NZD/USD Price Analysis: Bears move in at critical daily resistance

- NZD/USD bears are sinking in their teeth in the Tokyo open.

- The bulls eye a break of daily resistance.

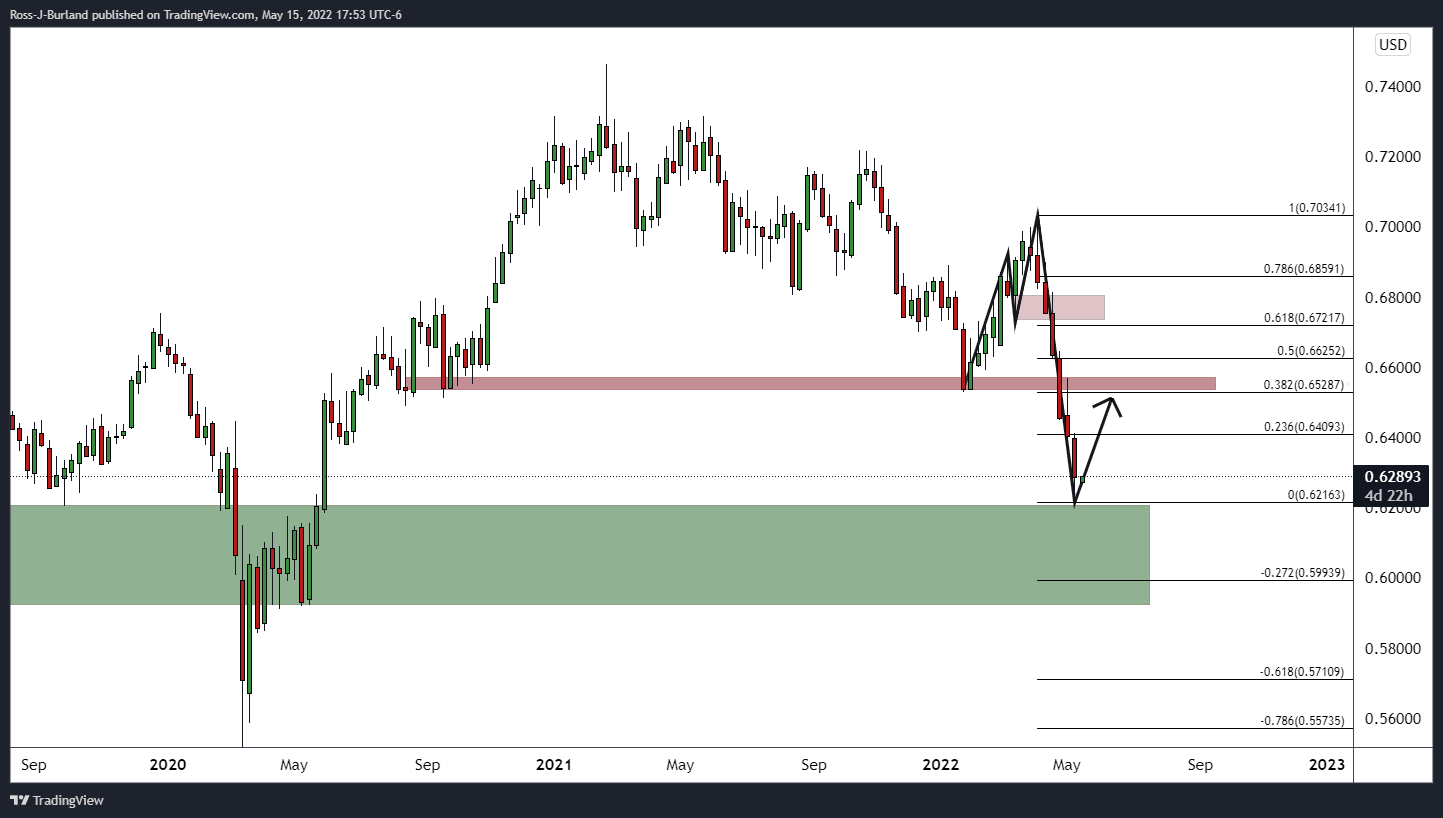

NZD/USD is under pressure from daily resistance at this juncture for the open but the weekly chart is overstretched, relatively and corrections to the upside could be on the cards for the sessions ahead. The following illustrates this from a weekly and daily perspective.

NZD/USD weekly chart

The price is still offering some prospects of a move to the downside but the overextendedness of the weekly bearish impulse is likely in need of a correction. This could correct as far as the prior support and beyond 0.64 the figure. However, there is a build-up of daily resistance ahead as follows:

NZD/USD daily chart

From a daily perspective, the price is meeting structure but a break of that could open the wat to prior levels that would be expected to act as resistance and failures there will pave the way to the next bearish impulse. Failing that, the price goes offered and moves into the weekly target from here considering how much potential resistance there already is at this point.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.