NZD/JPY Price Analysis: Bears advance and target the 20-day SMA

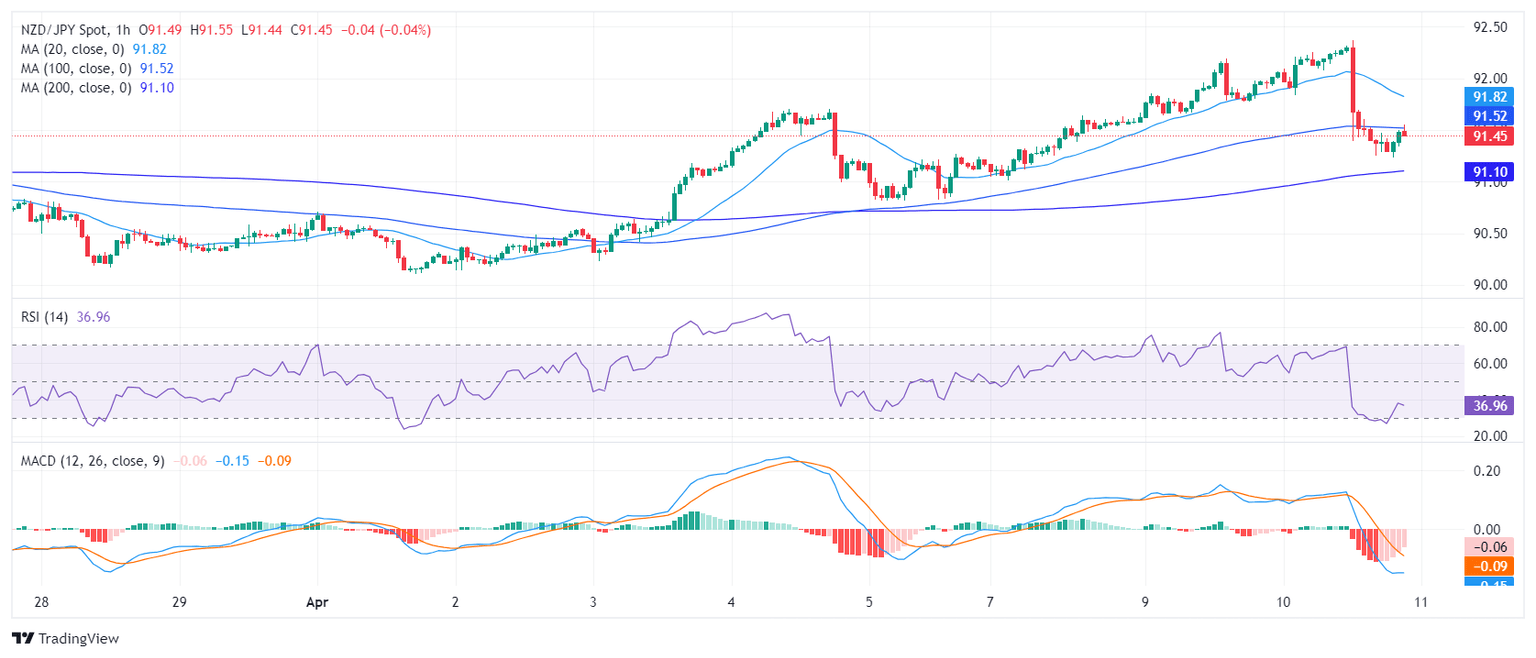

- The hourly chart indicators reveal a mounting selling pressure, hinting at a pause in bullish momentum.

- To maintain the current bullish momentum, it's essential for the pair to uphold its standing above the key SMA.

The NZD/JPY pair declined near the 91.33 mark, indicating a battle between optimism favoring a bullish market and mounting bearish pressure. The market trend leans towards the bullish side as the pair stays above critical Simple Moving Averages (SMAs) levels; however, a shift in momentum toward downward forces suggests impending consolidation.

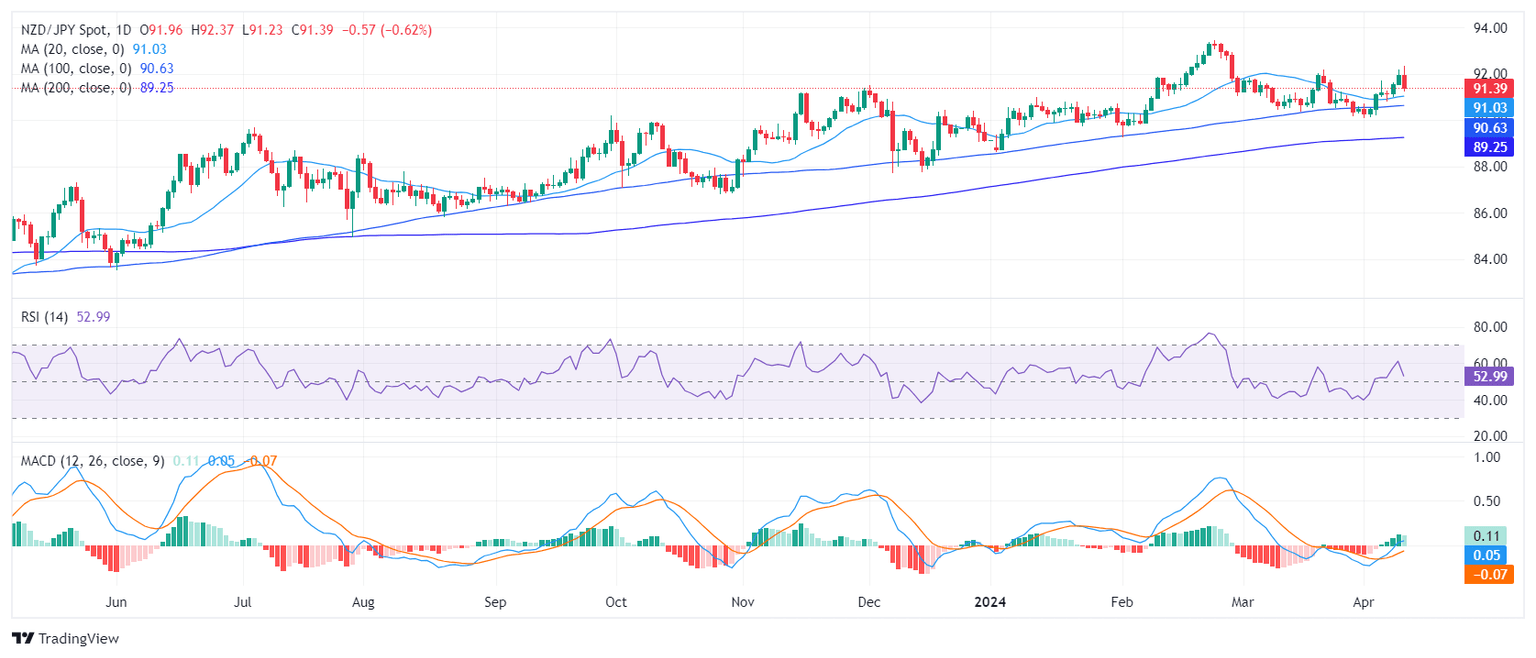

On the daily chart, the Relative Strength Index (RSI) is in positive territory, indicating a mild bullish momentum. Despite a recent decrease, the prevailing trend remains largely positive. The Moving Average Convergence Divergence (MACD) reveals decreasing green bars, also suggesting a slight loss in positive momentum. However, the persisting positive RSI readings indicate that the majority of traders favor the buy side.

NZD/JPY daily chart

In the hourly analysis, the RSI hovers in the oversold territory, indicating strong selling pressure but as the downward movements are overextended an upward corrective move may be possible ahead of the Asian session. In addition, the MACD histogram prints red bars, adding arguments for the negative momentum.

NZD/JPY hourly chart

Inspecting the broader perspective, the NZD/JPY demonstrates a bullish trend with its current standing above the 20,100, and 200-day Simple Moving Averages (SMAs). However, the bears seem to be eyeing the 20-day SMA level of 91.00, which poses a significant turning point. A successful breach below this level could reinforce the arguments for the bears and the pair could see additional downside in the next sessions.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.