Nvidia at a breaking point: Oversold bounce or trend shift?

Nvidia reports after today’s market close, but the real reaction only appears when trading opens tomorrow. The chart is already at a pressure point. Price is sitting on the anchored volume POC from the entire AI rally, momentum is washed out, and the broader market is in a defensive mood. This is the kind of setup where a single earnings print can flip the tone of the whole market.

Let’s walk through what this means before the numbers drop.

The technical setup: A familiar oversold reversion

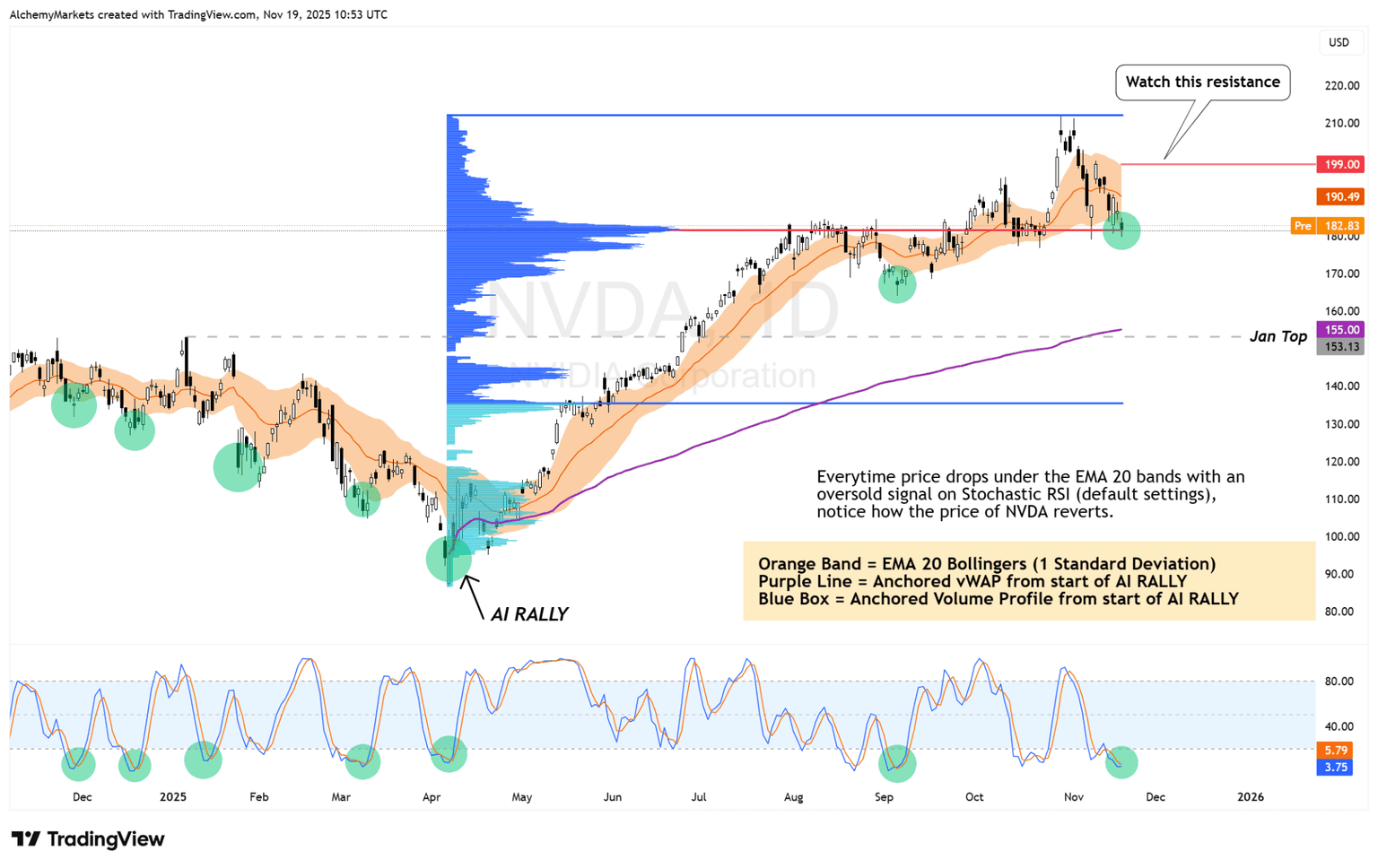

NVDA is sitting right on the Volume Profile Point of Control from the AI rally. That’s the price where the most volume has traded, which makes it a natural magnet for both support and indecision.

Price is also below the EMA 20 Bollinger bands (1 standard deviation) while the Stochastic RSI is oversold. Over the past year this exact combination has triggered clean reversion bounces every time. Each time price dipped under the band with washed out momentum, buyers stepped in and pushed it back toward the upper bands.

But history isn’t a guarantee. December 2024 is your caution flag. The same oversold setup appeared and NVDA bounced, yet the bounce was simply a retracement within a downtrend. You could see the same today. A reversion into resistance (upper band) that fails to break and hold higher can be the start of a larger downtrend.

Macro tone: Risk-off mood ahead of a big catalyst

It’s not just NVDA under pressure. Tech in general has pulled back with AI favourites losing steam due to increased CapEx, and comparatively low returns. The current read we’re getting is that global markets have shifted into a risk-off posture.

When traders derisk into a major earnings event, it raises the bar for any bullish reaction. A strong report is still able to spark a reversal, but it needs to be better than “good”. It needs to be confident, clear and forward leaning.

On the other hand, if the numbers come in soft or guidance sounds cautious, the market is already positioned in a way that can accelerate selling. This includes NVDA, the Nasdaq and anything tied to the AI theme.

Earnings impact: 7 to 8 percent expected move

Options are pricing a significant reaction with traders expecting a swing of around 7% to 8% once the dust settles. That’s a massive amount of potential movement for a company of this size. A gap is very likely tomorrow, but the direction depends on tonight’s report.

What will drive the move:

- Revenue strength.

- EPS and margins.

- Guidance for AI server demand.

- Blackwell rollout timing (Nvidia’s next-gen AI chip architecture).

- Cloud and enterprise appetite.

- Any signs of slowdown or supply strain.

The numbers don’t need to be bad for the stock to fall. They only need to be less impressive than what the market has priced in. That’s the risk when expectations are sky high.

What to expect when the market opens tomorrow

Here’s a cleaner way to frame the likely scenarios:

If the report is strong

- NVDA reverts from the POC back inside the Bollinger band.

- Momentum recovers.

- Price can squeeze into the $199 zone.

- The market treats the pullback as a reset, not a reversal.

If the report disappoints

- NVDA gaps below the POC at the open.

- Any intraday bounce struggles to break resistance.

- The structure behaves like December 2024.

- The downtrend continues after a brief reversion.

The key is that the first move is driven by earnings, but the second move is driven by positioning. The entire AI complex is watching this print. If NVDA delivers, tomorrow’s open can shock traders who derisked too aggressively. If it falls short, tomorrow becomes the start of a deeper unwind.

The bottom line

NVDA is sitting at a pivotal level with oversold momentum and the biggest catalyst of the month hitting after today’s close. The chart leans toward a bounce, but the trend risk is very real. The market’s reaction tomorrow morning will tell you which path this wants to take.

For now, treat the POC as the line in the sand. A hold keeps structure intact. A clean break turns this into a trend change.

Author

Zorrays Junaid

Alchemy Markets

Zorrays Junaid has extensive combined experience in the financial markets as a portfolio manager and trading coach. More recently, he is an Analyst with Alchemy Markets, and has contributed to DailyFX and Elliott Wave Forecast in the past.