NZD/USD Price Analysis: Bulls approach 0.5700 hurdle despite mixed China inflation

- NZD/USD takes the bids to extend the previous day’s rebound from 31-month low.

- China’s CPI rose to 2.8% YoY but PPI eased to 0.9% during September.

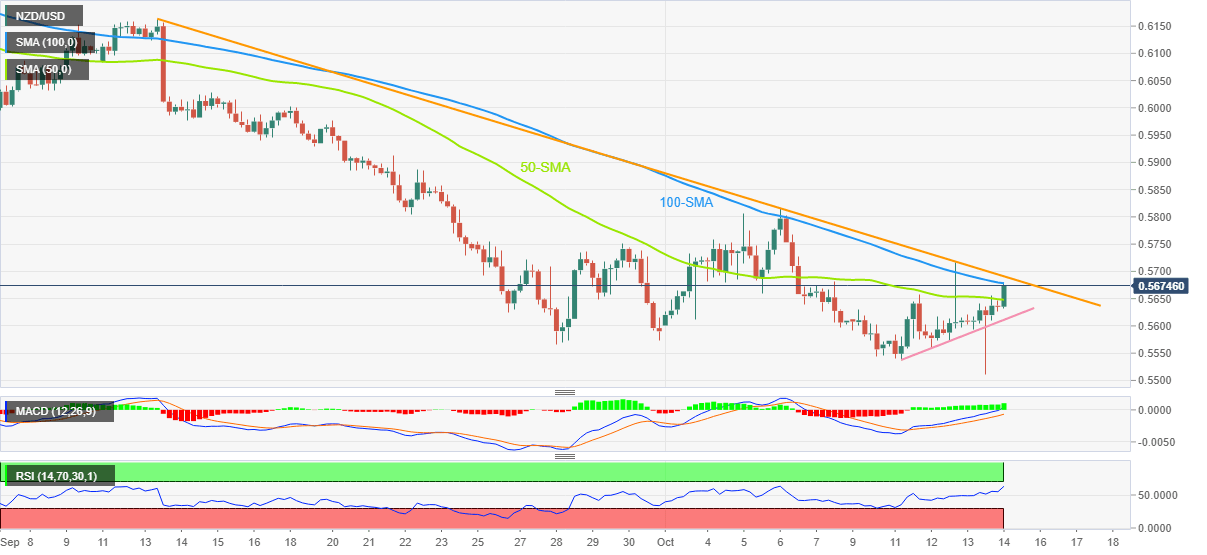

- Sustained break of 50-SMA, firmer oscillators favor buyers to cross the monthly resistance line.

- Sellers may not risk entries beyond four-day-old support line.

NZD/USD renews an intraday high around 0.5680 as bulls cheer a jump in China’s Consumer Price Index (CPI) during early Friday. Even so, the 100-SMA challenges the previous day’s recovery from a 2.5-year low.

That said, China’s headline Consumer Price Index (CPI) matched upbeat market forecasts by rising 2.8% in September while the Producer Price Index (PPI) fell short of meeting expectations during the stated month, down to 0.9% versus 1.0% forecasts and 2.3% prior.

It’s worth noting that the Kiwi pair’s successful break of the 50-SMA joins bullish MACD signals and firmer RSI (14), not overbought, to keep buyers hopeful.

However, a clear upside break of the one-month-old descending resistance line, around 0.5690 by the press time, appears necessary for the NZD/USD bull’s conviction. Following that, the monthly high of 0.5815 will be in focus.

Alternatively, pullback moves may initially aim for the 50-SMA support near 0.5645, a break of which could direct the quote toward an upward-sloping support line from Tuesday, close to 0.5610 at the latest.

In a case where the NZD/USD prices break 0.5610 support, the odds of witnessing a slump towards the fresh yearly low, around 0.5510 of late, can’t be ruled out.

NZD/USD: Four-hour chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.