NVDA Stock Price: Nvidia extends sell off as analysts look to other semiconductor stocks

- NASDAQ:NVDA fell by 6.75% during Monday’s trading session.

- Wall Street analysts like some of NVIDIA’s rivals better at these prices.

- NVIDIA’s failed acquisition of ARM lingers in the minds of investors.

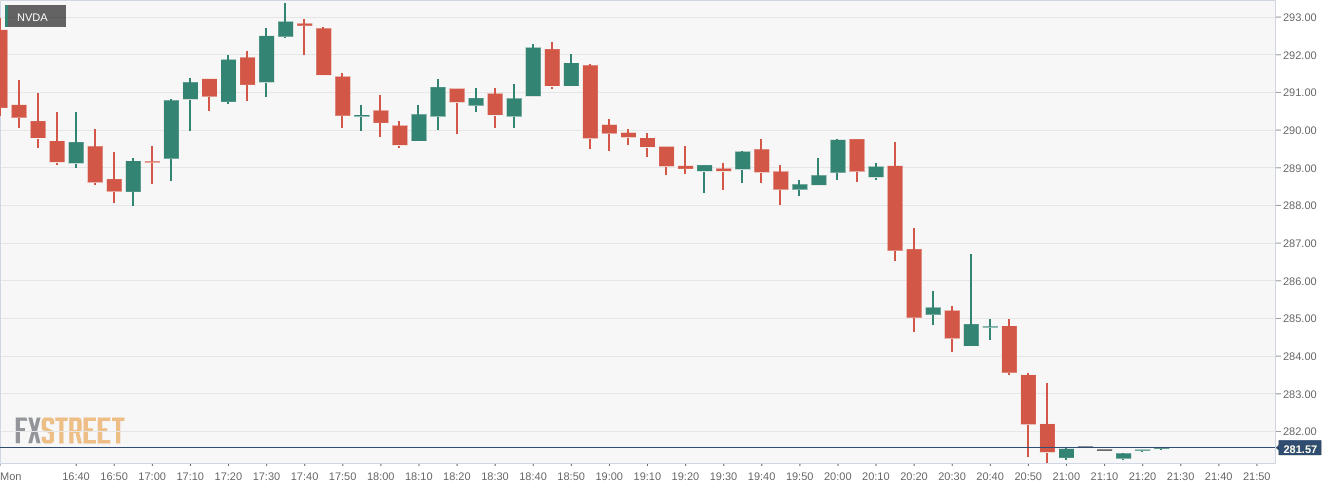

NASDAQ:NVDA has been on a roll this year as one of the hottest semiconductor stocks on the market. But after gaining 114% in 2021, the stock has pulled back in recent weeks, shedding nearly 10% over the past trading week. On Monday, shares of NVIDIA fell a further 6.75% and closed the trading session at $281.61. It was another red day for growth and tech stocks as the NASDAQ fell another 1.39% to start the week. The Dow Jones dropped by 320 basis points and the S&P 500 also pulled back from its recent record highs, falling by 0.91% during Monday’s session.

Stay up to speed with hot stocks' news!

Wall Street analysts weighed in on the semiconductor industry and pointed out a few stocks they prefer to NVIDIA’s high valuation right now. Investment bank JPMorgan is focused on Qualcomm (NASDAQ:QCOM), Evercore likes Micron (NASDAQ:MU), and several firms including Citigroup selected Broadcom (NASDAQ:AVGO) as their favorite semiconductor stock moving forward. It was a bit of a slight to two of the bigger names in the sector NVIDIA and AMD (NASDAQ:AMD), but given both stocks have sky-rocketed this year, it’s not surprising that these analysts are targeting stocks with room to grow.

NVIDIA stock forecast

With NVIDIA’s proposed acquisition of UK chip designer ARM now dead in the water, investors are likely taking their profits and moving on to other stocks. Much of the forward-looking anticipation for NVIDIA had the $40 billion acquisition baked into its stock price, and investors took the signal of NVIDIA executives like CEO Jensen Huang selling their shares to ditch their own. With the upcoming boom of the metaverse and all of the other segments NVIDIA has, this is likely just providing a buying opportunity for those who are looking to get into the stock.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet