NZD/JPY Price Analysis:Sellers take a pause, upwards correction in sight

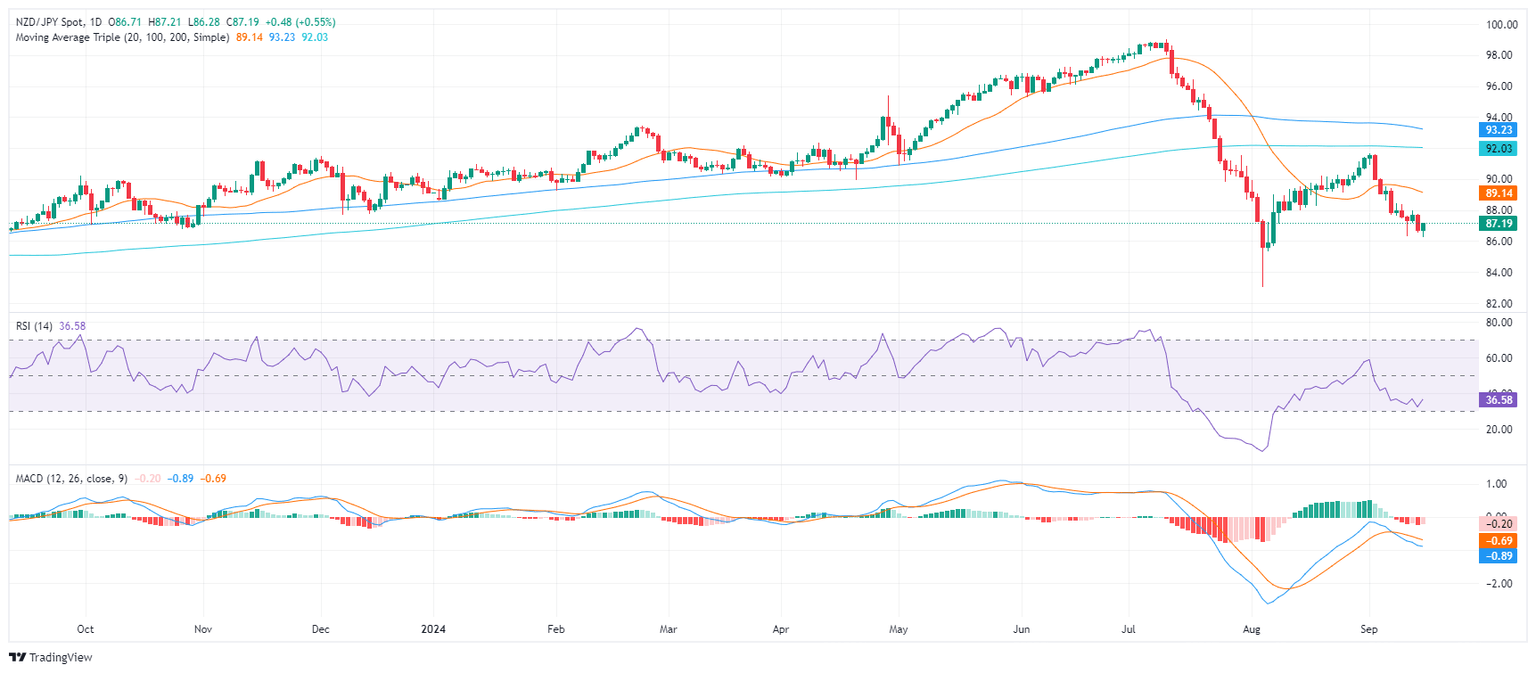

- NZD/JPY pair has been moving downwards in the last week, but today's price action showed a sharp uptick.

- The RSI is in a negative area, but its value is sharply rising suggesting that buying pressure is recovering.

- The MACD suggests that selling pressure is flattening.

Monday's session saw the NZD/JPY pair rise by 0.60% to 87.20. However, the overall technical outlook for the NZD/JPY remains negative due to the losses seen in the last week as sellers seem to be taking a breather.

The RSI is currently at 36, which is still near the oversold area. However, the slope of the RSI is sharply rising, which suggests that buying pressure is recovering. The MACD is also red and flat, indicating that selling pressure is flat. This suggests that last week’s downward movements became over-extended and the sellers paused to take a breather. This also gives light to the buyers as the cross might continue consolidating upwards.

NZD/JPY daily chart

Supports to the downside are located at 86.30, 86.60, and 87.00, while resistances are seen at 87.30, 87.60, and 87.90.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.