Pound Sterling weakens against US Dollar ahead of Trump's reciprocal tariffs

- The Pound Sterling falls to near 1.2900 against the US Dollar amid caution as US President Trump to unveil reciprocal tariffs on Wednesday.

- Goldman Sachs sees higher risks of a US recession amid Trump tariff jitters.

- The BoE is expected to follow a moderate monetary expansion cycle this year.

The Pound Sterling (GBP) drops against the US Dollar (USD) to near 1.2900 in Monday’s North American session. The GBP/USD pair drops as there safe-haven demand of the US Dollar improves ahead of the announcement of reciprocal tariffs by United States (US) President Donald Trump, which he will unveil on the so-called “Liberation Day” on Wednesday

Trump's tariffs are expected to have a significant impact on the global economic growth. Goods attracting higher duties will become less competitive globally, and their respective firms will be forced to lower their prices significantly. Such a scenario will force them to dump their products in other nations.

Analysts at Barclays said, "We expect the countries with the largest trade deficits in goods with the US and with the highest tariffs and non-tariff trade barriers could potentially be the target of the reciprocal tariffs.” As to their theory, the European Union (EU), China, Canada, India, and Japan will face higher tariffs from the US.

Financial market participants believe that the US economy will also face economic risks in the near term due to Trump’s tariffs. Analysts at Goldman Sachs have revised the chances of a recession in the US to 35% from their prior expectations of 20%. Their upward revision for recession risks has been based on a sharp “deterioration in household and business confidence” and statements from the White House officials indicating “greater willingness to tolerate near-term economic weakness” in pursuit of their policies.

This week, investors will also focus on a slew of US economic data such as ISM Manufacturing and Services Purchasing Managers’ Index (PMI) and labor market-related indicators, which will influence market speculation for the Federal Reserve’s (Fed) monetary policy outlook.

Daily digest market movers: Pound Sterling outperforms risky peers

- The Pound Sterling outperforms its risky peers at the start of the week, but trades lower against safe-haven currencies amid fears of reciprocal tariffs by US President Trump on Wednesday. The British currency gains as investors expect the impact of Trump tariiffs to be nominal on the United Kingdom’s (UK) economic outlook.

- On Thursday, UK Chancellor of the Exchequer Rachel Reeves said in an interview with Bloomberg Television that they are working intensely these next few days to try and secure a “good deal for Britain”. The optimism that the impact of Trump’s tariffs will be very limited on the UK is also driven by Trump’s comments in late February that he is not sure about imposing tariffs on the UK. Trump also sounded confident that a deal could be made as UK Prime Minister Keir Starmer was "very nice".

- Meanwhile, upbeat UK Retail Sales data for February has also strengthened the Pound Sterling. The Office for National Statistics (ONS) reported on Friday that Retail Sales, a key measure of consumer spending, surprisingly rose by 1% month-on-month compared to an expected 0.3% decline.

- Additionally, hopes of a moderate policy-easing cycle by the Bank of England (BoE) has also kept the Pound Sterling on the frontfoot. Market participants expect the BoE to cut interest rates only two times more this year. The BoE has already reduced borrowing rates once in 2025.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.40% | 0.26% | 0.01% | 0.51% | 1.03% | 1.17% | 0.58% | |

| EUR | -0.40% | -0.04% | -0.31% | 0.15% | 0.71% | 0.80% | 0.22% | |

| GBP | -0.26% | 0.04% | -0.35% | 0.23% | 0.75% | 0.87% | 0.31% | |

| JPY | -0.01% | 0.31% | 0.35% | 0.46% | 1.03% | 1.16% | 0.45% | |

| CAD | -0.51% | -0.15% | -0.23% | -0.46% | 0.55% | 0.66% | 0.08% | |

| AUD | -1.03% | -0.71% | -0.75% | -1.03% | -0.55% | 0.11% | -0.47% | |

| NZD | -1.17% | -0.80% | -0.87% | -1.16% | -0.66% | -0.11% | -0.58% | |

| CHF | -0.58% | -0.22% | -0.31% | -0.45% | -0.08% | 0.47% | 0.58% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

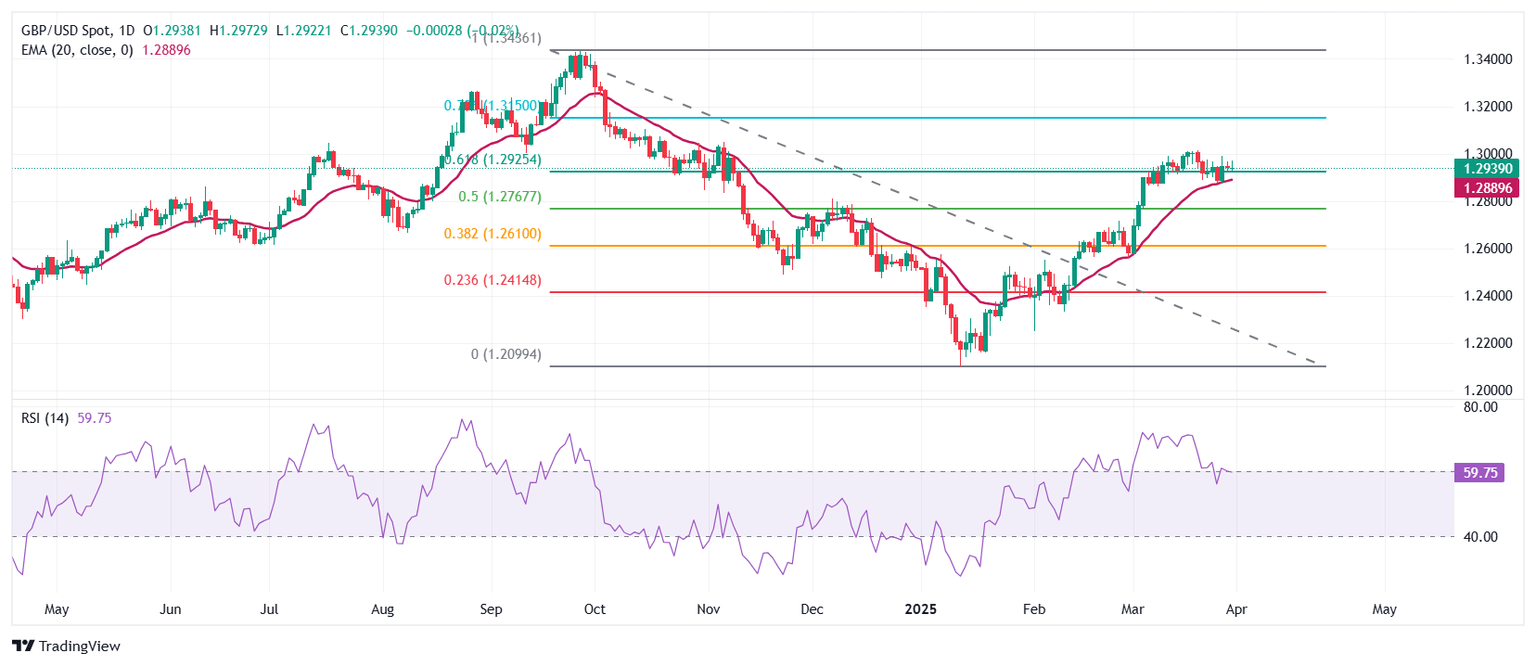

Technical Analysis: Pound Sterling holds key level of 1.2900

The Pound Sterling continues to wobble around the 61.8% Fibonacci retracement, plotted from late-September high to mid-January low, near 1.2930 against the US Dollar. Additionally, the 20-day Exponential Moving Average (EMA) continues to provide support to the pair around 1.2890.

The 14-day Relative Strength Index (RSI) cools down to near 60.00 after turning overbought above 70.00. Should a fresh bullish momentum come into action if the RSI resumes the upside journey after holding above the 60.00 level

Looking down, the 50% Fibonacci retracement near 1.2770 and the 38.2% Fibonacci retracement at 1.2610 will act as key support zones for the pair. On the upside, the October 15 high of 1.3100 will act as a key resistance zone.

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Next release: Fri Apr 04, 2025 12:30

Frequency: Monthly

Consensus: 128K

Previous: 151K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

BRANDED CONTENT

The right broker can enhance your trading experience by offering key features suited to your strategy. Discover a curated list of brokers designed to meet various trading preferences.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.