NZD/USD capped by 0.5970 for Thursday as US Dollar drives the market

- The Kiwi is facing upside momentum, climbing nearly a percent against the Greenback for Thursday.

- Ongoing market unease over China property woes is capping upside potential for the NZD.

- A broad-market DXY selloff sees the NZD/USD up around 50 pips for the day.

The NZD/USD has ticked about five basis points higher through Thursday's market trading, driven by a receding Greenback (USD). Ongoing economic concerns and spiking US Treasury yields has seen the USD bolstered across the broader market this week, but Thursday sees a step back in US Dollar action, giving the Kiwi (NZD) a brief reprieve and recovering some recent losses.

China's ongoing property debacle continues to sap confidence in the Asia sector currencies. Evergrande, the world's single most indebted property developer, had its chairman Hui Ka Yan placed under police watch this week as funding and liquidity concerns grip China's real estate sector. China's real estate and property development segment has reached such an outsized proportion of China's domestic economy that increased instability in construction could threaten the rest of the economy.

Next Up: US PCE inflation reading to close out the week

There is little of note on the economic calendar for the Kiwi, and market participants will be looking ahead to the US Personal Consumption Expenditure (PCE) Price Index figures due on Friday at 12:30 GMT.

The US PCE inflation reading is forecast to hold steady for the month of August at the previous print of 0.2%, with the annualized figure for the same period seen tipping back from 4.2% to 3.9%.

A beat on the Federal Reserve's (Fed) favorite inflation indicator could see the USD spike further on the charts, as higher-than-expected inflation will be increasingly likely to push the Fed into holding higher interest rates for even longer than anticipated.

NZD/USD technical outlook

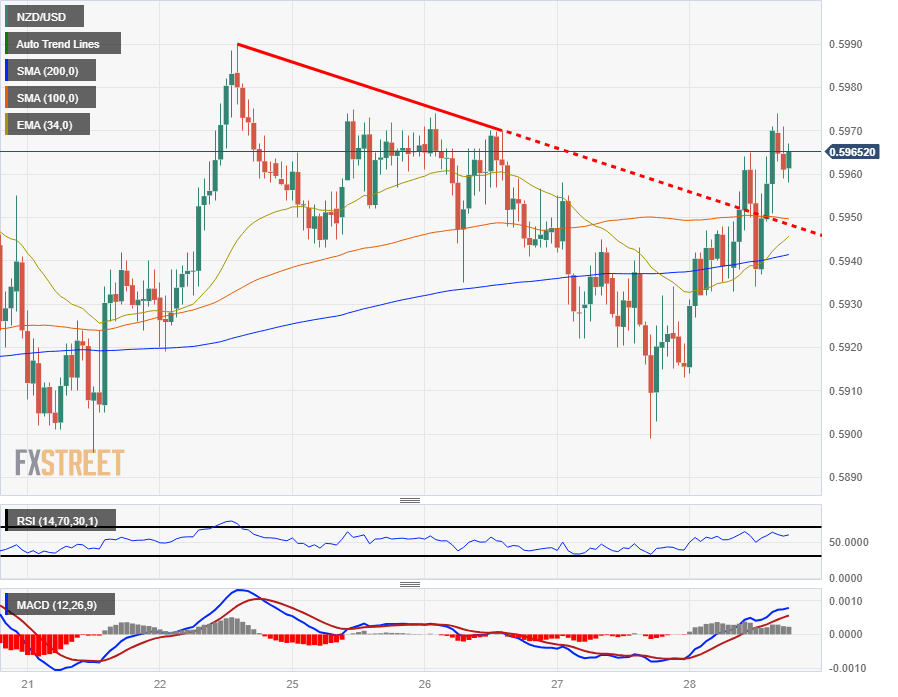

The Kiwi is currently capped under the 0.5970 handle after reaching an intraday high of 0.5975. The NZD/USD has broken to the north side of a minor descending trendline on hourly candles, and near-term support is baked in at the 200-hour Simple Moving Average (SMA) near 0.5940.

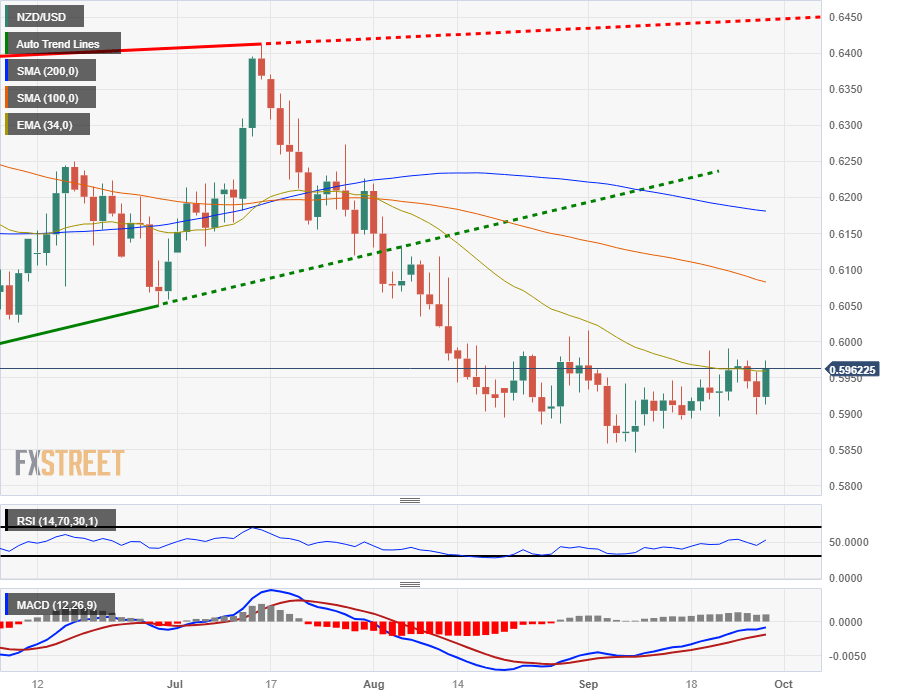

On daily candlesticks, the NZD/USD is pinned to the 34-day Exponential Moving Average, and the pair is pricing in a floor from the 0.5900 major handle. Long-term moving averages are rolling over bearish, and the 200-day SMA is settling to the low side of 0.6200.

Bidders will first have to crack the 34-day EMA and the 0.600 major psychological level before moving higher, while a resurgence of downside pressure will see the pair set to take a new run at ten-month lows below 0.5845.

NZD/USD hourly chart

NZD/USD daily chart

NZD/USD technical levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.