NZD/JPY Price Analysis: Buyers increase their efforts and approach 92.00

- NZD/JPY continues to trade withing a range despite Wednesday's sharp gains.

- Indicators show that buying pressure spiked.

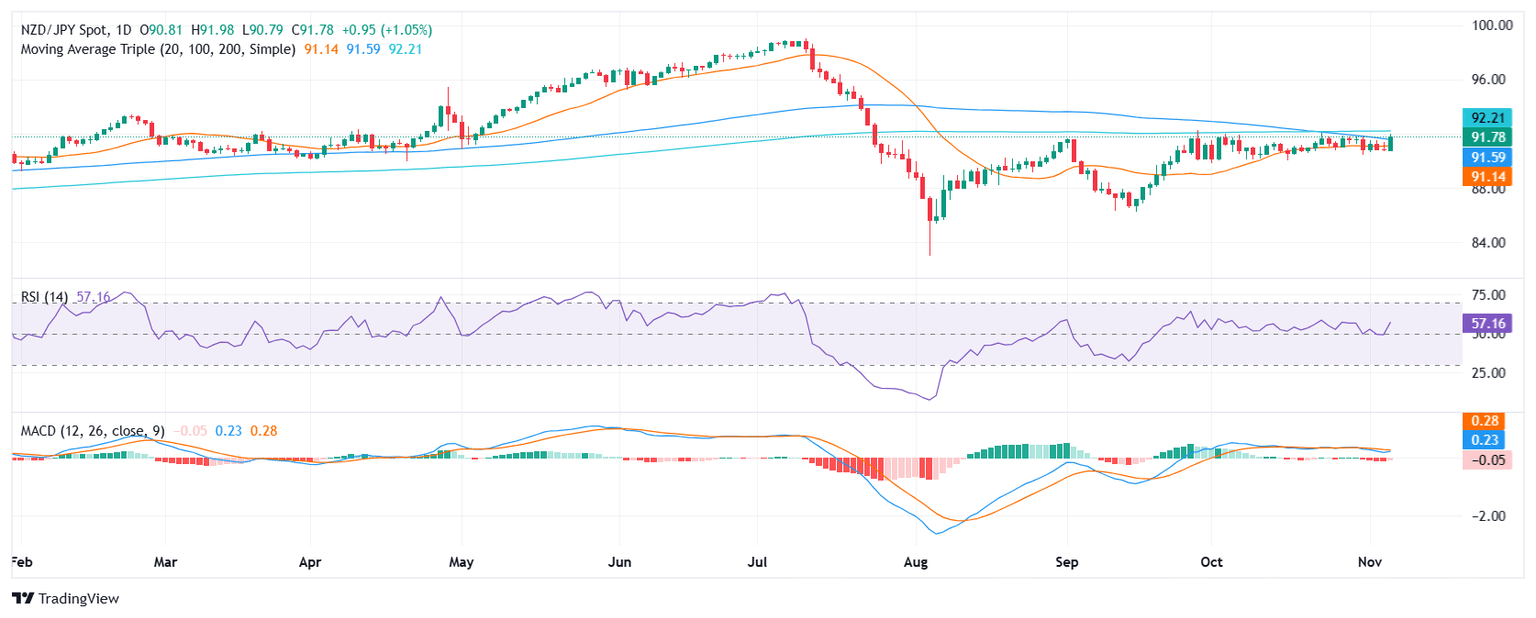

- The pair jumped above the 20 and 100-day SMA convergence.

In Wednesday's session, the NZD/JPY underwent upward fluctuations, gaining 0.96% to reach 91.80 and regaining key levels.

Regarding technical indicators, the Relative Strength Index (RSI) stands at 58, indicating a positive market sentiment with growing buying pressure. Moreover, the Moving Average Convergence Divergence (MACD) histogram displays decreasing red bars, suggesting a decline in selling pressure. These indicators collectively paint an improving technical picture For the NZD/JPY.

The NZD/JPY pair has rallied significantly, driven by buyers pushing the price action higher above the convergence of the 20 and 100-day Simple Moving Averages (SMAs). This move suggests a bullish momentum, as the SMAs are key technical indicators that gauge the average price movement over specific periods. The buyers must now maintain this level above the SMA convergence to sustain the bullish trend. If they succeed, it could lead to further upside potential.

NZD/JPY daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.