Occidental Petroleum Stock News and Forecast: Is it too late to buy OXY stock?

- Occidental Petroleum stock soars as it Buffet buys big.

- OXY stock is up 50% in the last month as oil prices surge.

- OXY stock gains followers as traders rush to follow Buffet's lead.

Occidental Petroleum stock (OXY) continues to trade higher as the Sage of Omaha backs the company by revealing a large stake. Warren Buffet has now bought nearly 15% of Occidental as Berkshire Hathaway (BRK.A, BRK.B) bought more stock in the US oil giant last week. With oil prices continuing to surge on geopolitical tensions, traders are rushing to copy trade the most legendary investor of them all.

Occidental Petroleum Stock News: Buffet back for more

Last week Warren Buffet reportedly bought another 18.1 million shares in OXY stock through Berkshire to take its stake in Occidental up to 14.6%. Berkshire now owns over $7 billion worth of OXY stock or 136.4 million shares after last week's additions. What prompted Buffet to step into OXY stock? He said he bought the stock after listening to the last earnings conference call.

Revenues for 2021 neared $26 billion for OXY, an increase from $17.38 billion a year earlier. Gross Profit hit $16 billion, up from $9.3 billion the year previously. Occidental's gross margin is over 60% when the sector average is closer to 40%. Interestingly, while Warren Buffet has been building a stake, it appears another legendary investor Carl Icahn has been reducing his stake in Occidental (OXY). Icahn has reportedly made $2 billion on his Occidental investment. Icahn is known as an activist investor who tries to restructure a company by taking a large stake and then influencing its board and structure of the business. This can involve changing the board or stripping out parts of the business. Carl Icahn says Occidental now is a bet on oil prices, and there is no more activism for him to do there.

Occidental Petroleum Stock Forecast: OXY follows oil price

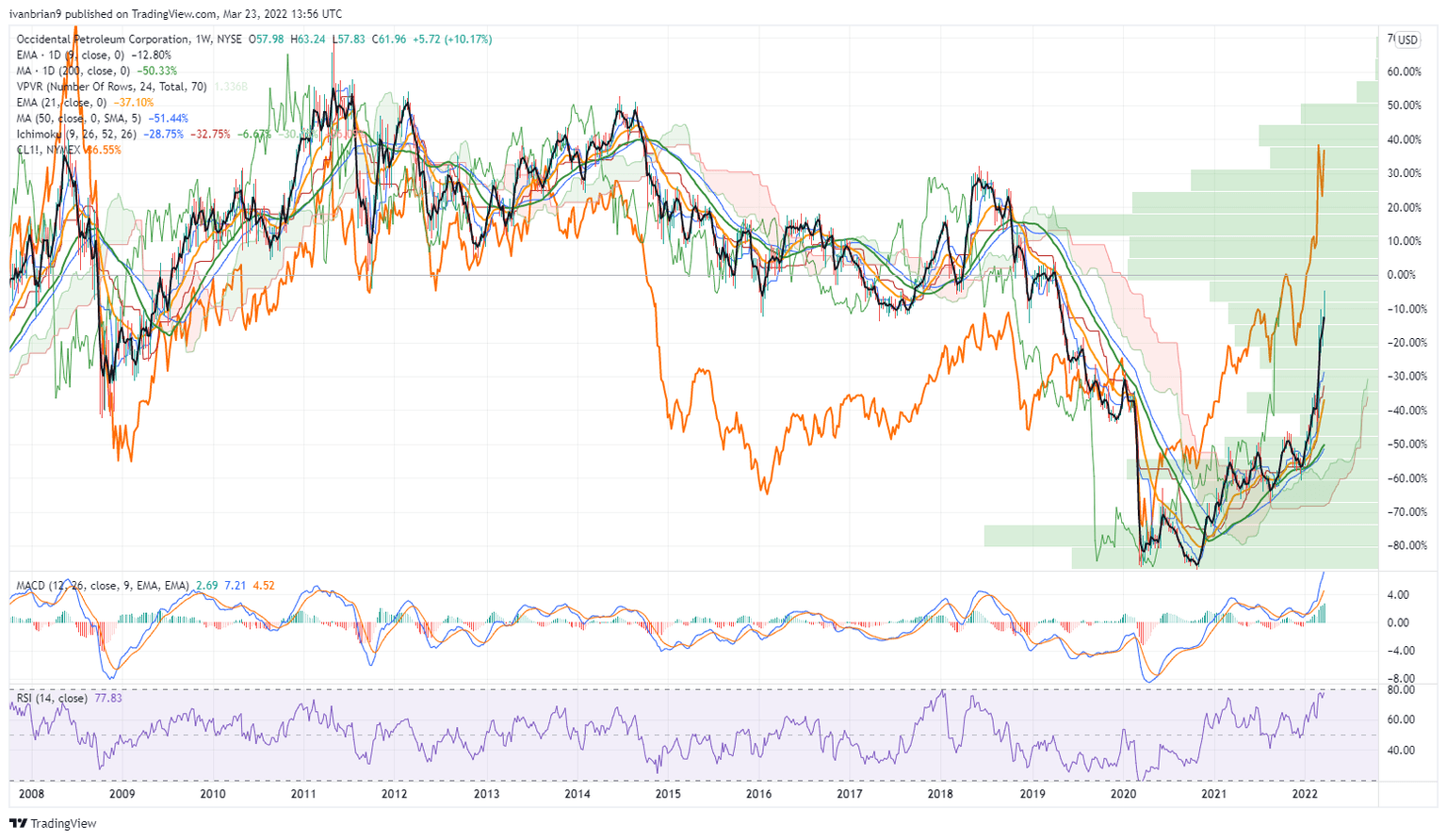

As Carl Icahn mentioned, this one is a play on oil prices. As we can see from the long-term chart below, we have overlapped the oil price and OXY. Going back to the financial crisis in 2008, we can see the strong correlation between the oil price and OXY stock price. The price of OXY has lagged the oil price in recent years, and could it be that Buffet has identified this? He said that after reading the last earnings presentation, that it persuaded him to take a position in the stock though he is long familiar with Occidental. He helped Occidental in its pursuit of Anadarko back in 2019 by taking a preferred stock position in OXY. Berkshire Hathaway committed to a $10 billion preferred stock investment in OXY if it was successful in its takeover of Anadarko. The preferred stock carried a nice 8% dividend and a warrant to purchase up to 80 million shares in OXY at a strike price of $62.50 per share, according to CNBC.

Carl Icahn was very critical of this deal, saying in a letter to shareholders in 2019: “Buffett figuratively took [CEO Vicki Hollub] to the cleaners ... The Buffett deal was like taking candy from a baby, and amazingly [Hollub] even thanked him publicly for it!"

OXY stock chart, daily versus WTI Crude futures, daily

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.