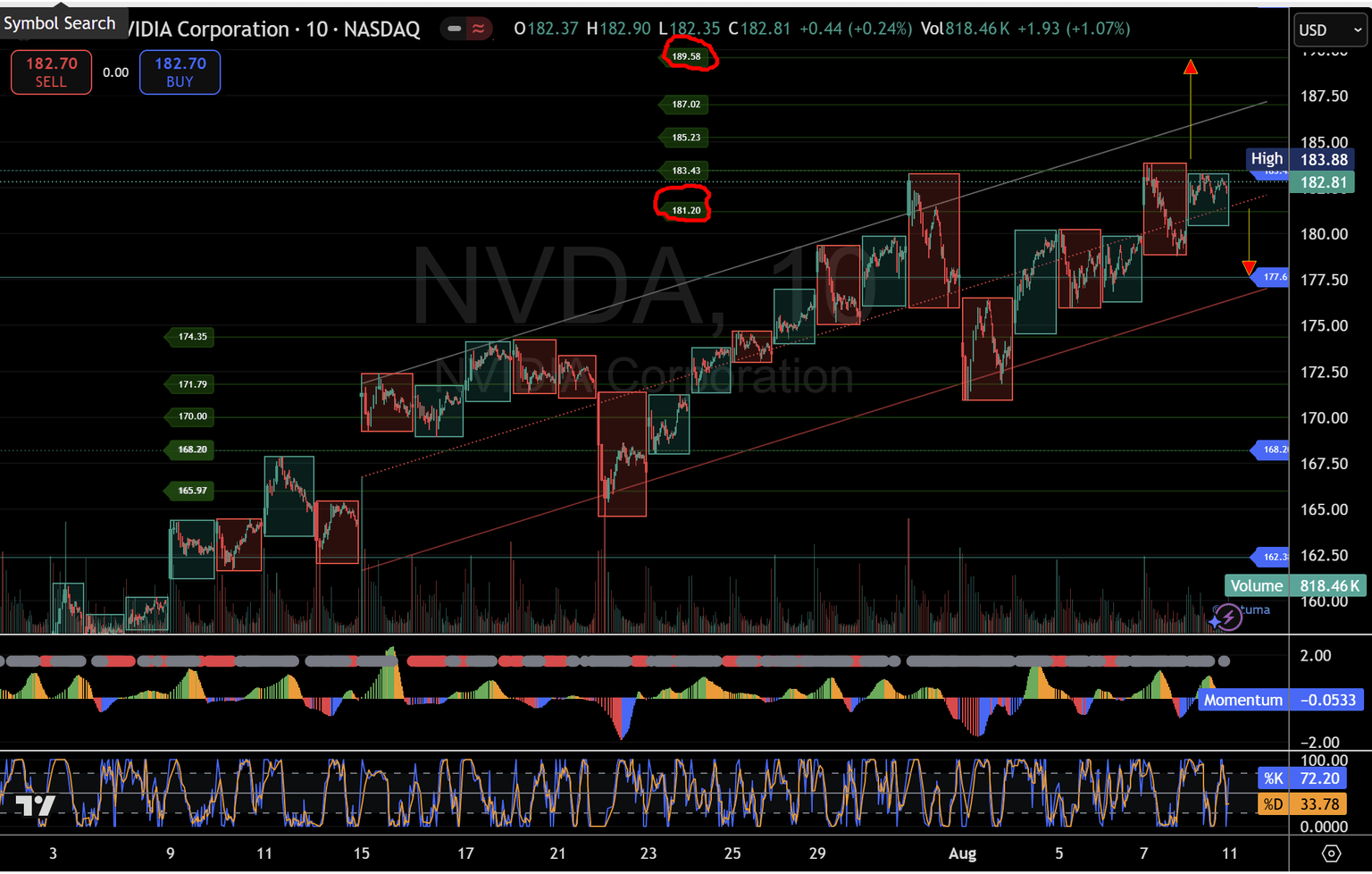

NVIDIA stock and august 15 call options poised for breakout: Bulls eye $192 as momentum builds

After conquering key price levels at $145 and $160, NVDA is now battling at the $183 pivot. Technicals, volume, and options flow point toward a decisive move — with upside targets stretching toward $192 if bulls hold control.

Since its decisive breakout above the $145 daily pivot in May 2025 and $160 in July, NVIDIA (NASDAQ: NVDA) has sustained an impressive bullish structure. The price action from July to date reveals a progressive upward channel, characterised by higher highs and higher lows, supported by strong volume inflows.

Every dip has been absorbed by buyers, reaffirming institutional participation and the robustness of the uptrend.

As of Friday, August 8, 2025, NVDA closed at $182.81, stalling just below micro 2 at $183.43, after securing $177.61 pivot and micro 1 at $181.20 earlier in the week.

- Primary zone: $183.43 – $177.61 (current tug-of-war range)

- Bullish breakout scenario:

- A clean break above $183.43 could unlock a rally toward micro 3–5 pivots, with $189.58 and $192.00 as extended upside targets.

- Bearish retest scenario:

- A rejection at $183.43 could trigger a pullback toward the $177.61 pivot and potentially micro 5 support at $174.35.

NVIDIA price chart end of trades Friday, August 8

Options market confirmation — NVDA August 15 $182.50 calls

Options flow is echoing the bullish setup visible on the equity chart. The August 15 $182.50 call contract has spent 15 trading sessions in a tight, disjointed channel following a steep drop from $4.90 on July 31 to just above the $1.20 major support on August 1.

Notable developments:

- August 7: Large volume spike after a gap-up, with resistance cemented at $4.30.

- August 8 close: Price reclaimed $3.30 with another significant upside volume surge.

Options key levels

- Bullish continuation: Holding above $3.30 could target $3.45–$4.05, with extended upside toward $4.30–$4.90.

- Downside risk: A drop below $3.10 may test $2.75, $2.50, and $2.15.

NVIDIA Options Call 182.50 August 15 end of trades Friday, August 8

MacroStructure signature trade context

NVDA's price action continues to align with MacroStructure's signature long bias — buying dips at micro 1–2 and targeting micro 3–5. This disciplined setup has repeatedly captured upside momentum, with volume confirmation reinforcing bullish conviction.

With both the stock and its near-term call options coiling for a breakout, next week's trading could deliver the decisive move that sets the tone for the remainder of August.

This analysis is for informational purposes only and does not constitute investment advice. Trading involves risk, and past performance is not indicative of future results.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.