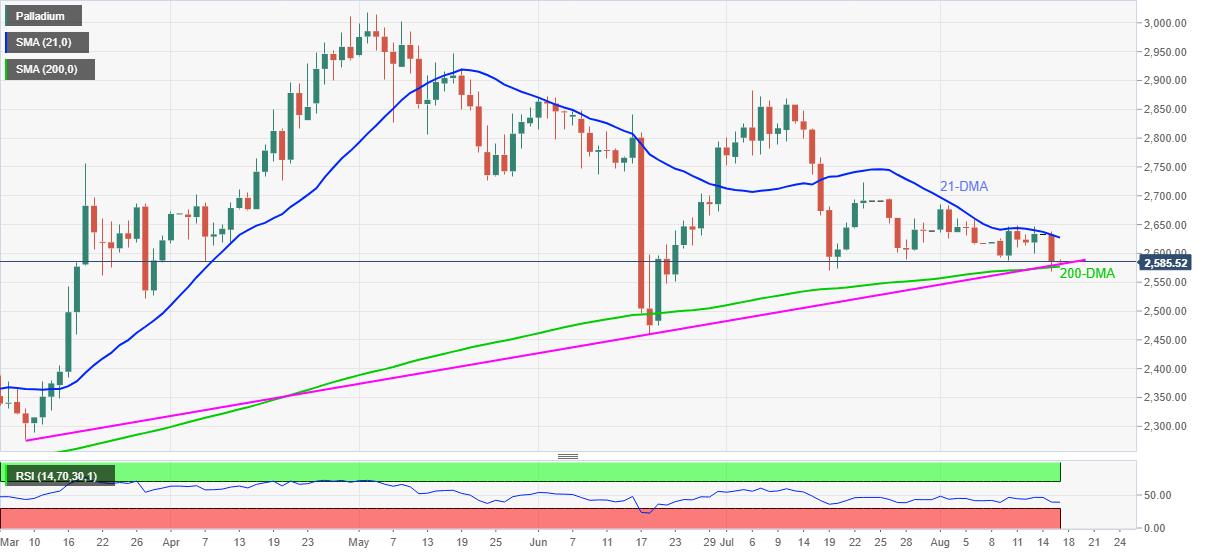

Palladium Price Analysis: XPD/USD sellers look for fresh entries below $2,577

- Palladium seesaws inside a choppy range near the key support confluence.

- 200-DMA, three-month-old support line challenge bears, 21-DMA guards immediate upside.

- Downbeat RSI, multiple failures to cross immediate moving average favor sellers.

Palladium (XPD/USD) remains pressured inside a choppy range surrounding $2,585 as European traders brace for Tuesday’s bell.

The bright metal dropped the most in August the previous day but couldn’t provide a daily closing below the convergence of 200-DMA and an ascending support line from early March.

Even so, a sustained trading below 21-DMA and downbeat RSI conditions, not to forget lower high formations in the last one week, keeps XPD/USD sellers hopeful.

However, a daily closing below $2,577 becomes necessary for the bears to keep the reins. Following that, late March’s low around $2,520 and June’s bottom surrounding $2,461 should return to the chart.

Meanwhile, corrective pullback needs to cross the 21-DMA level of $2,627 to direct the palladium buyers towards the monthly high near $2,685.

During the quote’s successful trading beyond $2,685, the $2,700 will be the key to further advances targeting May’s low near $2,725.

Palladium: Daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.