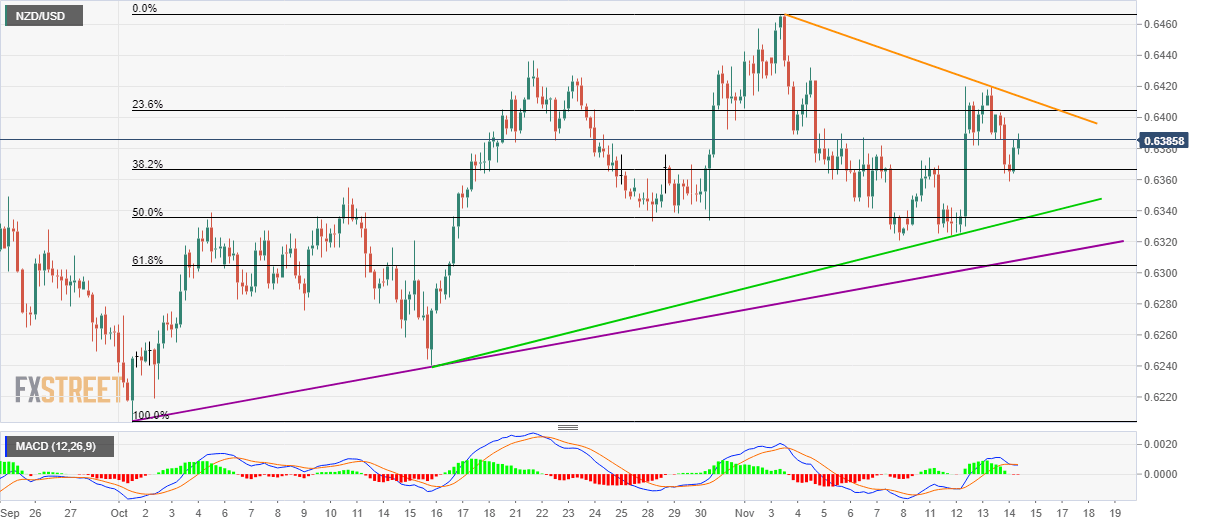

NZD/USD Technical Analysis: Buyers look for a break above multi-day long trendline

- NZD/USD bounces off 38.2% Fibonacci retracement of October month upside.

- A nine-day-old falling resistance line holds the key to 0.6425/30 resistance confluence.

- Multiple support lines to limit the pair’s declines ahead of 0.6300 round-figure.

Although 38.2% Fibonacci retracement level of October month advances recently triggered the NZD/USD pair’s U-turn, buyers still doubt the recovery as the pair trades near 0.6390 amid Friday’s Asian session.

23.6% Fibonacci retracement level of 0.6405 can offer an immediate resistance ahead of highlighting near-term descending trend line, at 0.6415 now, which holds the key to the further upside towards 0.6425/30 confluence including 100-day Exponential Moving Average (EMA) and 38.2% Fibonacci retracement of July-October declines.

Also challenging the pair’s upside is the bearish signal from the 12-bar Moving Average Convergence and Divergence (MACD) indicator.

If at all bulls manage to conquer 0.6430 on a daily closing basis, 0.6500 will return to the charts.

Alternatively, an ascending trend line from mid-October, around 0.6330 and a four-week-old support line, at 0.6308, could keep the pair’s declines under check.

In a case where prices dip below 0.6308, also conquer 0.6300 mark, sellers can take aim at 0.6240 and 0.6200 rest-points.

NZD/USD 4-hour chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.