NZD/USD Price Analysis: Pair extends rally, approaching the 0.5700 mark

- NZD/USD advances nearly 0.70% on Wednesday, climbing to 0.5685.

- The pair maintains its position above the 20-day SMA, reinforcing bullish momentum.

- Bulls must conquer the 0.5700 area to confirm a recovery.

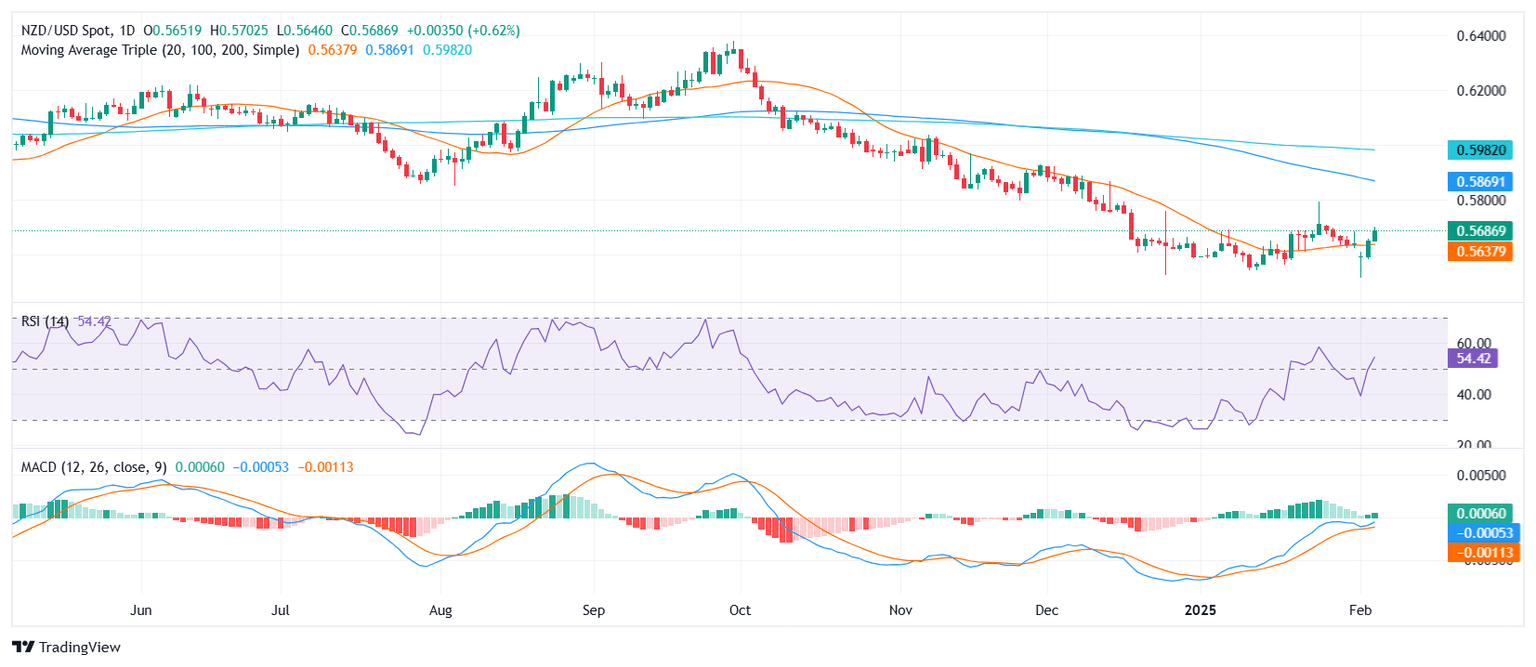

The NZD/USD pair extended its winning streak on Wednesday, posting a 0.67% gain to reach 0.5685. This upward move follows a breakout above the 20-day Simple Moving Average (SMA), which now acts as a key support level. The bullish sentiment appears to be strengthening, with the pair eyeing further gains toward the 0.5700 psychological threshold.

Technical indicators confirm the ongoing bullish trend. The Relative Strength Index (RSI) has surged to 58, indicating growing buying pressure, while the Moving Average Convergence Divergence (MACD) histogram continues to print rising green bars, reflecting a steady acceleration in momentum.

Looking ahead, NZD/USD faces an initial resistance zone at 0.5700, with a further upside target at 0.5735. On the downside, the 20-day SMA, currently near 0.5635, should act as the first line of support, followed by 0.5600 if a correction takes place. As long as the pair holds above the 20-day SMA, the short-term outlook remains in favor of the bulls.

NZD/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.