NZD/USD Price Forecasts: Kiwi is testing support at the 0.5700 area

- The New Zealand Dollar dives against a stronger USD, approaching the 0.5700 area.

- Easing concerns about a US-China trade war are buoying the US Dollar across the board.

- NZD/USD: Further depreciation below 0.5700 would confirm a bearish flag formation.

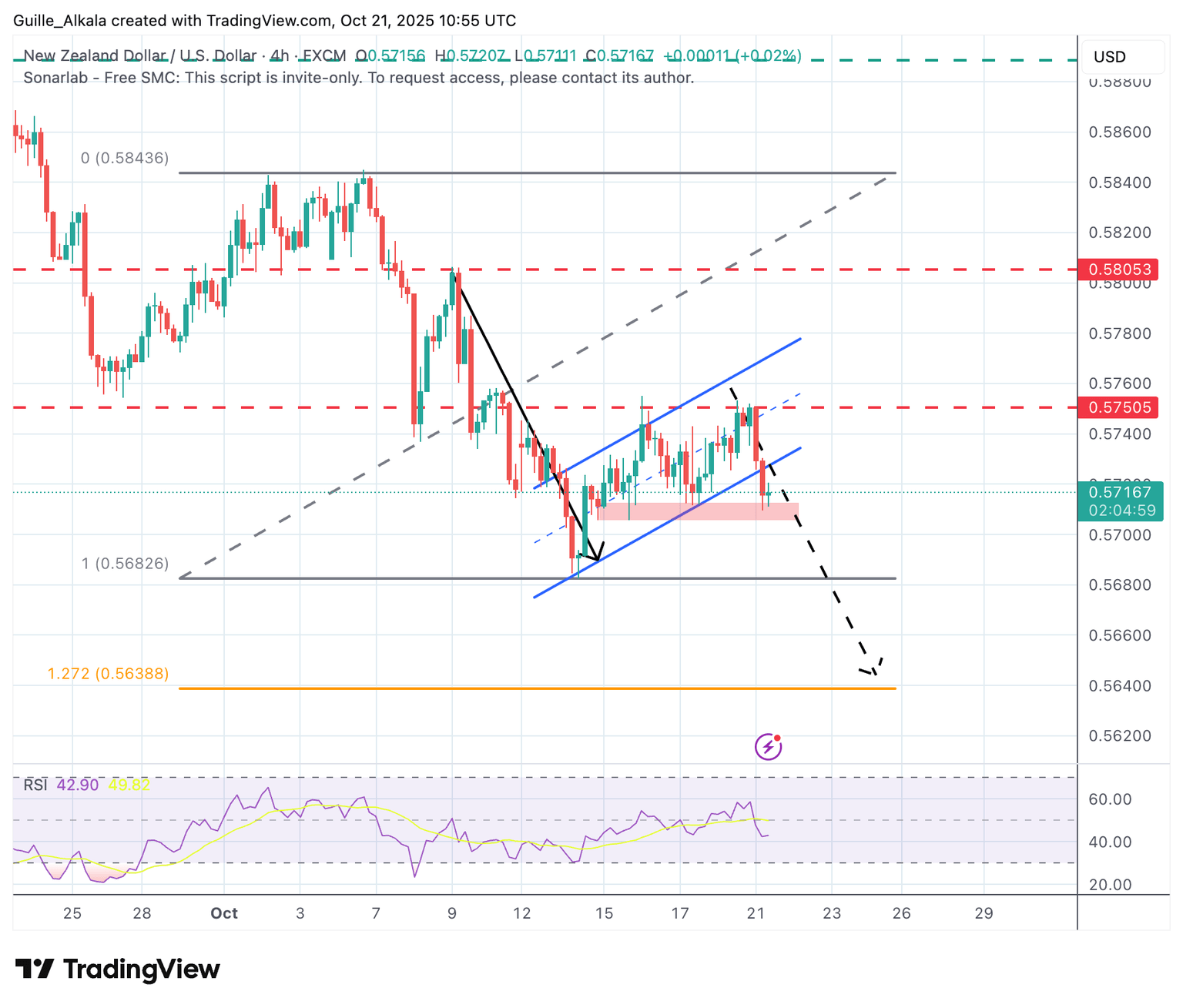

New Zealand Dollar’s rejection at the 0.5750-0.5760 resistance area on Monday has reactivated bearish pressure on the pair, pushing prices to the bottom of last week’s trading range, right above 0.5700, which is being tested at the moment.

Positive comments from US President Trump, who showed hopes of signing a fair deal with his Chinese counterpart Xi Jinping next week, are underpinning the US Dollar’s recovery on Tuesday. In New Zealand, on the other hand, the reaction to the

Stronger-than-expected CPI figures have been muted, as growing inflation coupled with slow growth poses a serious challenge for the RBNZ.

Technical Analysis: A break of 0.5700 would confirm a Bearish Flag

The double top at the 0.5750 area – on October 16 and 20 – highlights a strong resistance area, and the sharp reversal from those levels suggests that bears are taking control, aiming to push price action below the 0.5705–0.5710 area.

A bearish move below the mentioned 0.5700 would confirm a Bearish Flag formation, and increase pressure towards the October 14 low in the area of 0.5680. The flag formation’s measured target is the 127.2% Fibonacci extension of the early October sell-off, at 0.5640.

Upside attempts are likely to face resistance at the mentioned 0.5750-0.5760 area, ahead of trendline resistance, now at 0.5750, and the October 8 high, at 0.5805.

US Dollar Price Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.22% | 0.18% | 0.81% | 0.10% | 0.38% | 0.48% | 0.25% | |

| EUR | -0.22% | -0.04% | 0.56% | -0.13% | 0.17% | 0.25% | 0.02% | |

| GBP | -0.18% | 0.04% | 0.59% | -0.09% | 0.21% | 0.26% | 0.06% | |

| JPY | -0.81% | -0.56% | -0.59% | -0.68% | -0.40% | -0.31% | -0.52% | |

| CAD | -0.10% | 0.13% | 0.09% | 0.68% | 0.28% | 0.38% | 0.15% | |

| AUD | -0.38% | -0.17% | -0.21% | 0.40% | -0.28% | 0.08% | -0.17% | |

| NZD | -0.48% | -0.25% | -0.26% | 0.31% | -0.38% | -0.08% | -0.23% | |

| CHF | -0.25% | -0.02% | -0.06% | 0.52% | -0.15% | 0.17% | 0.23% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.