NZD/JPY Price Analysis: Pair plunges to multi-month low before partial rebound

- NZD/JPY declines 0.99% on Monday, settling at 86.55 after hitting its lowest level since August 2024.

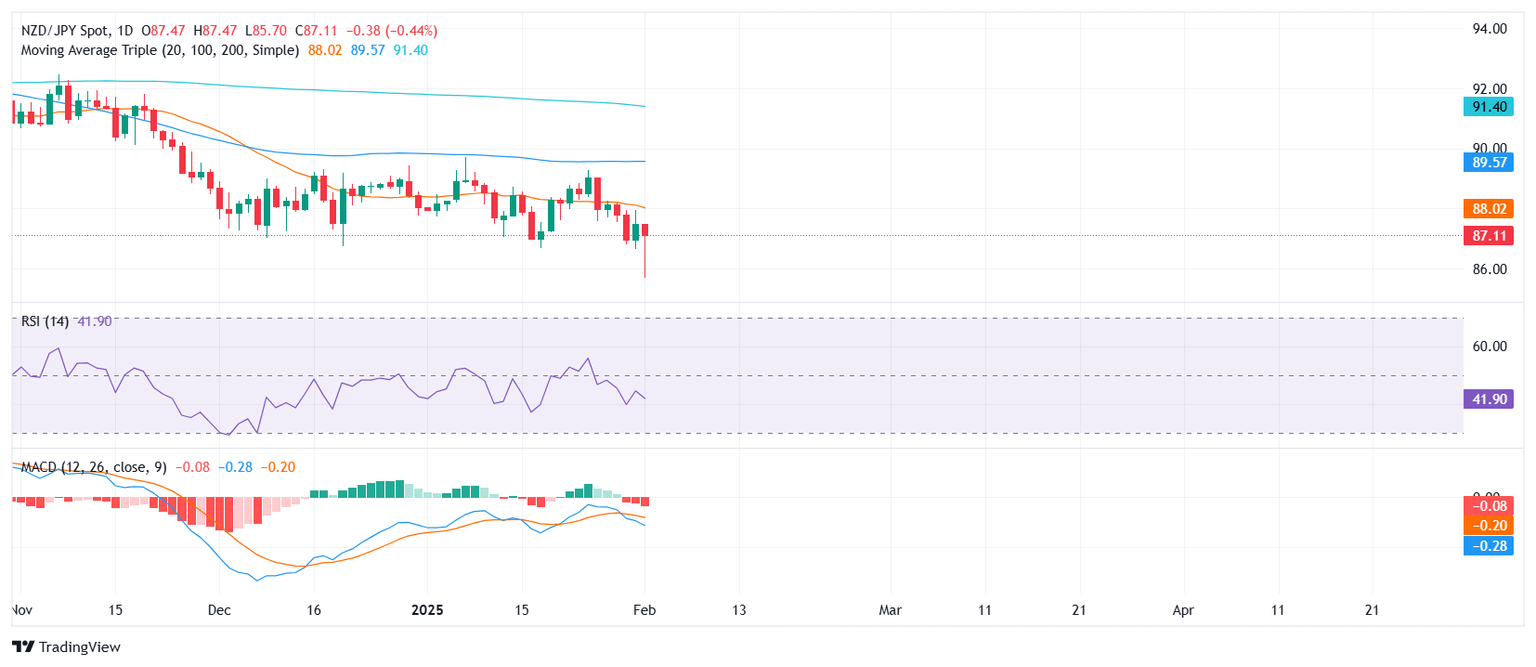

- The pair briefly dropped to 85.70 before bouncing back around 87.00, though it remains below the 20-day SMA at 88.00.

The NZD/JPY pair saw heightened volatility on Monday, plunging to a fresh multi-month low of 85.70 before staging a partial recovery to close at 86.55. Despite the rebound, the broader outlook remains bearish, as the pair continues to struggle below key resistance levels, with the 20-day Simple Moving Average (SMA) at 88.00 acting as a cap.

Technical indicators suggest mixed signals regarding momentum. The Relative Strength Index (RSI) remains flat at 41 in negative territory, signaling persistent selling pressure. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram is printing rising red bars, which further supports the bearish thesis.

Looking ahead, the pair faces immediate resistance at 87.00, and a sustained break above this level could pave the way for a move toward the 20-day SMA at 88.00. On the downside, renewed selling could push the pair back toward 85.70, with further losses potentially targeting 85.30. As long as NZD/JPY remains below the 20-day SMA, the outlook remains tilted to the downside.

NZD/JPY daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.