NZD/USD Price Analysis: Pair tumbles to fresh multi-month low before paring losses

- NZD/USD drops 0.59% on Monday, hitting 0.5515, its lowest level since October 2022.

- The pair staged a partial recovery to 0.5595 but remains under heavy bearish pressure.

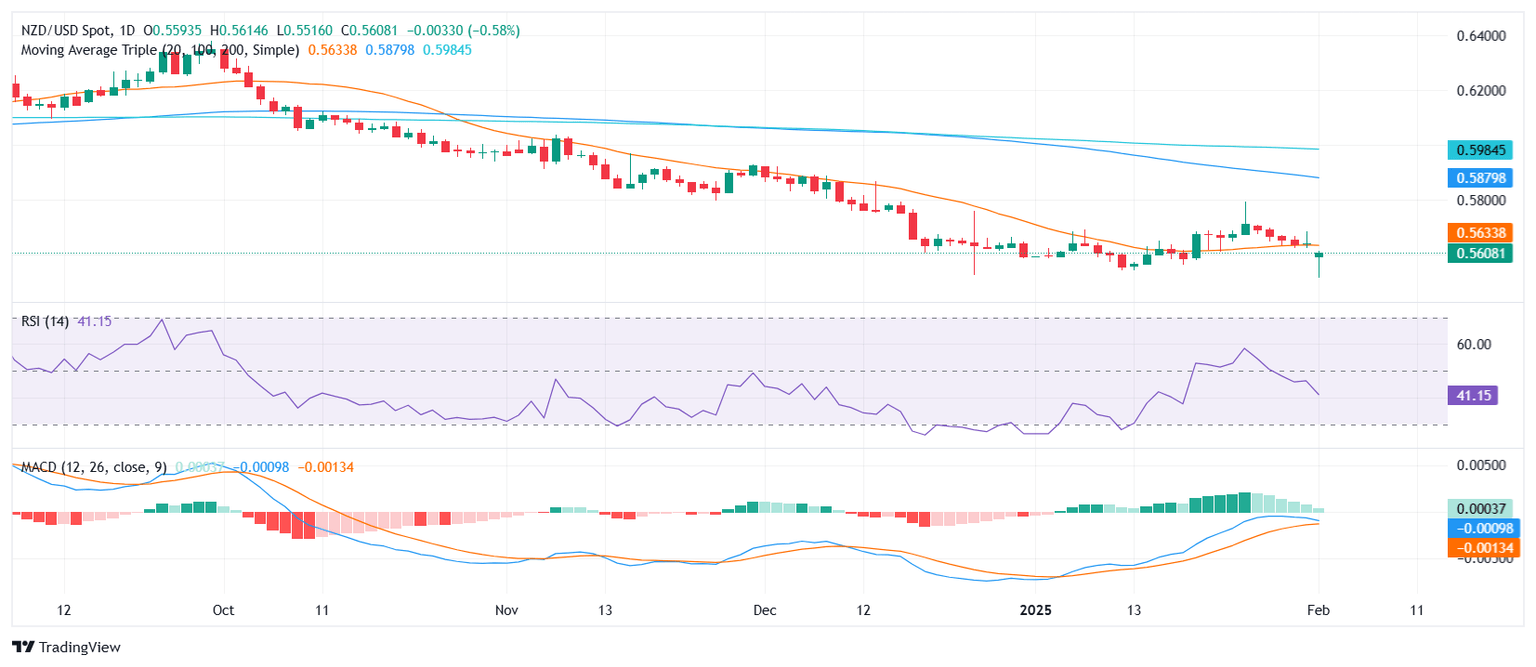

- RSI stays flat in negative territory, while MACD histogram shows decreasing green bars, signaling fading bullish attempts.

The NZD/USD pair extended its downward trajectory on Monday, falling sharply to 0.5515, its lowest point in over a year, before managing a slight rebound to settle at 0.5595. Despite the brief recovery, the pair remains trapped in a bearish structure, with sellers firmly in control amid persistent downside momentum.

Technical indicators confirm the lack of strong buying interest. The Relative Strength Index (RSI) points down at 41 in negative territory, suggesting that selling pressure has yet to ease. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram is printing decreasing green bars, pointing to waning bullish momentum and reinforcing the broader downtrend.

For now, support is seen at 0.5515, and a sustained break below this level could expose further downside toward 0.5480. On the other hand, if the pair attempts a rebound, initial resistance is found at 0.5620, followed by the 20-day Simple Moving Average (SMA) near 0.5630. As long as NZD/USD trades below this key threshold, the broader bearish outlook is expected to persist.

NZD/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.