Plug Power (PLUG) freefall: Is the hydrogen hype stock headed for a sub-$2 breakdown?

Plug Power, Inc. (PLUG), a market leader in the end-to-end hydrogen ecosystem, was slammed hard on Friday, plummeting 9.84% to close at $2.25. This dramatic decline puts the stock over 50% down from its high pivot back on October 6th. This massive drop indicates intense selling pressure that looks poised to push the price even lower.

Plug Power specializes in the full hydrogen life cycle, from green hydrogen production via electrolyzers to liquefaction, transportation, storage, and specialized fuel cell solutions for various applications, including material handling, electric vehicle charging, and industrial decarbonization.

Testing the limits: The consolidation zone

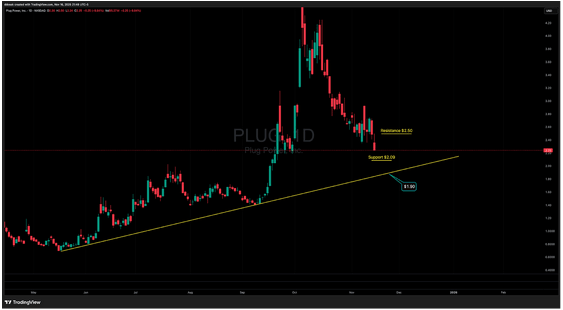

Technical analysis shows that Friday’s closing price settled right near the lows of the late September consolidation phase, confirming a strong break in the recent, weak price action.

Should the current plunge continue, the next immediate support level is the top of the July consolidation at $2.09. Just beyond that lies an even stronger line in the sand: $1.90. This level is derived from an inclining trendline that has defined the low-point action since May of this year.

This entire $1.90 – $2.09 zone is critically significant. The market will find it difficult for PLUG to break straight through this area without at least some consolidation or a strong technical bounce.

High reward for risk takers

Should a technical bounce occur off of either the $2.09 or the $1.90 level, it could potentially bring the price sharply back up toward the $2.50 area. For current prices, this implies a potential near-term gain of over 20% if the key support holds, presenting a high-reward scenario for nimble traders.

Author

Drew Dosek

Verified Investing

Passionate technical and cycle analyst committed to empowering traders through data-driven insights.