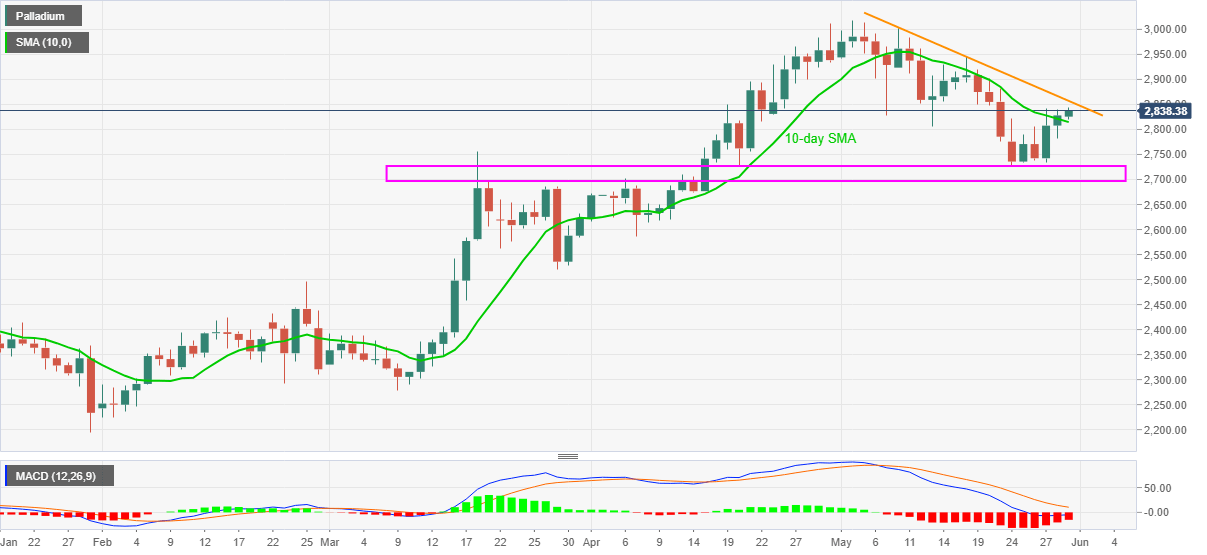

Palladium Price Analysis: XPD/USD stays on the way to key hurdle below $2,900

- Palladium prints three-day uptrend, bulls target three-week-old resistance line.

- Receding bearish MACD, rebound from $2,726 favor buyers.

Palladium (XPD/USD) prices remain firm around $2,840, up 0.41% intraday, as traders in Brussels prepare for Monday’s bell.

The precious metal crossed 10-day SMA for the first time since May 05 on Friday and is keeping the breakout, backed by receding bearish bias of MACD, by the press time.

Also favoring the XPD/USD could be the metal’s successful rebound from a ten-week-old broad horizontal support.

However, a clear upside break of a short-term resistance line around $2,857 becomes necessary for the commodity buyers to aim for the $3,000 psychological magnet, not to forget the monthly peak surrounding $3,020.

During the run-up, the previous swing top close to $2,946 may act as an extra filter to the north.

Meanwhile, a downside break of a 10-day SMA level of $2,814 can again drag the quote towards the $2,726-2,696 support zone.

In a case where Palladium bears keep the reins past $2,696, a late March low near $2,520 should return to the charts.

Palladium daily chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.