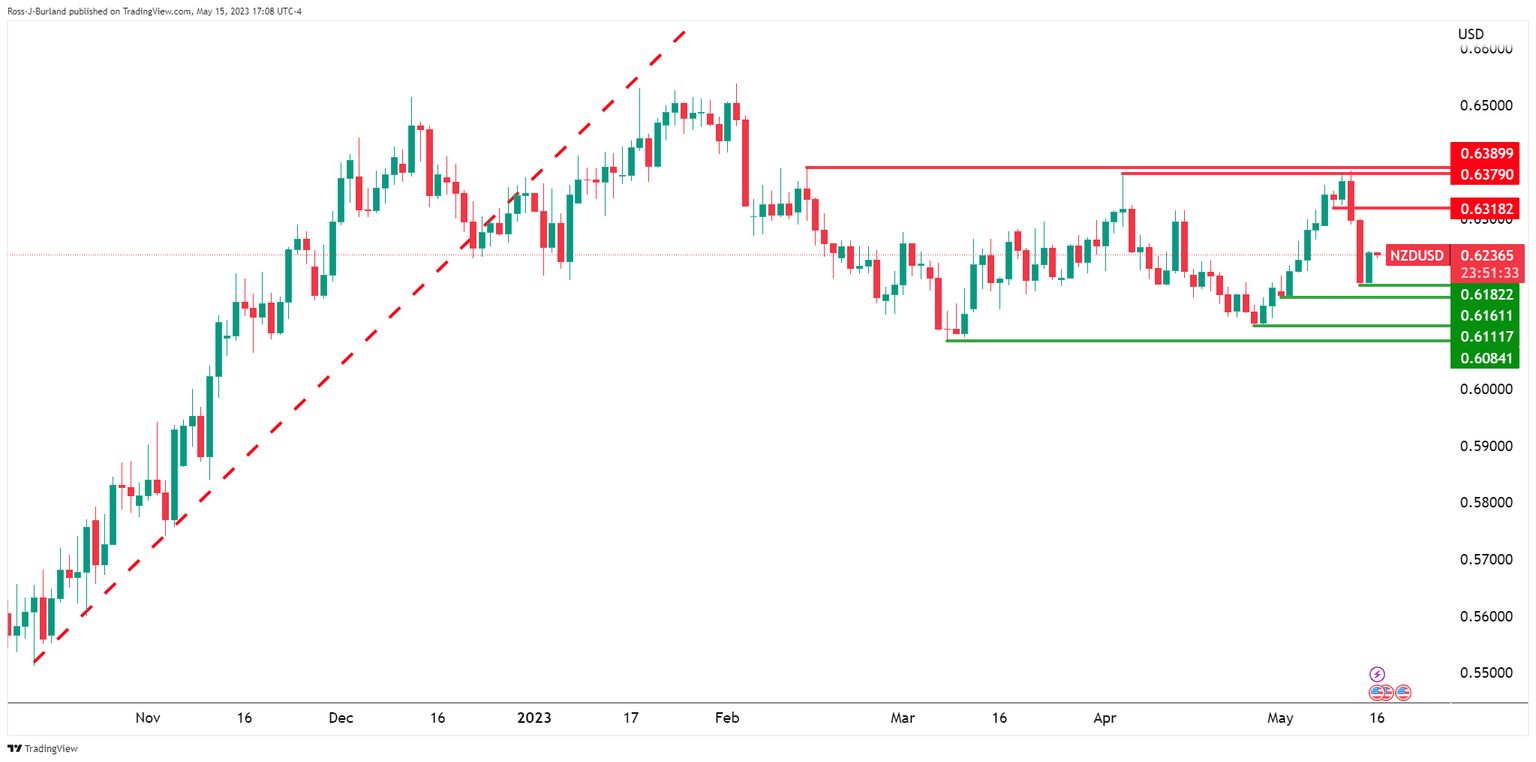

NZD/USD bulls in the market and eye a firm correction

- NZD/USD bulls are moving on a soft US Dollar.

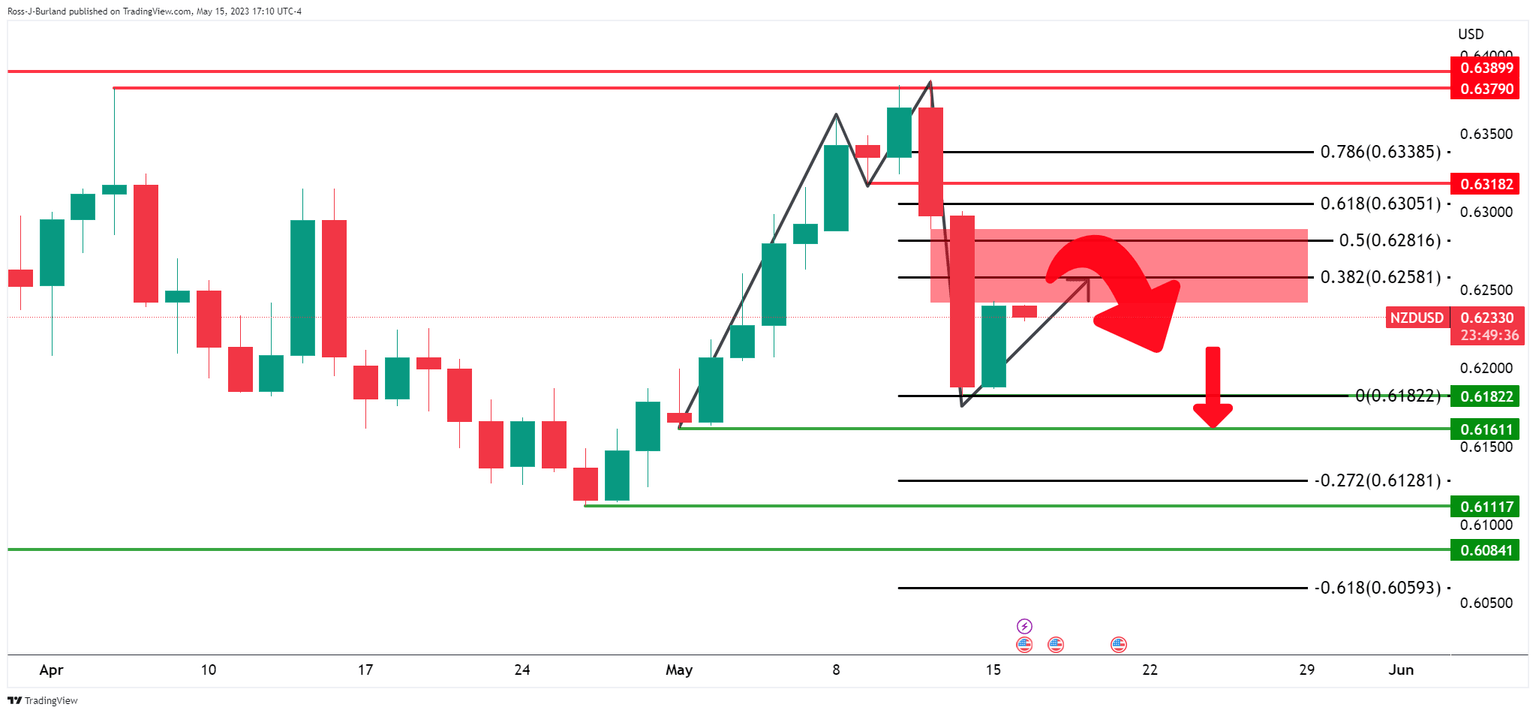

- Bears are lurking in the Fibonacci scale below 0.6320.

NZD/USD is down on the day, losing some 0.12%, and has fallen from a high of 0.6240 and reached a low of 0.6232.

The Kiwi has picked up a touch off yesterday’s lows, reflecting a combination of a weaker USD, and market chatter about the possibility of the OCR perhaps needing to climb to 6% given the migration boom.,´´ analysts at ANZ Bank explained.

´´It is certainly a risk and as we have said for a while, we do think local rates markets are overplaying cuts when the battle against inflation isn’t even won yet, but New Zealand faces fiscal and current account challenges as well, so other than higher carry, it’s not clear whether these challenges and presumably the prospect of moderating growth is good for the Kiwi,´´ the analysts added.

´´In the US, debt ceiling negotiations are dragging on, and Fed speakers are pushing back against market calls for cuts; that’s helping the USD,´´ the analysts concluded.

NZD/USD technical analysis

From a daily perspective, the M-formation is pulling the price into the Fibonacci scale with a focus on the 0.6320s as a key resistance area if bulls were to commit.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.