Palantir Stock News and Forecast: PLTR looks set for short-term rally

- PLTR stock is down 59% year to date.

- Palantir was one of retail's favorite stocks during 2021, but the crash has lost it fans.

- PLTR operates in the government and defense spaces.

Palantir (PLTR) is a stock that generates much debate on social media and still carries a reasonable retail following. This has diminished along with the share price, but there are some believers still willing to trust the long-term investment thesis.

Palantir stock news

The main problem for Palantir over the last 12-18 months has been around the area of stock-based compensation. This has frustrated many investors and led them to exit the company. Now for starters, Palantir went public at the height of the pandemic boom and so its valuation was also far too high. This pullback cannot be ascribed to stock-based compensation however. The whole valuation narrative was skewed too high.

PLTR stock began trading in October 2020 at $10 before soaring to $45 a few months later. This more than quadrupling of the stock price was on the back of little change in the fundamentals. We can mostly put this down to the speculative bubble. Now that PLTR is trading at $7.53, it starts to represent a different proposition.

Revenue growth is strong and looks stable. With heightened geopolitical developments and Palantir having numerous government, US Army and US intelligence agencies as customers, this trend looks likely to remain strong.

Profit growth is also strong.

Palantir looks on target to finally turn a profit.

If it can keep reducing stock-based compensation, then maybe shareholders will be enticed back in.

There is plenty of cash and no debt.

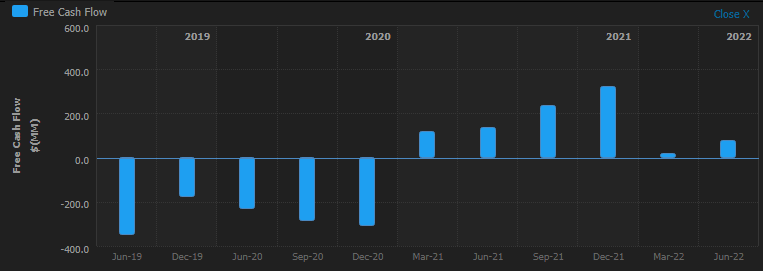

Cash generation is all over the place though and needs to be more consistent in this environment.

Source: Refinitiv

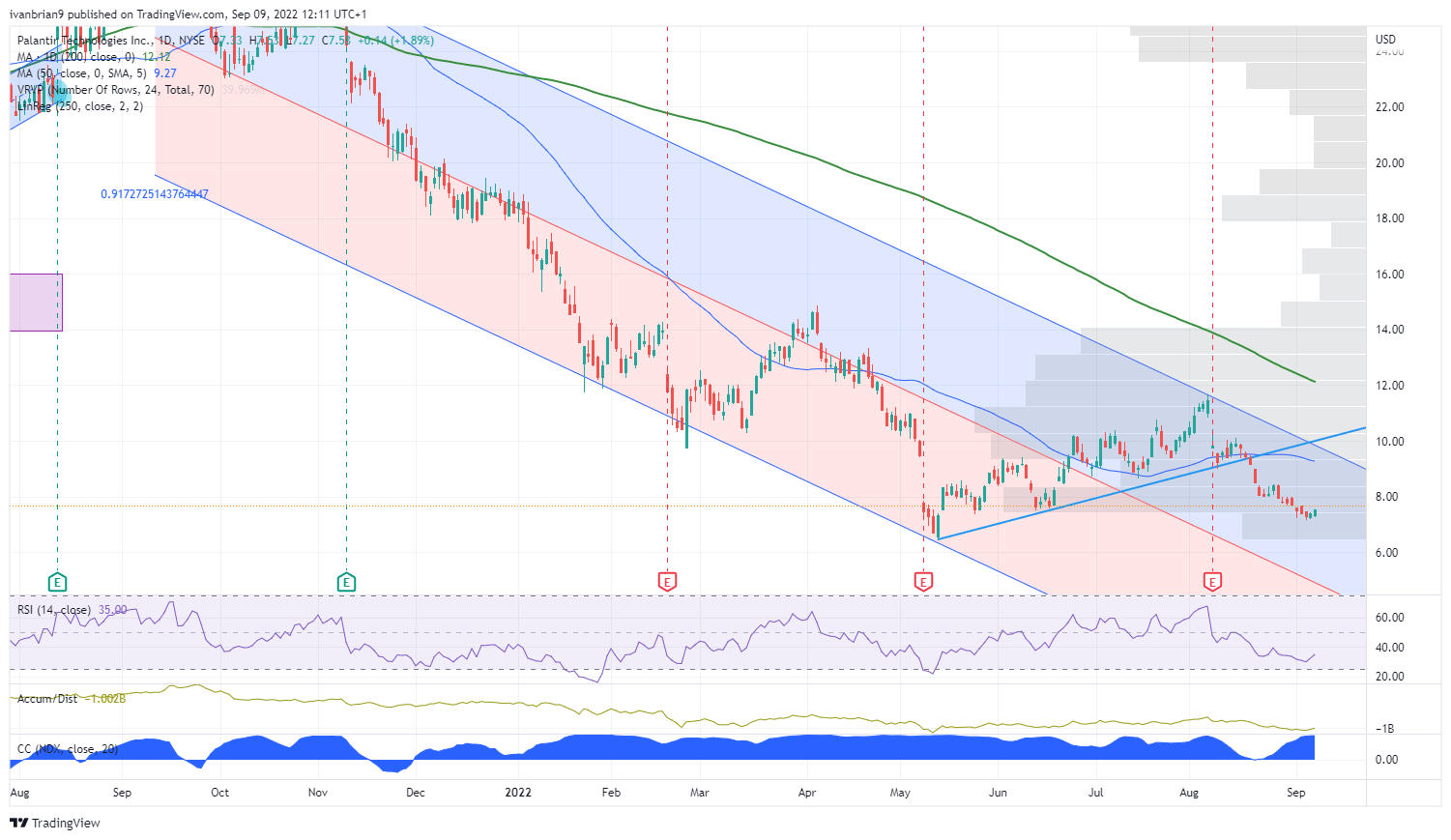

Palantir stock forecast

Based on the above, the company looks in a reasonable position, albeit free cash flow is poor. In the current environment cash is king, but technically at least there are some bullish signs. The summer rally saw PLTR stock move from $6.44 to $11.45. Earnings then came out and torpedoed the stock. PTR lost 14% on the release. Revenue beat, but the loss was too big and guidance was lower than forecast.

How much of that is now in the price? Holding above $6.44 gives some prospect of a short-term bottom. Risk assets look set for a short-term rally with Bitcoin, Nasdaq and other high-growth, high-beta names looking better. Positions and sentiment have once again become overly bearish just like in June. Holding $6.44 could give a short-term rally. The first resistance is at $9.27 from the 50-day moving average and $10.85 from the earnings gap. A break of $11.62 would mark a new high and end the series of lower highs and make things look more promising on a longer time horizon. $6.44 is the pivot.

PLTR stock, daily

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.