NIO Stock News: Nio Inc extends gains as CEO discusses smartphone business

- NYSE:NIO gained 0.67% during Thursday’s trading session.

- Nio CEO William Li commented on the company’s smartphone progres.

- Nio has also established a software subsidiary in Shanghai.

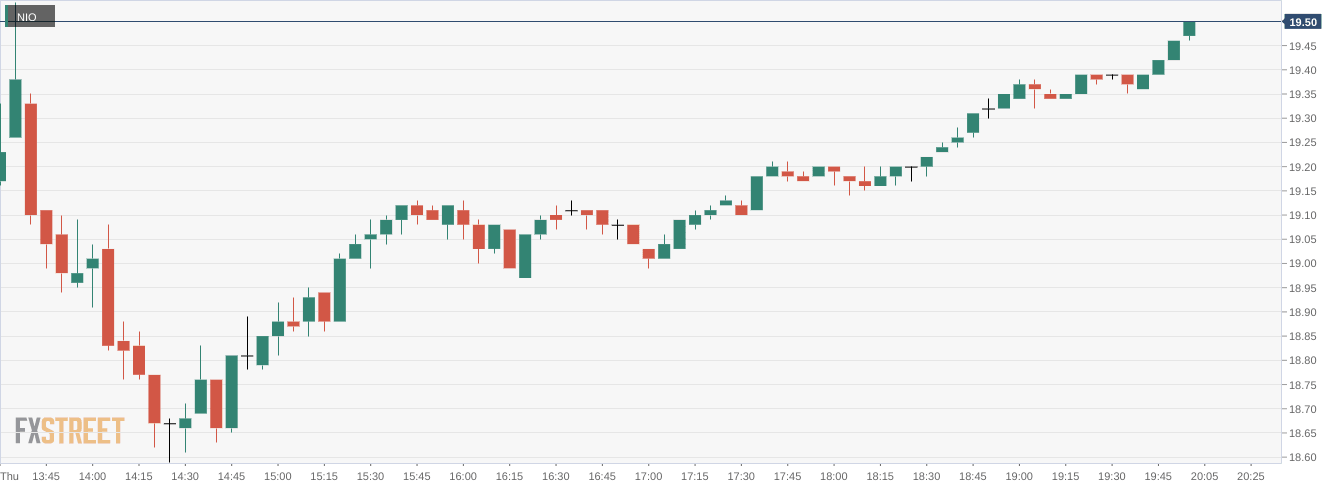

NYSE:NIO pushed higher again as the markets continued to rally following the latest Fed rate hike for the month of July. On Wednesday, shares of Nio added a further 0.67% and closed the trading session at $19.51. Stocks extended their gains on Wednesday as all three major indices rose again ahead of key earnings reports from tech giants Amazon (NASDAQ:AMZN) and Apple (NASDAQ:AAPL). Overall, the Dow Jones gained 332 basis points, the S&P 500 rose by 1.21%, and the NASDAQ posted a 1.08% gain during the session.

Stay up to speed with hot stocks' news!

Nio CEO William Li was recently interviewed by Nio users and shareholders at a company event. Li mentioned that Nio is still making progress on its smartphone business, but that creating great hardware is becoming increasingly difficult to do. Li went on to say that once established, Nio is planning to release a new version of the smartphone every year, similar to what companies like Apple and Alphabet (NASDAQ:GOOGL) do. It is an interesting contrast to Apple who is currently trying to develop their first electric vehicle. The crossover between different tech industries is blurring, as companies begin to integrate all of their products and services.

NIO stock forecast

Nio also revealed that it has established a software subsidiary in Shanghai called the Nio Software Technology Co, Ltd. No details have been revealed about what the subsidiary will be doing, but given that Nio is expanding its tech offerings, it could be to help both the EV and smartphone businesses. It could also be to develop Nio’s NAD or Nio Autonomous Driving system.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet