NZD/USD Price Analysis: Bears tests critical support of 20-day SMA

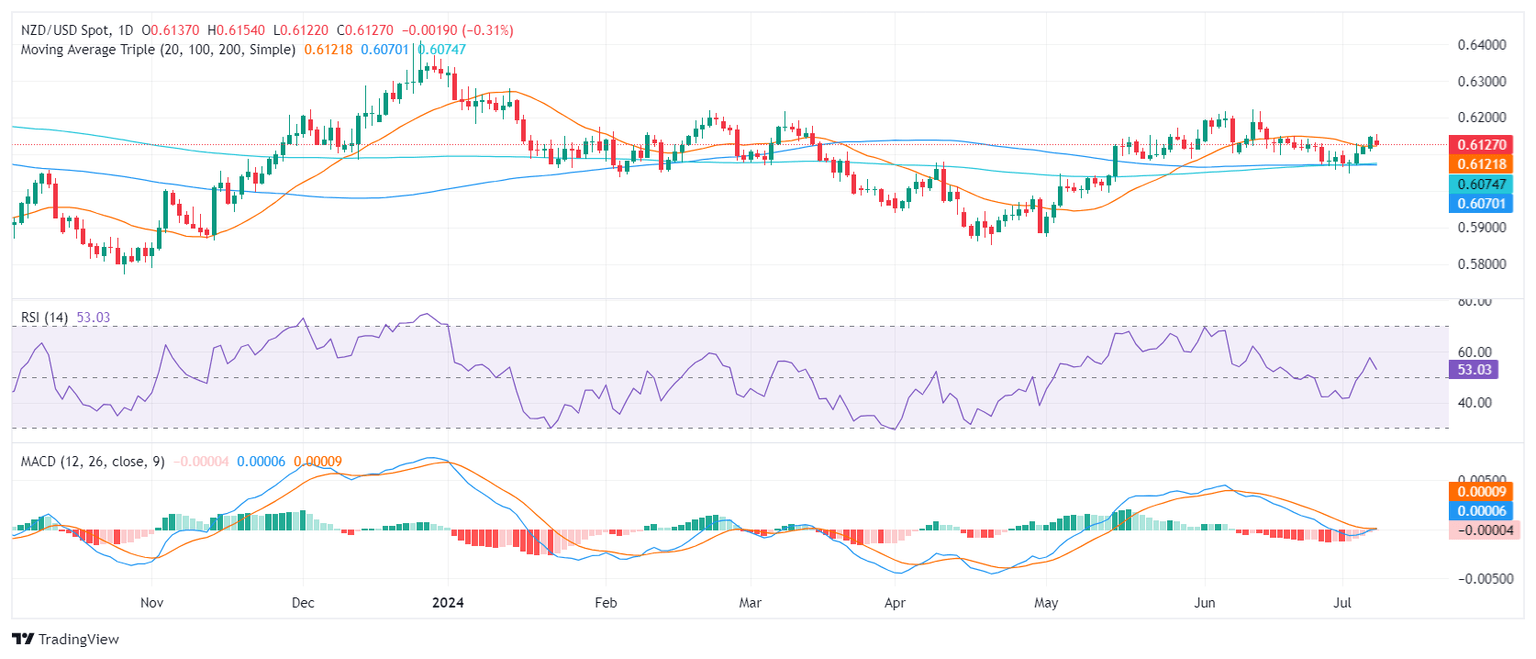

- NZD/USD saw slight losses but maintained a position above the crucial 20-day SMA support around 0.6120.

- The technical outlook remains positive, despite Monday's bearish activity.

- Bears are testing the 20-day SMA strength.

On Monday, the NZD/USD struggled, losing 0.30% to 0.6125, erasing its daily gains. Despite this, the pair successfully defended its position above the 20-day Simple Moving Average (SMA) support level at 0.6120, a feat securely achieved in the past week.

As for the daily technical indicators, the Relative Strength Index (RSI) now stands at 53, showing a downward movement, indicating that the bullish momentum took a slight hit. The Moving Average Convergence Divergence (MACD) keeps on printing decreasing red bars, noting the fading bearish strength.

NZD/USD daily chart

From the perspective of resistances, the 0.6170 level is the immediate challenge, which is trailed closely by the significant 0.6200 mark. A firm break above these levels can be viewed as a full confirmation of the recent bullish momentum, taking the pair deeper into bullish territory.

Ahead lies immediate support near the 20-day SMA at 0.6120, with stronger support at the decisive 0.6070 mark. If the sellers manage to lower the price below these supports, it will indicate a developing selling pressure that could lead to a deeper corrective decline.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.