NZD/USD Price Analysis: mild rebound overshadowed by negative signals

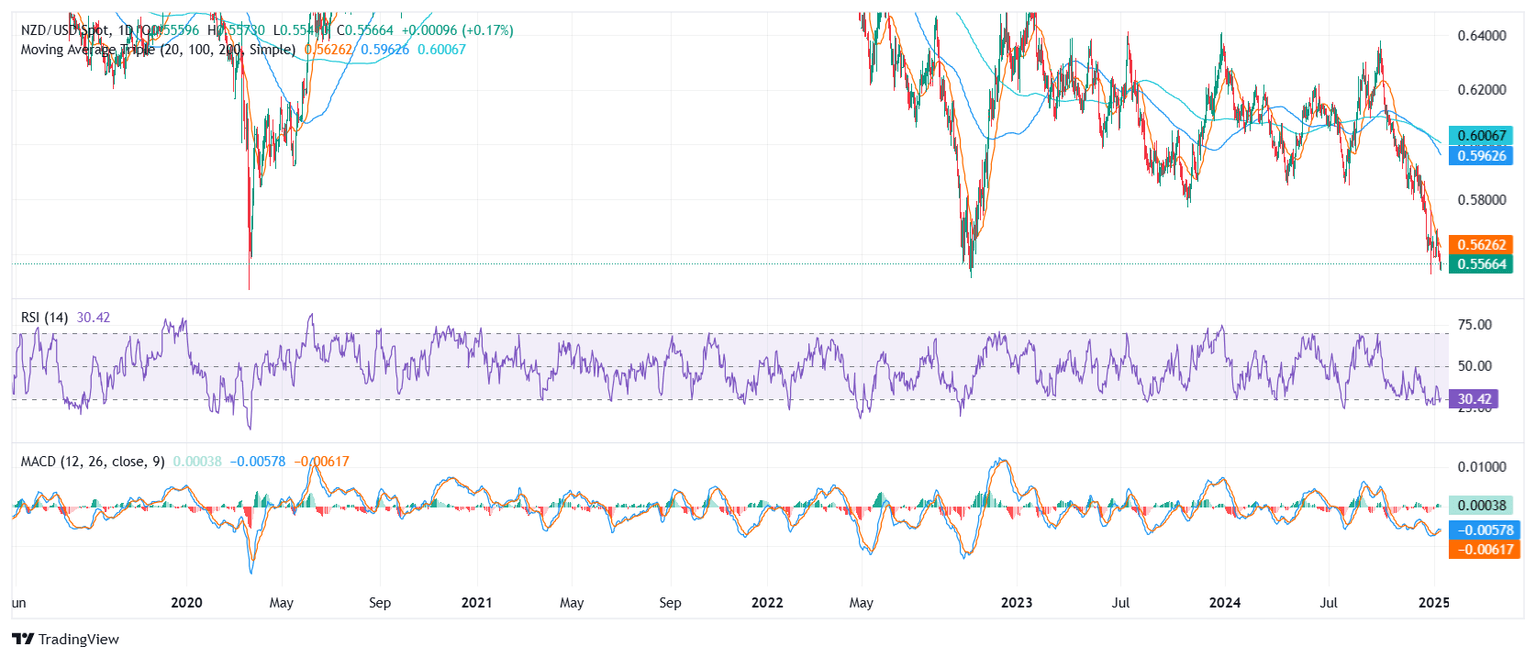

- NZD/USD inches higher to 0.5560 on Monday, briefly lifting from its lowest levels since October 2022.

- RSI stands at 31 and is mildly declining, hinting that oversold conditions persist.

The NZD/USD pair attempted a minor rebound on Monday, climbing to around 0.5560 and offering a temporary respite from its recent sharp decline. Despite this uptick, the pair remains hovering near multi-year lows, reflecting the broader downbeat sentiment that has dominated trading for several sessions.

Technically, the Relative Strength Index (RSI) is poised at 31 and shows signs of further deterioration, indicating that bearish forces still hold the upper hand. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram is losing momentum in the green zone, reinforcing the notion that buyers may lack the strength for a sustainable turnaround.

Looking ahead, a failure to extend beyond 0.5600 could see sellers regain traction, potentially driving the pair toward the 0.5530 support region. On the flip side, reclaiming and consolidating above 0.5600 might provide a glimmer of hope for bulls, setting sights on 0.5650 as the next resistance hurdle to overcome.

NZD/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.