NZD/JPY Price Forecast: Pulls back on mixed mood, uptrend faces key test

- NZD/JPY stalls below 87.00 after three-day high; trend remains constructive above Ichimoku Cloud.

- Bulls need break above 87.73 to aim for YTD high at 89.70 and key 90.00 level.

- Drop below 85.97 Kijun-sen may trigger decline toward 85.85 and key support at 84.30–84.50.

NZD/JPY retreated after reaching a three-day high of 86.82, dropping towards the 86.00 figure as market appetite turned slightly sour. US economic data weighed on the US Dollar and US equities, which finished Wednesday’s session mixed due to uncertainty about trade and investors eyeing two rate cuts by the Federal Reserve.

NZD/JPY Price Forecast: Technical outlook

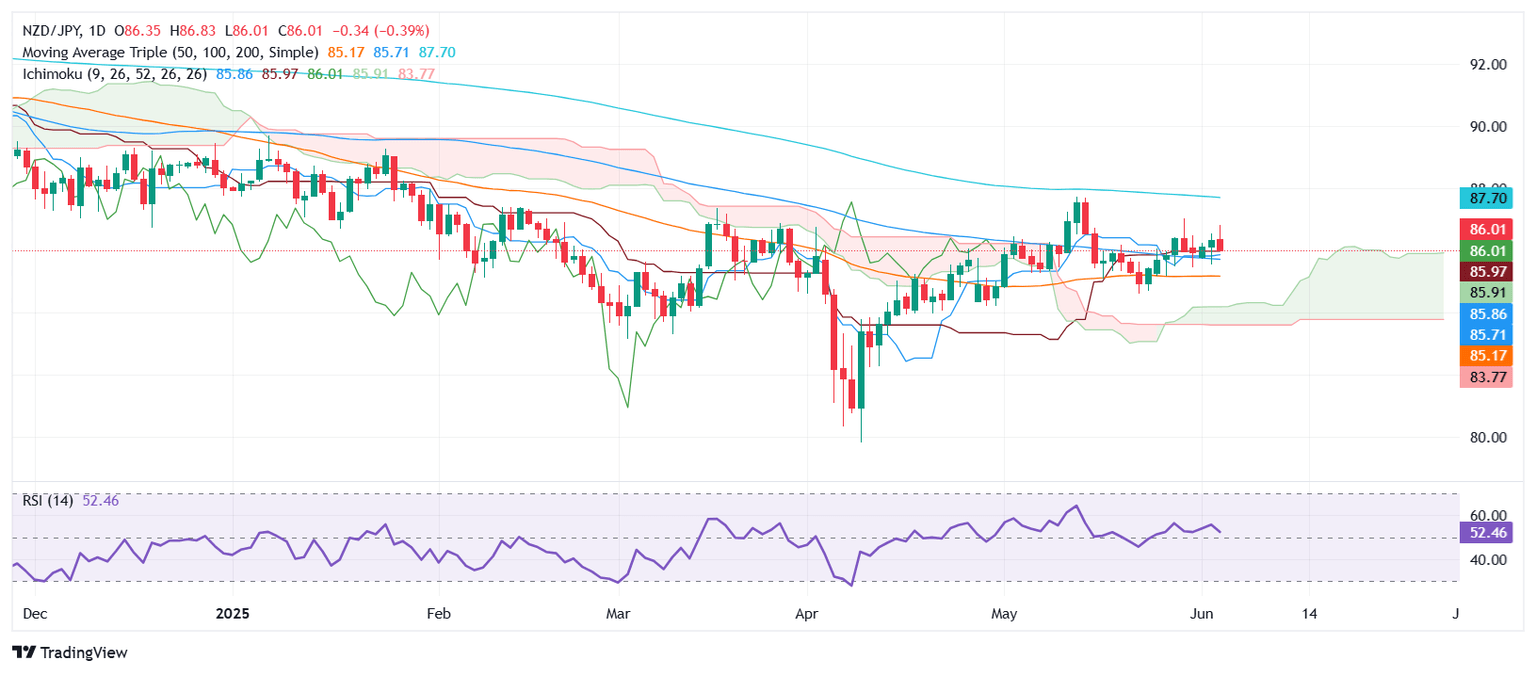

The NZD/JPY remains subdued, yet the overall trend is tilted to the downside. It is worth noting that since April, the cross-pair has remained constructive, having hit higher highs and lower lows, and it trades above the Tenkan-sen, the Kijun-sen, and the Ichimoku Cloud (Kumo).

Nevertheless, AUD/JPY needs to clear the May 13 high at 87.73. If cleared, the next stop would be the year-to-date (YTD) high of 89.70, ahead of the 90.00 figure.

Conversely, a drop below the Kijun-sen at 85.97 opens the path to challenge the Tenkan-sen at 85.85, followed by the top of the Kumo at around the 84.30/50 range.

NZD/JPY Price Chart – Daily

New Zealand Dollar PRICE This week

The table below shows the percentage change of New Zealand Dollar (NZD) against listed major currencies this week. New Zealand Dollar was the strongest against the US Dollar.

| JPY | EUR | GBP | USD | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| JPY | 0.14% | 0.12% | 0.78% | 0.31% | -0.13% | -0.26% | 0.08% | |

| EUR | -0.14% | -0.04% | 0.62% | 0.14% | -0.27% | -0.45% | 0.01% | |

| GBP | -0.12% | 0.04% | 0.66% | 0.18% | -0.23% | -0.42% | 0.05% | |

| USD | -0.78% | -0.62% | -0.66% | -0.47% | -0.90% | -1.05% | -0.61% | |

| CAD | -0.31% | -0.14% | -0.18% | 0.47% | -0.42% | -0.60% | -0.13% | |

| AUD | 0.13% | 0.27% | 0.23% | 0.90% | 0.42% | -0.13% | 0.36% | |

| NZD | 0.26% | 0.45% | 0.42% | 1.05% | 0.60% | 0.13% | 0.47% | |

| CHF | -0.08% | -0.01% | -0.05% | 0.61% | 0.13% | -0.36% | -0.47% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the New Zealand Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent NZD (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.