OCGN Stock Forecast: Ocugen Inc extends sell-off amid covid vaccine doubts, profit-taking

- NASDAQ:OCGN drops by 20.24% despite the NASDAQ breaking through the 14,000 barrier.

- One Wall Street analyst warns OCGN has risen too high in a short amount of time.

- OCGN is attempting to bring its COVID-19 vaccine candidate to the United States.

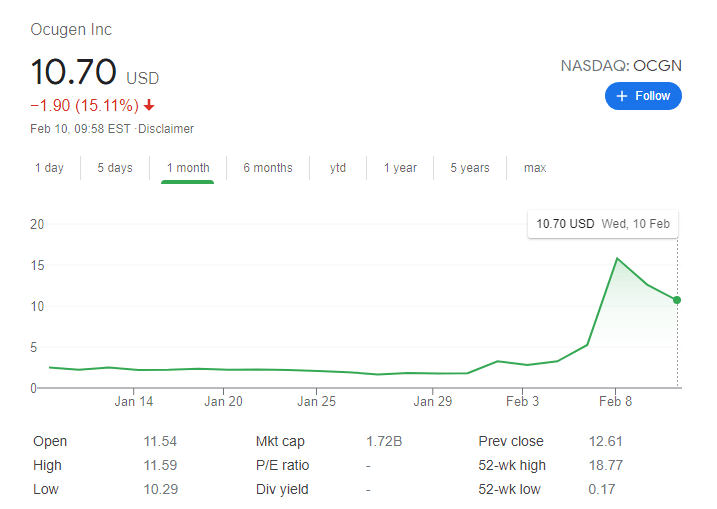

Update: Ocugen Inc (NASDAQ: OCGN) has kicked off Wednesday's trade with a substantial decline of around 15% to trade below $11. Shares of the Malvern, Pennsylvania-based company are falling for the second consecutive day after hitting an all-time high of $18.77. One of the reasons for the decline from the highs – it is essential to note that OCGN was a penny stock back in December – is profit-taking. Another factor is that some investors are concerns that the deal that Ocugen struck with Bharat BioTech may not yield the dividends that some expect. The road to a COVID-19 vaccine may be long. See all the latest hot stocks news.

NASDAQ:OCGN has finally hit a speed bump as the penny biotech stock surged to a new all-time high in 2021, already returning over 500% to its investors. On Tuesday, the stock fell 20.24% to close the trading day at $12.61 as Wall Street cautioned investors on the meteoric stock performance. Even with the drop, Ocugen has grown from a stock worth $0.20 to a $2 billion market cap company all within the span of the past 52-weeks, as the Pennsylvania-based firm uses its leverage to take on some pharmaceutical giants.

Those companies that Ocugen is challenging include Pfizer (NYSE:PFE) and Moderna (NASDAQ:MRNA), the two leaders in the COVID-19 vaccine race. Ocugen is not producing their own vaccine though, but rather are working on receiving FDA Emergency Use Authorization to bring over Bharat’s vaccine candidate, Covaxin. Bharat is an Indian pharmaceutical titan that has produced an intranasal vaccine for COVID-19 that does not require a shot. Bharat would supply the initial doses but Ocugen is looking to work with American-based biotech companies to produce subsequent doses of Covaxin.

OCGN stock news

OCGN also received an analyst downgrade on Tuesday as Chardan analyst Keay Nakae warned of the euphoria surrounding Ocugen, and lowered the price target to $13. While Ocugen certainly has a high ceiling moving forward given it has agreed to a 45% revenue split with Bharat, Covaxin still has yet to receive FDA EUA. In fact, Ocugen has yet to even approach the FDA and Phase 3 clinical trials are still taking place until March. Investors who have ridden Ocugen up from its penny stock status may want to trim some profits until more affirmative news is released.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet