OIL Price Forecast: WTI approaches the range top at the $67.00 area

- Oil prices maintain their immediate bullish trend, with geopolitical tensions back on the table.

- Iran stopped its collaboration with the UN nuclear watchdog, and Crude prices jumped.

- WTI Oil price action suggests a potential bottoming formation at $64.00.

WTI Crude Prices jumped on Wednesday following news that Iran suspended its cooperation with the International Atomic Energy Agency (IAEA) and is holding gains on Thursday, despite the unexpected increase in US Oil stocks.

Tehran announced on Web¡nesday that President Masoud Pezeshian approved a law to halt its cooperation with the nuclear watchdog, which raises questions about the Islamic Republic's plans to resume its nuclear program.

The higher geopolitical fears have offset the impact of a widely expected supply hike, after this weekend’s OPEC+ meeting and increase of 3,845 million barrel increase on US Crude stocks last week, which were expected to have dropped by 2 million

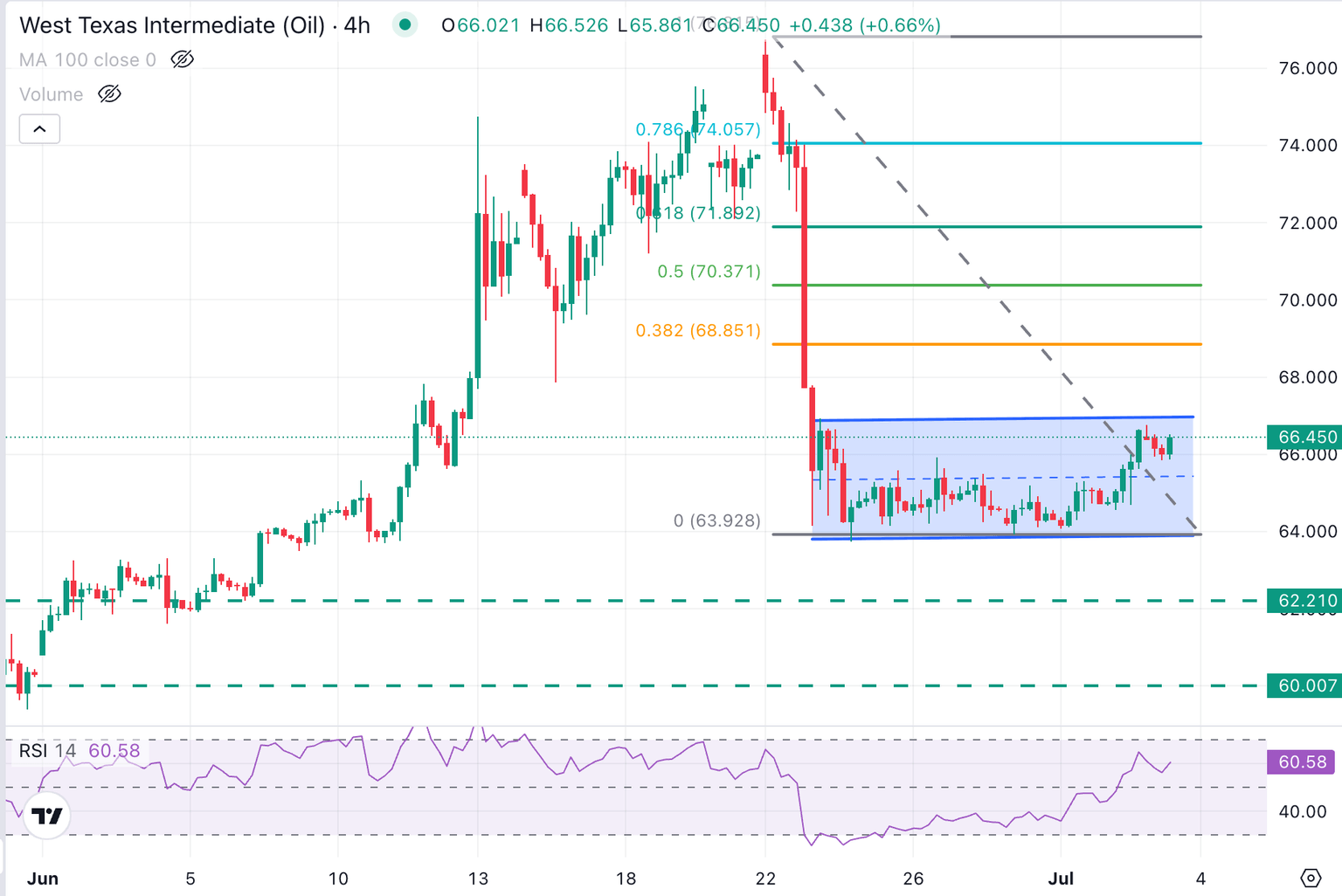

Technical Analysis: WTI might set a potential bottom at the 64.00 area

From a technical perspective, WTI Prices are showing an improving bullish momentum on Thursday. The 4-hour RSI stays at positive territory, well above the 50 level, and downside attempts are finding buyers.

Recent price action suggests that the commodity might be going through a bottoming formation, which would be confirmed with a decisive breach of the $67.00 resistance area (June 24, July 2 highs).

Above here, the next bullish target would be the 38.2% Fibonacci retracement of the June 22-23 sell-off, at $68.85 and the $70.00 psychological level, which is coincident with the 50% Fibonacci retracement of the mentioned period.

On the downside, immediate support is at the intraday low at $65 90. A further decline below the mentioned $64.00 area cancels this view and brings the June 6 low, at 62.20, into focus.

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 12 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.