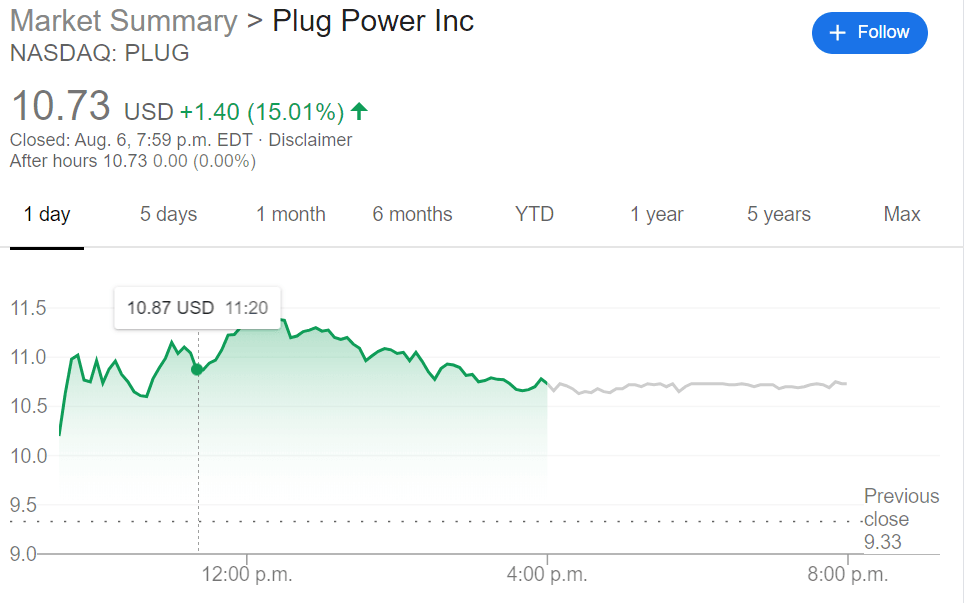

PLUG Stock Price: Plug Power Inc. sizzles after earnings call

- NASDAQ:PLUG rises 15.01% on earnings beat despite a drop in revenues.

- The clean energy company has reaffirmed its guidance for the rest of 2020.

NASDAQ:PLUG has extended its steady growth in the past week after a successful earnings call that reinforced investor optimism in the long-term potential of the stock. The share price surged over 15% during Thursday’s trading session, closing the day at $10.73 – a 32% increase from the start of the week. PLUG’s stock price is now within 6% of its 52-week high of $11.48 and a stellar third quarter should be able to break through that for a new yearly high.

PLUG has extremely high hopes for the future as it continues to grow alongside the red-hot electric vehicle sector – one of the best performing stock industries so far this year. The clean energy player has its hands in a myriad of different products, including its well-known hydrogen-powered forklifts – which are smaller and charge faster than traditional ones. The Latham, New York-based firm is banking on its fuel cell technology to be adopted in other markets as well – including passenger and delivery vehicles. PLUG’s managers are so confident in the outlook for PLUG that they believe billings will continue to grow by 40% every year – with an estimated $1.2 billion by 2024.

PLUG Stock Forecast

PLUG investors have enjoyed a profitable year so far as the stock price is up 470% off of its 52-week lows. According to the earnings call, PLUG expects between $110 million and $115 million in billings for the third quarter of 2020 – and have reaffirmed its guidance for the rest of 2020. The future does look bright for PLUG and if management does follow through on its guidance for the rest of the year, the stock price could be hitting new highs sooner rather than later.

Author

Stocks Reporter

FXStreet