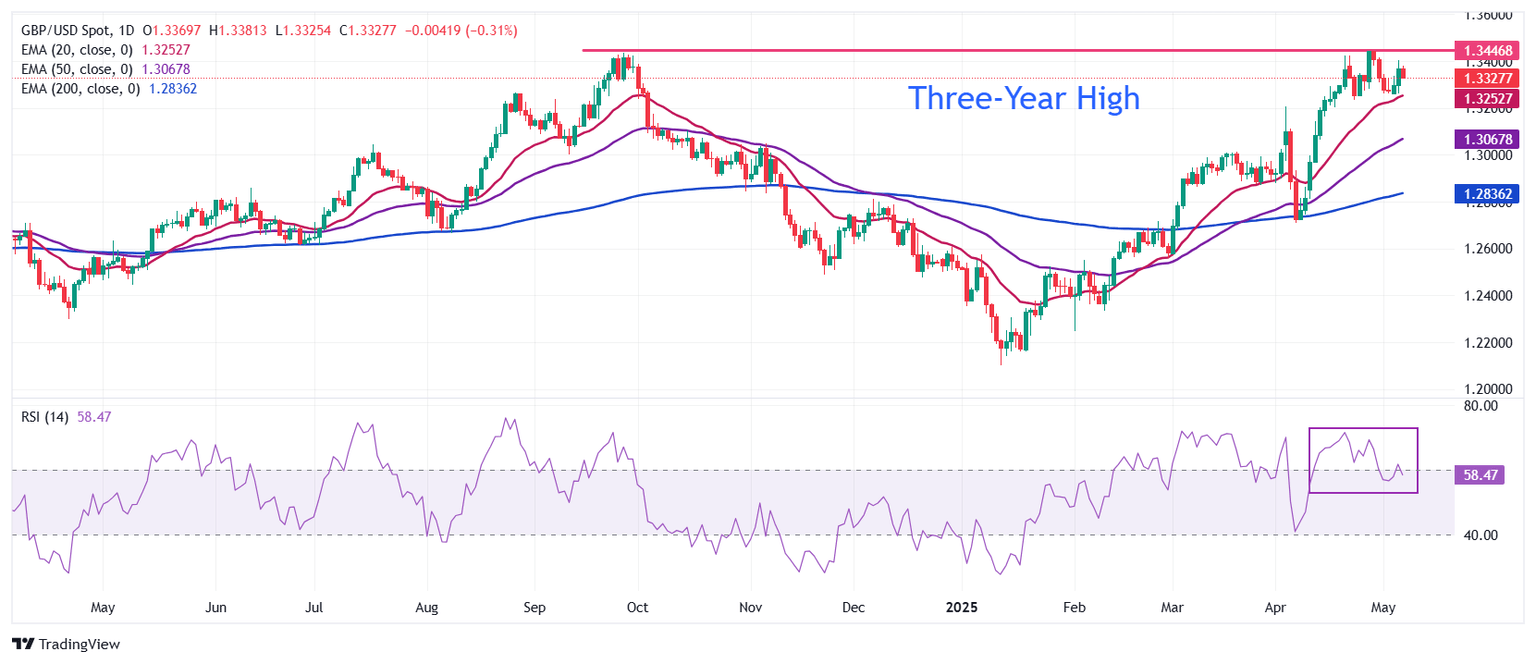

The Pound Sterling clings to Tuesday’s gains around 1.1370 against the US Dollar on Wednesday. The overall outlook remains bullish as all short-to-long Exponential Moving Averages (EMAs) are sloping higher.

The 14-day Relative Strength Index (RSI) strives to return above 60.00. A fresh bullish momentum would trigger if the RSI manages to do so.

On the upside, the three-year high of 1.3445 will be a key hurdle for the pair. Looking down, the April 3 high around 1.3200 will act as a major support area.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.