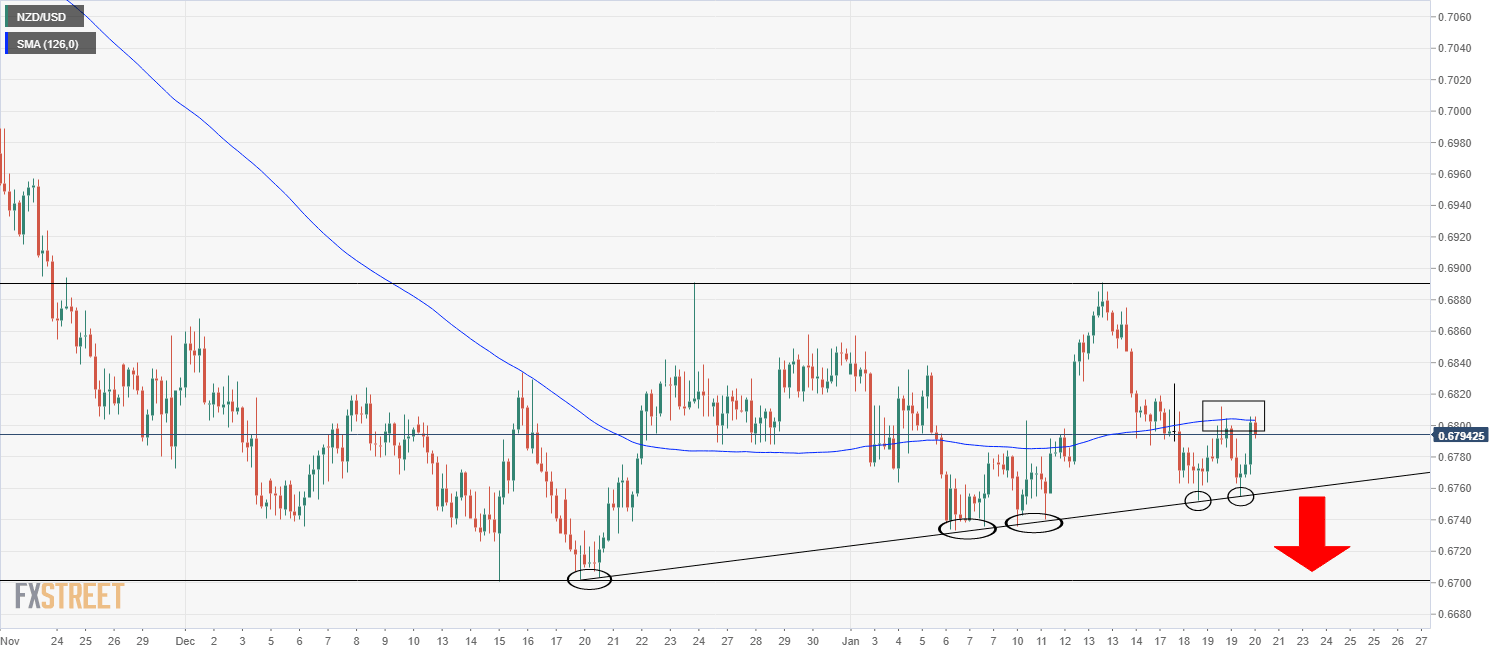

NZD/USD struggling to push back above 0.6800 level as 21DMA acts as resistance

- NZD/USD is currently struggling to push above the 0.6800 level, hampered by resistance in the form of the 21DMA.

- The pair found support during APac trade at a trendline going back to mid-December.

- A break below this support could open the door to a push lower towards 0.6700.

Though the pair does trade reasonably higher versus Asia Pacific session lows in the 0.6750s, NZD/USD is currently struggling to push above 0.6800, with the 21-day moving average acting as resistance for a second successive session. Amid a lack of domestic data or positive drivers, the kiwi has struggled to emulate the outperformance seen in its Aussie counterpart, which is deriving an independent boost from strong Australian labour market data. Indeed, chatter from New Zealand PM Jacinda Ardern about a potential toughening of domestic Covid-19 curbs in case of community transmission in the country, albeit not about a return to the fullscale lockdowns of old, may well be hampering the kiwi.

It was notable during the Asia Pacific session how NZD/USD found support at an uptrend that has been in play since the middle of December. The pair’s struggles to get back above 0.6800, however, suggest it is vulnerable to a broader pick up in the fortunes of the US dollar heading into next week’s Fed meeting. A push higher by the DXY on hawkish expectations, for example, could translate into a bearish breakout below 0.6750 and on towards a test of December lows just above 0.6700. For now, sub-par US weekly jobless claims data that saw initial claims leap to 280K from 230K the week prior, perhaps indicative of some Omicron-related labour market weakness, has been enough to keep the buck bulls at bay.

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset