NZD/USD Technical Analysis: Continuing rough channel lower amidst frequent upswings

- The Kiwi is seeing another intraday cyclical rebound from lows near 0.6750 in a repeat of Monday's market action that saw the NZD/USD lurch to 0.6815 before bedding back down as broader market action saw overall flows push out of and then back into the US Dollar.

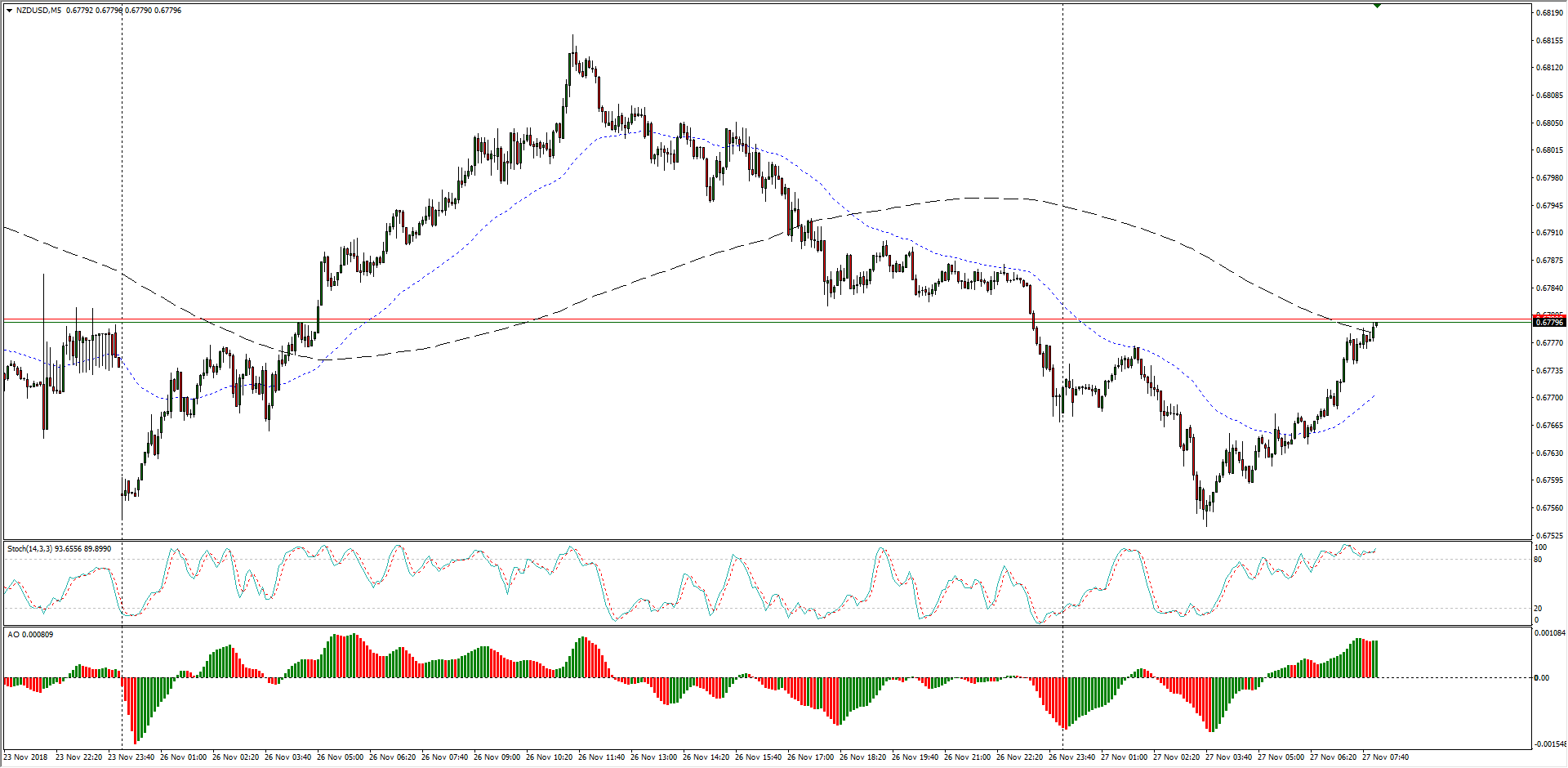

NZD/USD Chart, 5-Minute

- The past two weeks shows the Kiwi steadily cycling lower in large swings, marking out a rough channel that threatens to lose momentum from a lateral swing low at the 0.6750 level.

NZD/USD Chart, 30-Minute

- The past two months have seen the NZD/USD pair recover from medium-term lows at the 0.6440 level, but the last move towards the upside appears to have run out of momentum as the Kiwi becomes entangled in the 50-period moving average at the 0.6800 handle.

NZD/USD, 4-Hour

NZD/USD

Overview:

Today Last Price: 0.6778

Today Daily change: -7.0 pips

Today Daily change %: -0.103%

Today Daily Open: 0.6785

Trends:

Previous Daily SMA20: 0.674

Previous Daily SMA50: 0.6632

Previous Daily SMA100: 0.6659

Previous Daily SMA200: 0.6877

Levels:

Previous Daily High: 0.6818

Previous Daily Low: 0.6756

Previous Weekly High: 0.6876

Previous Weekly Low: 0.6767

Previous Monthly High: 0.663

Previous Monthly Low: 0.6424

Previous Daily Fibonacci 38.2%: 0.6779

Previous Daily Fibonacci 61.8%: 0.6794

Previous Daily Pivot Point S1: 0.6755

Previous Daily Pivot Point S2: 0.6724

Previous Daily Pivot Point S3: 0.6693

Previous Daily Pivot Point R1: 0.6816

Previous Daily Pivot Point R2: 0.6848

Previous Daily Pivot Point R3: 0.6878

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.