NZD/USD Price analysis: 100-HMA holds the key to Kiwi pair’s upside past 0.6200

- NZD/USD struggles to extend the previous day’s recovery moves but stays on the way to posting weekly gains.

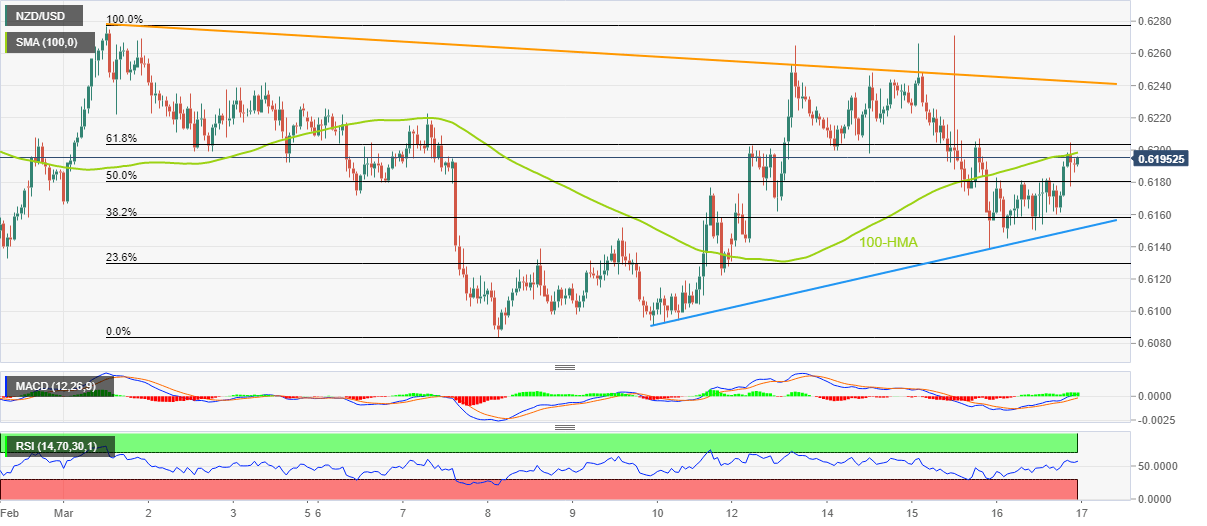

- 100-HMA probes buyers even as upbeat oscillators, one-week-old support line suggest further upside of the Kiwi pair.

- Descending trend line from early March appears the key upside hurdle for the bulls to cross.

NZD/USD makes rounds to the key moving average as buyers struggle to keep the reins around 0.6200, bracing for the weekly gains, during early Friday.

In doing so, the Kiwi pair benefits from the upbeat RSI (14), not overbought, as well as bullish MACD signals. Not only the price-positive oscillators but the quote’s U-turn from a one-week-old ascending trend line also keeps the NZD/USD buyers hopeful of witnessing further upside.

Hence, the buyers are ready to overcome the immediate 100-Hour Moving Average (HMA), surrounding the 0.6200 threshold.

However, the 61.8% Fibonacci retracement level of the pair’s March 01-08 downside, near 0.6205, could act as a validation point for the rally targeting a downward-sloping resistance line since the month’s start, around 0.6245 at the latest.

Should the NZD/USD bulls stay in the driver’s seat beyond 0.6245, the odds of witnessing a fresh monthly high, currently around 0.6280, can’t be ruled out.

Alternatively, pullback moves may initially aim for the 50% Fibonacci retracement level of 0.6180 before directing the NZD/USD bears towards the aforementioned one-week-old support line, close to 0.6150 by the press time.

It should be noted, however, that the NZD/USD pair’s sustained trading below 0.6150 makes it vulnerable to testing the monthly low of 0.6084. During the fall, the 0.6100 round figure may act as an intermediate halt.

NZD/USD: Hourly chart

Trend: Limited upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.