NZD/USD Price Forecast: Stalls near 200-SMA, bearish bias emerges

- NZD/USD capped by strong resistance at 200-day SMA as doji signals exhaustion, leaving downside risks toward 0.5700.

- Relative Strength Index remains bearish but flattish, hinting at neutral momentum tilted toward further weakness.

- Bulls need a clean break above 0.5845 to target 0.5875–0.5950 zone and flip short-term sentiment.

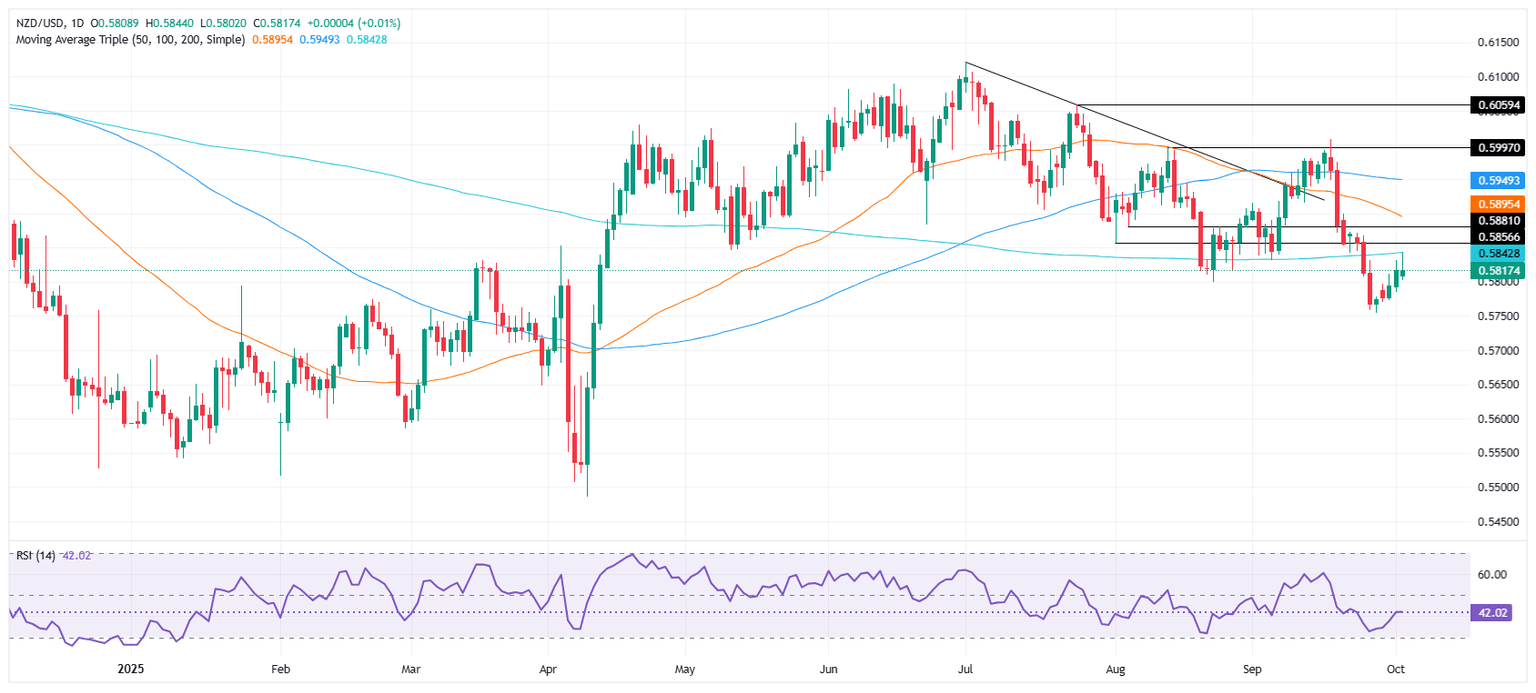

The NZD/USD reversed its course on Thursday as it formed a doji after hitting weekly highs near the 200-day Simple Moving Average (SMA) of 0.5845, but it reversed, ending the day virtually unchanged at around 0.5816.

NZD/USD Price Forecast: Bearishly biased, eyes on 0.5800

The NZD/USD technical picture shows that the leg-up that started on September 26 at around 0.5754, seems to face stir resistance. This opens the door for sellers, which could lean onto the 200-day SMA, as they eye September 26 low, followed by 0.5700, ahead of challenging the yearly low of 0.5485.

Momentum as measured by the Relative Strength Index (RSI) is bearish, but as the line is flattish, it indicates that the NZD/USD bias is neutral but tilted to the downside.

For a bullish reversal, the NZD/USD must clear the 200-day SMA, which could exacerbate a rally toward the 20-day SMA at 0.5875, ahead of the 50-day SMA at 0.5891 and the 100-day SMA at 0.5948.

NZD/USD Price Chart – Daily

New Zealand Dollar Price This week

The table below shows the percentage change of New Zealand Dollar (NZD) against listed major currencies this week. New Zealand Dollar was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.14% | -0.34% | -1.52% | 0.24% | -0.69% | -0.50% | -0.02% | |

| EUR | 0.14% | -0.20% | -1.54% | 0.36% | -0.55% | -0.35% | 0.10% | |

| GBP | 0.34% | 0.20% | -1.25% | 0.56% | -0.41% | -0.16% | 0.31% | |

| JPY | 1.52% | 1.54% | 1.25% | 1.80% | 0.88% | 0.91% | 1.56% | |

| CAD | -0.24% | -0.36% | -0.56% | -1.80% | -0.87% | -0.72% | -0.25% | |

| AUD | 0.69% | 0.55% | 0.41% | -0.88% | 0.87% | 0.19% | 0.65% | |

| NZD | 0.50% | 0.35% | 0.16% | -0.91% | 0.72% | -0.19% | 0.62% | |

| CHF | 0.02% | -0.10% | -0.31% | -1.56% | 0.25% | -0.65% | -0.62% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the New Zealand Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent NZD (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.