NZD/USD Price Forecast: Support at the 0.6000 area keeps the upward trend intact

- The US Dollar regained lost ground after strong US jobs data.

- NZD/USD remains bullish while above 0.5990.

- Below that level, the next support areas are 0.5925 and 0.5890.

The New Zealand Dollar turned lower on Tuesday, weighed by a stronger US Dollar, but downside attempts have been contained at the 0.5990-0.6000 area, which keeps the broader upward trend intact.

The Kiwi retreated from year-to-date highs, at 0.6050, following stronger-than-expected US job openings numbers, that eased concerns about US debt and trade tariffs, at least momentarily, and provided a moderate impulse to an ailing US Dollar.

Technical Analysis: The pair remains bullish while above 0.5990

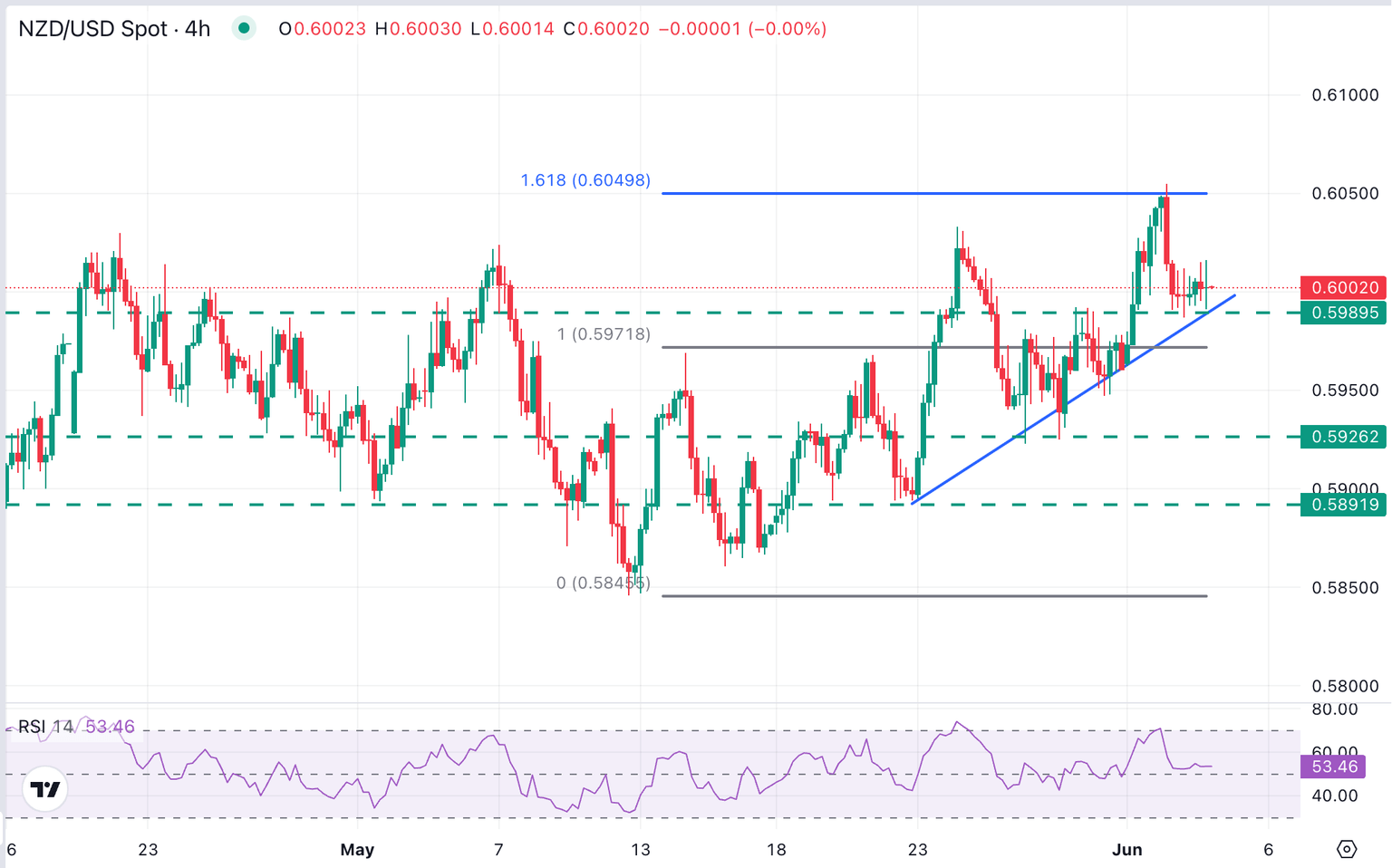

The New Zealand Dollar´s correction has been holding above a previous resistance, now turned support at 0.5990, which is also coincident with the ascending trendline resistance from the May 22 lows.

The 4-hour chart is showing hesitation, but the RSI remains within positive territory, above the 50 level. If this support holds, bulls will remain in control, with the 0.6050 resistance on focus.

Further decline beyond 0.5990, on the contrary, would add pressure towards 0.5925 and 0.5890.

NZD/USD 4-Hour Chart

New Zealand Dollar PRICE Today

The table below shows the percentage change of New Zealand Dollar (NZD) against listed major currencies today. New Zealand Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.16% | -0.09% | 0.13% | -0.02% | -0.02% | -0.08% | -0.10% | |

| EUR | 0.16% | 0.05% | 0.28% | 0.12% | 0.12% | 0.06% | 0.05% | |

| GBP | 0.09% | -0.05% | 0.19% | 0.06% | 0.08% | 0.02% | 0.00% | |

| JPY | -0.13% | -0.28% | -0.19% | -0.13% | -0.21% | -0.16% | -0.20% | |

| CAD | 0.02% | -0.12% | -0.06% | 0.13% | -0.00% | -0.06% | -0.07% | |

| AUD | 0.02% | -0.12% | -0.08% | 0.21% | 0.00% | -0.06% | -0.09% | |

| NZD | 0.08% | -0.06% | -0.02% | 0.16% | 0.06% | 0.06% | -0.02% | |

| CHF | 0.10% | -0.05% | -0.00% | 0.20% | 0.07% | 0.09% | 0.02% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the New Zealand Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent NZD (base)/USD (quote).

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.