NZD/USD Price Analysis: Kiwi trades near 0.5700 as short-term bullish bias builds momentum

- NZD/USD trades near the 0.5700 area after posting solid gains ahead of the Asian session

- Shorter-term moving averages point to a bullish bias despite mixed indicator signals

- Support sits in the mid-0.5700 while resistance emerges closer to the 0.5800 zone

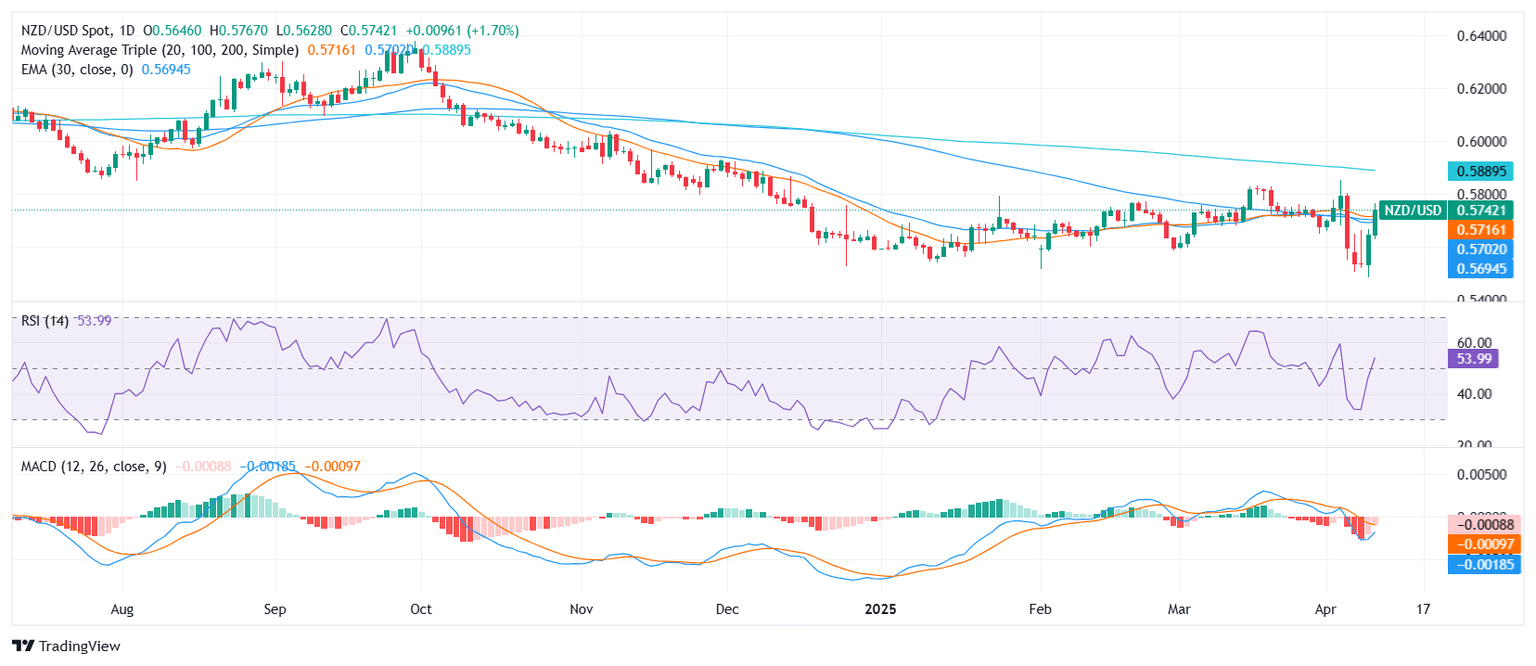

The NZD/USD pair extended its upside momentum during Thursday’s session, climbing toward the 0.5700 area after posting notable intraday gains. The pair remains comfortably positioned within its daily range of 0.56282 to 0.57656, reflecting growing bullish sentiment in the short term.

From a technical perspective, the Relative Strength Index (RSI) currently prints at 53.82, indicating neutral momentum but improving to positive area, while the Moving Average Convergence Divergence (MACD) continues to suggest a sell signal. Despite this, the shorter-term moving averages are aligning in support of the ongoing bullish movement. The 10-day EMA at 0.56685 and the 10-day SMA at 0.56688 both point upward, followed closely by the 20-day SMA at 0.57156 and the 100-day SMA at 0.57072—further validating the short-term bullish bias.

Meanwhile, the 200-day SMA at 0.58946 may act as a longer-term resistance threshold. The Stochastic RSI Fast at 41.67 and the Awesome Oscillator at -0.00854 remain neutral, adding no immediate conviction to the directional bias.

Daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.