NZD/USD unfazed by strong NZ trade numbers, remains support above 0.7000

- NZD was broadly unfazed by strong New Zealand trade numbers for October, which paint a picture of an improving domestic economy.

- NZD/USD closed Wednesday FX trade above the 0.7000, a bullish sign moving forward.

Strong trade numbers bode well for the New Zealand economy

In October, New Zealand exports recovered to NZ$ 4.78B, a more than NZ$ 700M increase in exports in September. Note that September is typically the weakest month of the year for exports. Meanwhile, Imports rose to their highest levels since 2019 of NZ$ 5.29B, a sign of the continued recovery of demand in the New Zealand economy. That meant the monthly trade balance came in at a deficit of NZ$ 1B, its highest level since November 2019. That did not stop the YoY trade balance from increasing further into surplus territory at over NZ$ 2B (over the last 12 months).

Tuesday’s strong trade numbers are a good sign that the New Zealand economy continues to perform robustly, in large part thanks to the country’s excellent handling/containment of the Covid-19 pandemic. Exports may come under pressure in the months ahead of key export destinations such as Europe and North America go back into recession given winter Covid-19 containment measures.

NZD was nonetheless broadly unreactive to the data at the time, with NZD/USD remaining broadly supported above 0.7000. With volumes likely to thin over the next two days given Thursday’s US Thanksgiving holiday, conditions are likely to remain somewhat subdued for the rest of the week.

NZD/USD bulls push pair above key resistance levels

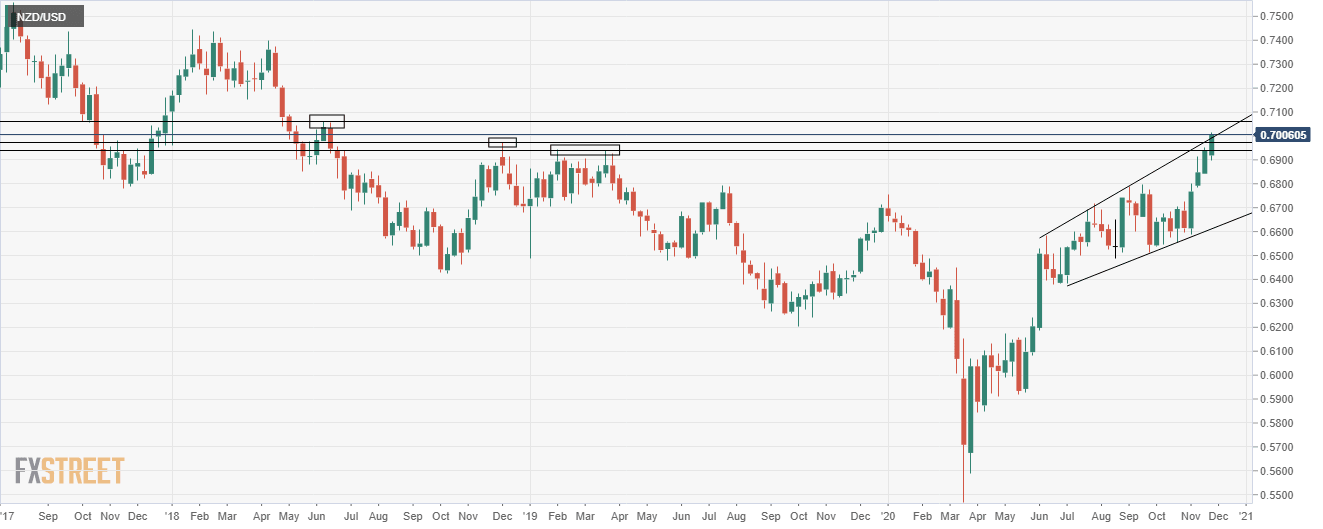

Not only did NZD/USD hurdle the 0.7000 level today (and Tuesday’s highs) and close above this key area, the pair has also broken to the upside of a long-term resistance uptrend that links the 9 and 10 June, 23, 23, 28 and 31 July and 2 September highs.

Thus, little by way of notable levels of resistance stand between the pair at current levels and the 0.7050 mark, as well as June 2018 highs just beyond it. To the downside, the most notable levels of support are the December 2018 highs at 0.6970 and then the Q1 2019 highs at 0.6940.

NZD/USD weekly chart

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset