NZD/JPY Price Analysis: Bullish momentum strengthens, threatens 92.00

- NZD/JPY sees a continuation of its uptrend with buying pressure dominating.

- Technical indicators, including the RSI and MACD, support the bullish outlook.

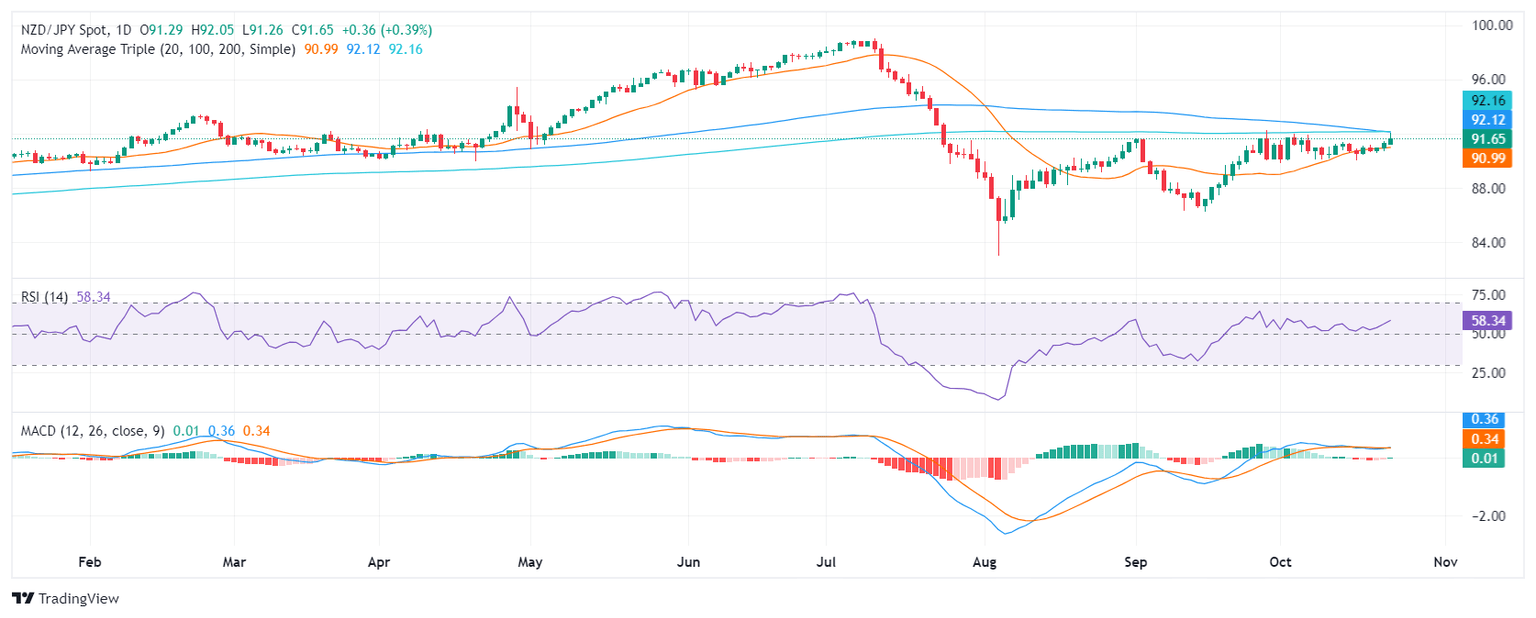

- The pair attempting to breach the 100 and 200-day SMA convergence.

Wednesday's trading session witnessed sustained buying pressure in NZD/JPY, leading to a 0.45% increase to 91.65. The pair extended its upward momentum from previous sessions, indicating a growing bullish sentiment.

Technical indicators reinforce the positive outlook for NZD/JPY. The RSI, which measures the strength of buying pressure, has risen to 60 and the upward sloping movement suggests that buying pressure is increasing. The MACD, which measures the relationship between the pair's short-term and long-term moving averages, also supports the bullish sentiment. The histogram is green and flat, indicating that buying pressure is dominant.

Key support and resistance levels remain relevant, with support at 91.50,91.30 and 91.00 and resistances are seen at 92.00 (100 and 200-day SMA convergence), 92.30 and 92.50. These levels are likely to influence the pair's price action in the near term. The 20-day SMA, a crucial support level, has successfully held off selling pressure, contributing to the pair's bullish bias.

NZD/JPY daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.