NTPC Elliott Wave technical analysis [Video]

![NTPC Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Industries/Utilities/water-pipes-637435359838416228_XtraLarge.jpg)

NTPC Elliott Wave technical analysis

Function: Larger Trend Higher (Intermediate degree Wave (5), orange).

Mode: Motive.

Structure: Impulse.

Position: Minute Wave ((v)) Navy.

Details: Minute Wave ((v)) Navy, is progressing higher towards 455, within Minor Wave 5 of Intermediate Wave (5) Orange. Alternatively, Wave 5 could be complete around 448-50. Traders may tighten risk to 386.

Invalidation point: 386.

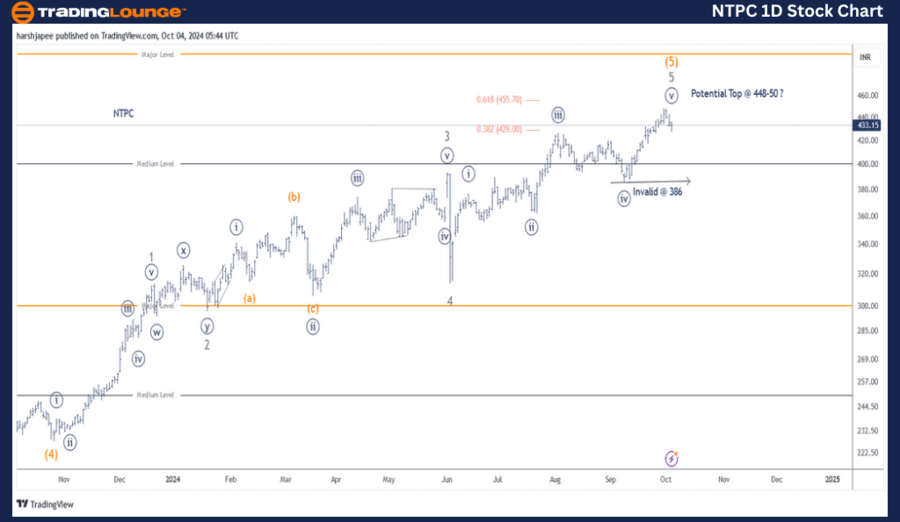

NTPC daily chart technical analysis and potential Elliott Wave counts

NTPC daily chart is suggesting potential termination of Intermediate Wave (5) Orange around 448-50 levels. The stock has pulled back from the above highs and is trading around 430 mark at the time of writing. A break below 386 will confirm a major top in place.

NTPC has risen since October 2023 after carving low around 220-25 range, which is marked as Intermediate Wave (4) Orange. Minor Waves 1 through 5 are also looking complete as Wave 2 unfolded as a combination while Wave 4 was a sharp drop to 314 on June 04, 2024.

If the above proposed NTPC Elliott Wave counts hold, the stock should stay below 448 and continue lower towards 386 in the near term. Alternatively, Minute Wave ((v)) Navy could push further towards 455-60 range before terminating.

NTPC Elliott Wave technical analysis

Function: Larger Trend Higher (Intermediate degree Wave (5), orange).

Mode: Motive.

Structure: Impulse.

Position: Minute Wave ((v)) Navy.

Details: Minute Wave ((v)) Navy, is progressing higher towards 455, within Minor Wave 5 of Intermediate Wave (5) Orange. Alternatively, Wave 5 could be complete around 448-50, just shy by a few points off the fibonacci 0.619 extension at 455.

Invalidation point: 386.

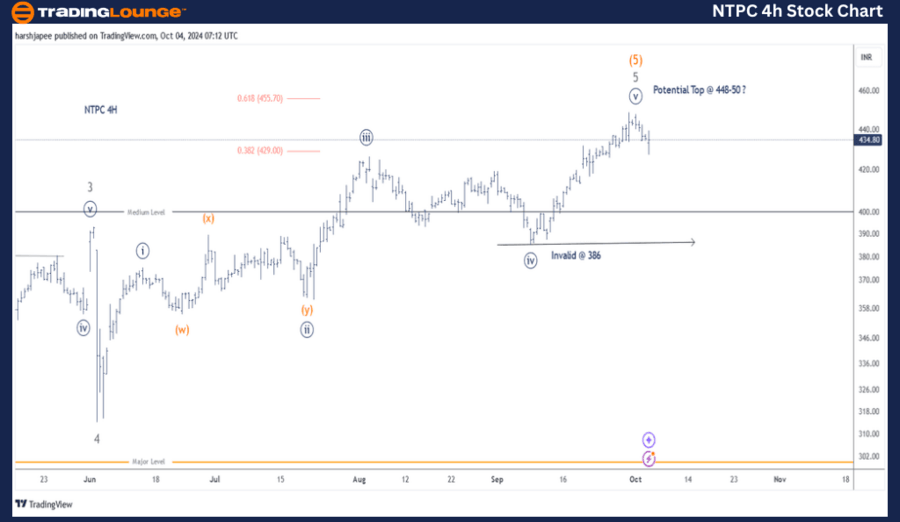

NTPC four-hour chart technical analysis and potential Elliott Wave counts

NTPC Elliott Wave counts for 4H is indicating a five wave rally between 314 and 448 levels, terminating Minute Wave ((v)) of Minor Wave 5. If correct, the stock is now underway to break below 386, which is Minute Wave ((iv)) as marked here.

Conclusion

NTPC might have carved a major top around 448 as fifth wave terminates at multiple degrees; Minute, Minor and Intermediate. Alternatively, the stock might push through 455-60 highs before reversing lower.

NTPC Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.