Palantir Earnings see PLTR stock fall 15% as forecasts disappoint

- Palantir stock is set to report earnings on Monday before the market opens.

- PLTR is a former retail favourite but has slumped as the retail army suffers.

- Palantir could benefit from increased security spending, but stock compensation issues dog performance.

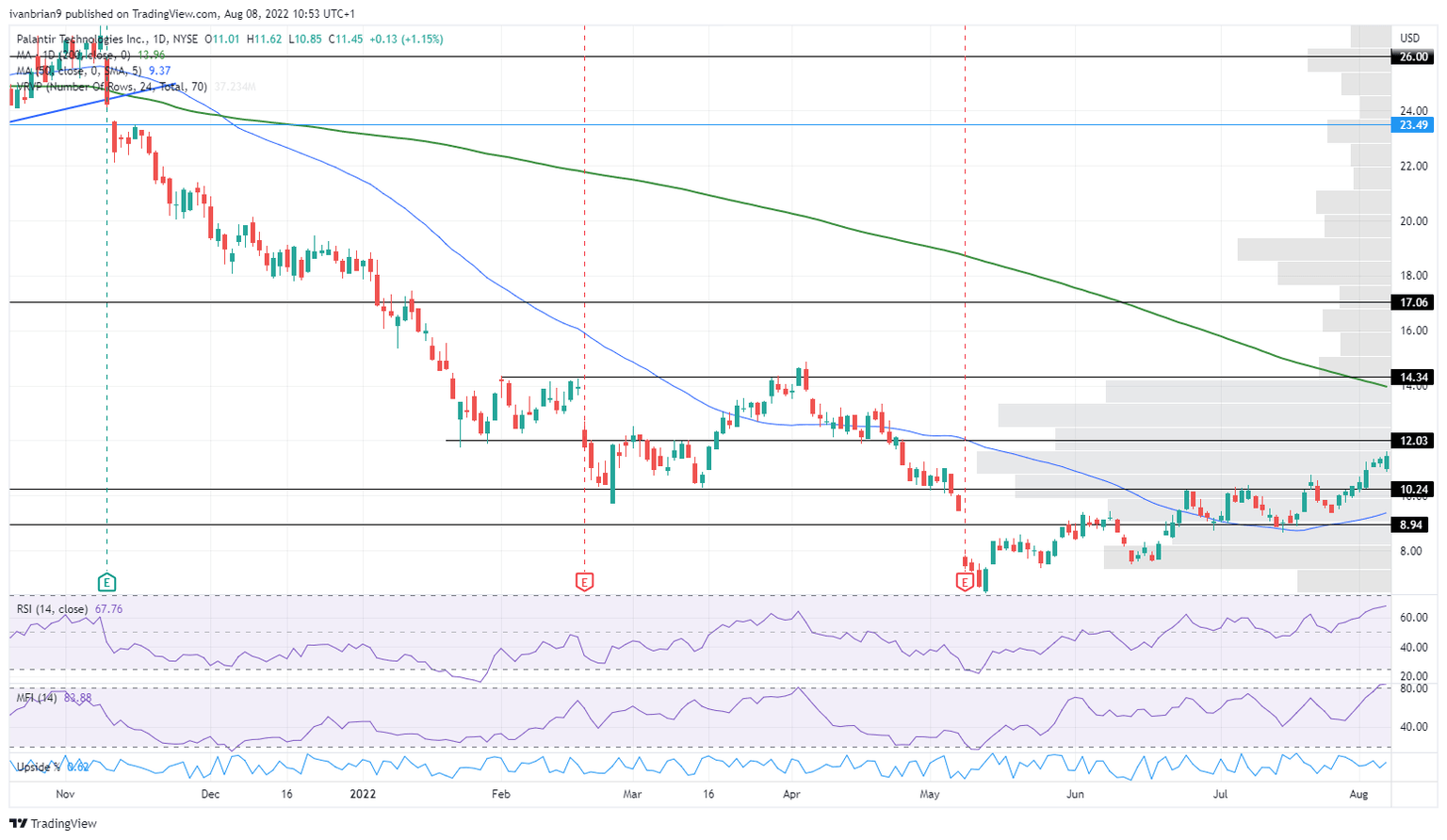

Update: Earnings from Palantir were poor and the stock has reacted accordingly, currently PLTR stock is 15% lower in the premarket. PLTR missed on EPS $-0.01 versus $0.03 estimate. Revenue beat slightly $473 million versus $471 million consensus. But again revisions to the next quarter's earnings have done the damage. Q3 revenue is forecast to remain largely flat at $473 million when consensus was above $500 million. Our prophetic note this morning gave you the set up "In my view, the stock is set up for a risk-reward trade to the downside. PLTR has had eight straight up days in a row and is up from $6.44 to $11.45 from the last earnings report to this. The Q1 earnings report did not deserve to see PLTR nearly double! PLTR stock is also flashing as overbought on the Money Flow Index (MFI) and is close to it on the Relative Strength Index (RSI)".

Palantir (PLTR) stock is finally set to at least garner some attention if not performed as the former retail favourite reports earnings before the open on Monday. Palantir is involved in the security industry and has numerous government contracts with defence and army units, but issues over stock compensation and dilution have dogged the performance and caused investors to shy away.

Palantir stock news

The company already guided for Q2 earnings to disappoint during its Q1 report. This led to a slew of downgrades from Wall Street analysts. Q1 earnings dropped in early May and showed an EPS miss, while revenue was just ahead of forecasts. Palantir said Q2 revenues would be around $470 million, which was a notable downgrade from consensus at the time of $483 million. Despite this PLTR stock is up about 90% since that Q1 report. Currently, the consensus for Q2 earnings is for EPS of $0.03 and revenue of $471 million.

Palantir stock forecast

Palantir as mentioned has run up significantly from the last earnings report. The main question is how low did Palantir guide analysts? In forecasting revenue down from $483 million to $470, was it setting up for a beat, being truthful or preparing the ground for yet more bad news? We shall see.

In my view, the stock is set up for a risk-reward trade to the downside. PLTR has had eight straight up days in a row and is up from $6.44 to $11.45 from the last earnings report to this. The Q1 earnings report did not deserve to see PLTR nearly double! PLTR stock is also flashing as overbought on the Money Flow Index (MFI) and is close to it on the Releative Strength Index (RSI).

PLTR daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.