NZD/USD Price Analysis: Limited upside potential despite defending 0.6900

- NZD/USD picks up bids towards intraday high, consolidates the heaviest daily loss in a week.

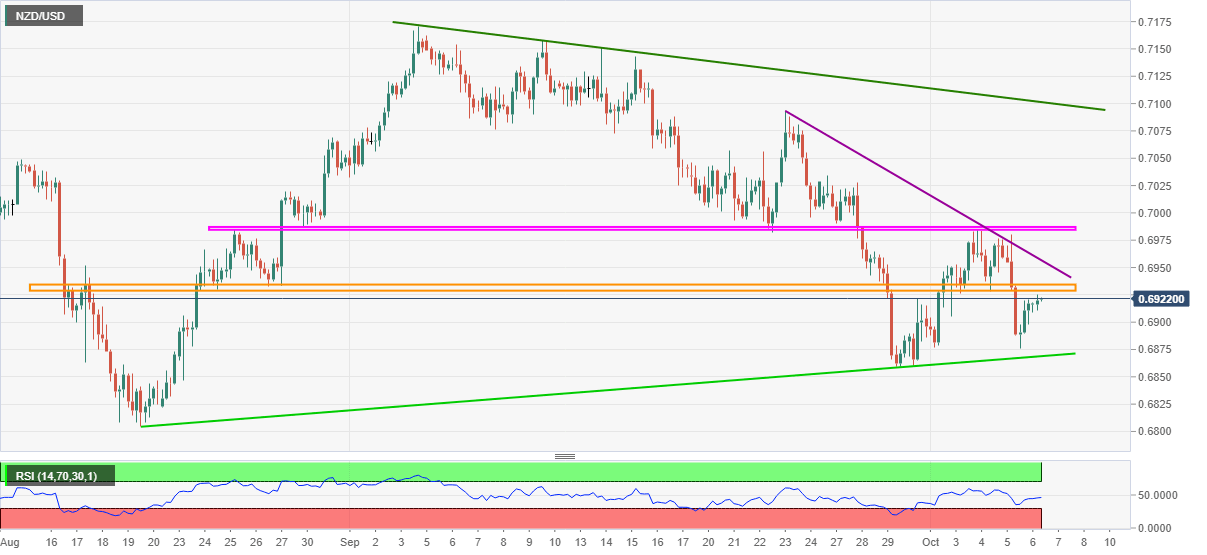

- Multiple trend lines, horizontal hurdles question bulls, bears need a break of immediate support line for further rights.

NZD/USD licks its wounds around 0.6920, up 0.10% intraday ahead of Thursday’s European session, after dropping the most in a week the previous day.

Although RSI rebound underpins the kiwi pair’s latest bounce, multiple hurdles to the north probes the bulls.

Among them, a seven-week-old horizontal area and a descending trend line from September 23, respectively around 0.6930-35 and 0.6955, guard the quote’s immediate upside.

Following that, a horizontal region comprising levels marked since late August, near 0.6985-90, will challenge the NZD/USD advances before highlighting the 0.7000 threshold and the monthly resistance line, close to 0.7100.

Alternatively, pullback moves need a clear break of the 0.6900 round figure to tease the NZD/USD sellers before giving back the controls to them on a clear break of an upward sloping support line from August 20, surrounding 0.6865.

While a clear downside break of 0.6865 will direct the bears towards the yearly low of 0.6805, marked in August, September’s bottom near 0.6860 may add to the downside filters.

NZD/USD: Four-hour chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.