NIO Stock Price and News: Bounces after Tuesday losses

-

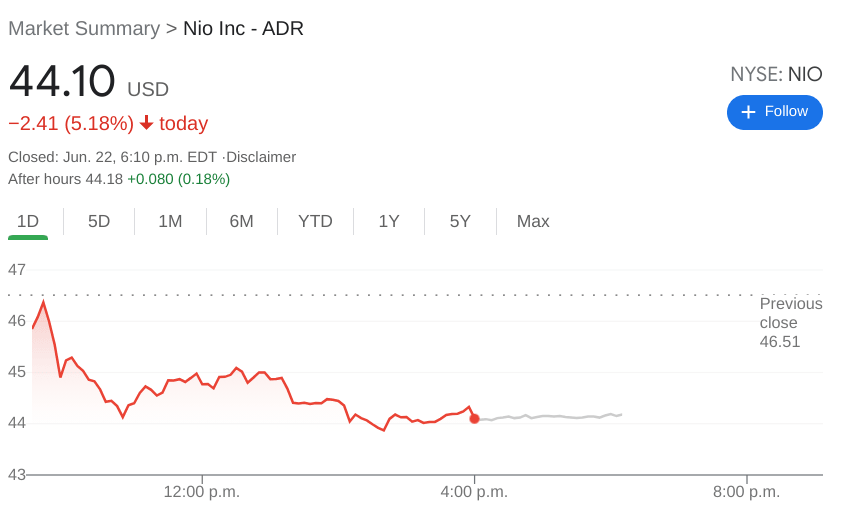

NYSE:NIO fell by 5.18% during a second straight green day for the broader markets.

-

Chinese companies saw red on Tuesday as the ongoing political tensions raised fear of regulatory concerns.

-

Volkswagen reports sluggish demand for its EVs in China.

Update: NIO shares bounce after suffering a 5% loss on Tuesday. NIO shares are currently trading at $45.16. The shares ahve recovered nicely from lws near $30 in mid-May as Chinese EV deliveries were strong.

NYSE:NIO shares seemed to drop off a cliff on Tuesday, although a cooling off period should not come as a surprise as the stock has rallied over the past month. Shares of Nio fell by 5.18% to close the trading day at $44.10, even as the rest of the broader markets turned green for a second straight session. With the loss, Nio fell below its 200-day moving average price of $45.32.

Stay up to speed with hot stocks' news!

Nio was not the only Chinese company to be hit hard on Tuesday, as increasing political tensions between the U.S. have raised fears of stricter regulatory controls. Alongside Nio, stocks like Xpeng (NYSE:XPEV), Li Auto (NASDAQ:LI), PinDuoDuo (NASDAQ:PDD), and Tencent (TCEHY) were all down sharply during the session. The Shanghai Stock Exchange in China reported its third weekly drop last week as tensions with the West continue to intensify, especially after the House of Representatives voted in favor to delist Chinese stocks from American exchanges.

NIO stock forecast

German automaker Volkswagen has called its initial foray into the Chinese electric vehicle market sluggish, with underwhelming demand for its vehicles from the Chinese market. Volkswagen’s ID4 electric SUV models sold only 1,213 vehicles in May, which was actually 200 fewer than the month before. The monthly figures are off Volkswagen’s anticipated sales pace of 50,000-60,000 vehicles this year, with further growth in the future. While the news could be interpreted as positive for domestic automakers like Nio, investors are clearly taking this as a waning interest in EVs by the Chinese market as a whole.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet